- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- Different Types of Organizational Structures

Different Types of Organizational Structures

Modern business organizations run multiple product and service lines, operate globally, leverage large number of registered legal entities, and operate through complex matrix relationships. To stay competitive in the current global business environment, they must often develop highly diverse and complex organizational structures that cross international borders.

Modern business organizations run multiple product and service lines, operate globally, leverage large number of registered legal entities, and operate through complex matrix relationships. To stay competitive in the current global business environment, they must often develop highly diverse and complex organizational structures that cross international borders.

The various, multifaceted tasks and activities of an organization have to be divided into smaller, manageable components to facilitate efficient achievement of business objectives. Regulatory and management needs are the main driving forces behind organizational structures. These complexities create need for advanced operational and supporting business processes to drive organization wide effectiveness, efficiency and achieve business objectives.

This forces companies to create a diverse array of subsidiaries, legal entities, organizations, and accounting processes to ensure a smooth and profitable business flow. Tax considerations also impact how businesses construct these complex legal structures. In this section we will explore the different legal and operational structures that are commonly adopted by these global conglomerates.

Legal Structure - Driven by regulatory needs

Every organization must have a registered or legislated legal structure. In rapidly changing national and global business environment, it has become necessary that regulation of corporate entities is in tune with the emerging economic trends, encourage good corporate governance and enable protection of the interests of the investors and other stakeholders. Further, due to continuous increase in the complexities of business operation, the forms of corporate organizations are constantly changing.

Legal structures are driven by compliance and is used for external purposes. They are generally mandatory for all businesses. Banks, investors, customers, suppliers, lenders and regulators use these business structures to make contacts, approve loans, lines of credits and to make sure you are following regulatory requirements.

When you are just starting out you may not worry too much about the formal decision making process in your business. But, as your business grows issues about who has the authority to make what decisions could undercut your ability to make deals or grow as quickly as you want to. It is even more important to make sure the lines of authority are clear when multiple people own the business. Different business structures allow for different types of decision-making processes and lines of authority. If you want to avoid a legal battle in the future over who is in charge of your business, you have to choose the right business entity. You will also want to make sure those details are spelled out in any legal formation documents drafted by your business lawyer.

When choosing a business entity you are also committing to doing what is needed to maintain the legal status of your business. Different types of companies have different types of compliance burdens. The simplest structure is the sole proprietorship, which usually involves just one individual who owns and operates the enterprise. If your business will be owned and operated by several individuals, you'll want to take a look at structuring your business as a partnership. The corporate structure is more complex and expensive than most other business structures. A corporation is an independent legal entity, separate from its owners, and as such, it requires complying with more regulations and tax requirements.

Types of Legal Structures:

- Sole Proprietorship

- Partnership

- Limited Liability

- Legal Entity

- Subsidiary

- Representative Office

- Branches - Domestic and Foreign

- Joint Venture

- Corporation or Conglomerate

Operational Structure - Driven by management needs

The company defines its operational structures to assign roles and responsibilities and fix accountability at various levels where actual business activities take place. These levels are used to divide the control of economic resources and operational processes in a business. People at these operating levels have a duty to maximize the use of scarce resources, improve processes, and account for their performance. These levels are known as operating units and used to record and report financial/other information that is not legally required, but that is used for internal control.

Types of internal organizational structures:

- Hierarchical organizational structures

- Functional organizational structures

- Horizontal or flat organizational structures

- Divisional organizational structures (market-based, product-based, geographic)

- Matrix organizational structures

- Team-based organizational structures

- Network organizational structures

Related Links

You May Also Like

-

Divisional Organizational Structures

The divisional structure or product structure consists of self-contained divisions. A division is a collection of functions which produce a product. It also utilizes a plan to compete and operate as a separate business or profit center. Divisional structure is based on external or internal parameters like product /customer segment/ geographical location etc.

-

Concept of Representative Office

A representative office is the easiest option for a company planning to start its operations in a foreign country. The company need not incorporate a separate legal entity nor trigger corporate income tax, as long as the activities are limited in nature.

-

Understand what we mean by GAAP to STAT adjustments. This article discusses the different standards that are used for multiple representations of the financial results for global organizations. Understand the meaning of US GAAP, Local GAAP, STAT, IFRS, and STAT. Finally, understand why accounting differences arise and how they are adjusted for different financial representations.

-

Team-Based Organizational Structure

Team-based structure is a relatively new structure that opposes the traditional hierarchical structure and it slowly gaining acceptance in the corporate world. In such a structure, employees come together as team in order to fulfill their tasks that serve a common goal.

-

What is a Business Eco System?

The goal of a business is to generate capital appreciation and profits for its owners or stakeholders by engaging in provision of goods and services to customers within the eco system/framework governed by respective laws(local/international). The eco system involves various entities that the business works with for delivery of a product or service.

-

Prepayments and Prepaid Expenses

Prepayments are the payment of a bill, operating expense, or non-operating expense that settle an account before it becomes due. Learn the concept of prepaid expenses. Understand the accounting treatment for prepaid expenses. Understand the concept by looking at some practical examples and finally learn the adjusting entry for these expenses.

-

A subsidiary is a company that is completely or partly owned by another corporation that owns more than half of the subsidiary's stock, and which normally acts as a holding corporation which at least partly or wholly controls the activities and policies of the daughter corporation.

-

General Ledger - Advanced Features

Modern automated general ledger systems provide detailed and powerful support for financial reporting and budgeting and can report against multiple legal entities from the single system. These systems offer many advanced functionalities right from journal capture to advanced reporting. This article will provide an overview of some advanced features available in today's General Ledgers.

-

GL - Different Accounting Methods

The accounting method refers to the rules a company follows in reporting revenues and expenses. Understand the two common systems of bookkeeping, single, and double-entry accounting systems. Learners will also understand the two most common accounting methods; cash and accrual methods of accounting and the advantages and disadvantages of using them.

-

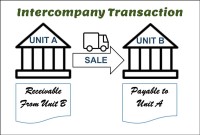

After reading this article the learner should be able to understand the meaning of intercompany and different types of intercompany transactions that can occur. Understand why intercompany transactions are addressed when preparing consolidated financial statements, differentiate between upstream and downstream intercompany transactions, and understand the concept of intercompany reconciliations.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved