- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- Cash Management

- Account Reconciliation – How?

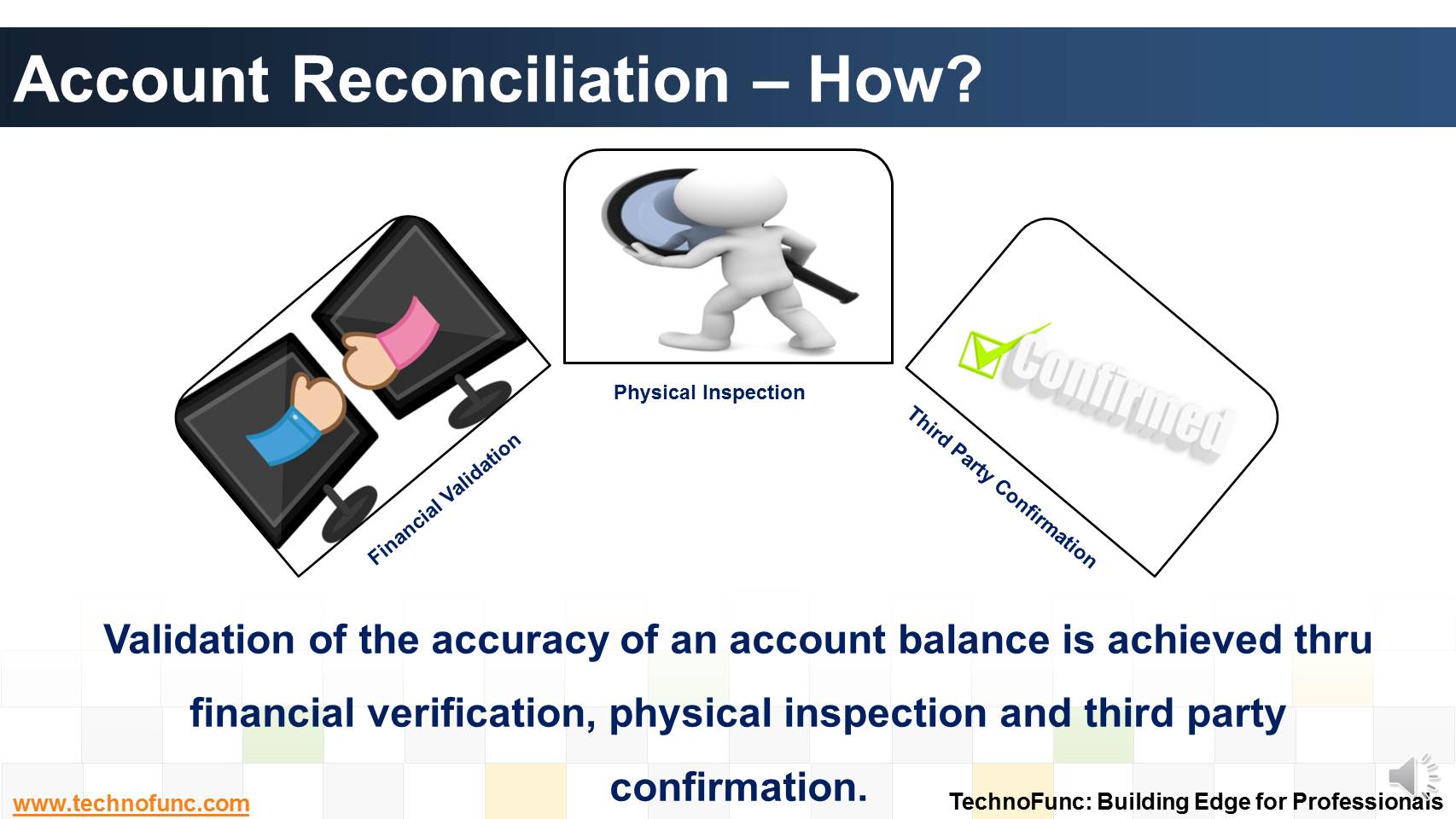

Account Reconciliation – How?

Account Reconciliation – How? Learn the three key attributes to perfom account reconciliation.

Account Reconciliation Process

Validation of the accuracy of an account balance is achieved by doing financial verification as well as physical inspection.

Confirmation is done with other parties and/or other procedures are performed on a periodic basis to complete reconciliation process.

The three steps are depicted in the attached image.

- Financial Validation

- Physical Verification

- Confirmation

Related Links

You May Also Like

-

Have you ever wondered what is actually a Bank Statement and why it is needed. What is the information that is available in a bank statement?

-

Unravel the mystery behind clearing. Why we use clearing accounts. Find the relevance of word "Clearing" in business context.

-

Why enterprises need cash management. What is the purpose of having a well defined cash management process?

-

Treasury Management - Functions

Treasury management has become an specialized function. Treasury function helps in managing the Risk-return profile as well as the tax-efficiency of investment instruments. In larger firms, it may also include trading in bonds, currencies and financial derivatives. Learn about the various tasks, activities and imperatives, undertaken by treasuries in in today's context.

-

The objective of funding Management is to implement strategies that lead to the best borrowing rates and lower investment costs. Learn how treasury aids in loans and investment management functions.

-

Bank Reconciliation is a PROCESS to Validate the bank balance in the general ledger With Bank Statement. Learn the bank recon process.

-

Introduction to Cash Clearing Process

Unravel the mystery behind clearing accounts. Learn why clearing accounts are used in finance and accounting. Learn why so many clearing accounts are defined in ERPs and Automated Accounting Systems.

-

Cash Clearing – Accounting Entries

The Cash Clearing process enables you to track amounts that have actually cleared your bank. Learn the steps and accounting entries that gets generated during the cash clearing process.

-

The objective of Financial risk management is to protect assets and cash flows from any risk. Treasury function works to accurately assess financial risks by identifying financial exposures including foreign exchange, interest rate, credit, commodity and other enterprise risks. Learn about the various risks that are managed by treasury.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved