- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- GL - Journal Entry & Import

GL - Journal Entry & Import

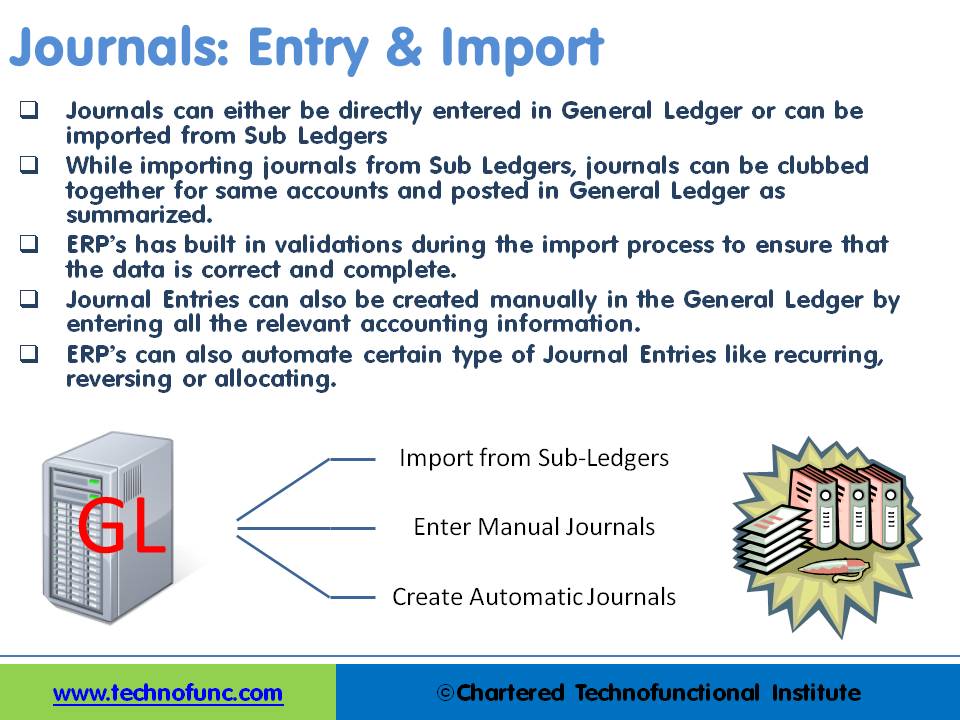

This article explains the process of entering and importing general ledger journals in automated accounting systems. Learn about the basic validations that must happen before the accounting data can be imported from any internal or external sub-system to the general ledger. Finally, understand what we mean by importing in detail or in summary.

Recording Journals in General Ledger:

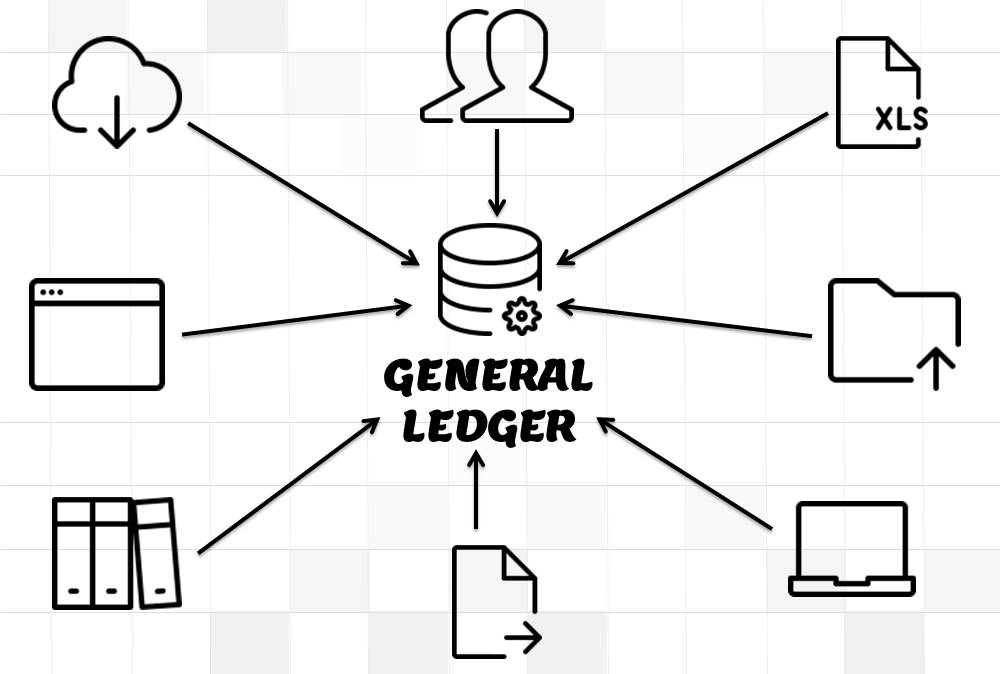

Journals can either be directly entered in General Ledger or can be imported from Sub Ledgers. Most of the journals are created along-with business transactions like sales, purchases, receipts, and payments and get recorded in respective sub-ledgers. As sub-ledgers generally capture data at a more granular level, the relevant accounting information must flow to the general ledger for posting and subsequent reporting. From sub-ledgers, they need to be imported to the general ledger for financial recording and reporting.

Journal Entries can also be created manually in General Ledger by entering all the relevant accounting information. ERPs can also automate certain types of Journal Entries like recurring, reversing, or allocating journals. In case of manual entry follow the steps and guidelines outlined in the Recording Journals tutorial.

Importing – Detail V/s Summarized:

While importing journals from Sub Ledgers, journals can be clubbed together for the same accounts and posted in General Ledger as summarized.

Various general ledger systems provide the functionality to create Summary Journals which summarize all transactions for the same account, period, and currency into one debit or credit journal line. This results in fewer transactions in the general ledger systems and makes financial reports more manageable in size. In the case of summary journal users, lose the one-to-one mapping of detail transactions in the sub-ledger to the summary journal lines created by the import process. However most of the organizations use this feature as this prevents too many transactions in GL Accounts and transactions get clubbed based on category, type, or transaction source.

Using the drill-down functionalities available in most of the modern general ledger systems, users can still perform various review and analysis functions, as even if the system creates summary journals, it can still maintain a mapping of how Journal Import summarizes sub-ledger detail transactions from feeder systems into general ledger journal lines.

Journal Import Validations:

ERP’s and automated accounting systems must have built in validations during the import process to ensure that the data is correct and complete. An effective Journal Import program should validate key accounting information before it creates journal entries in the General Ledger application to prevent errors and reconciliation efforts.

Given below are some of the common data validations that can happen during the GL Import process:

1. Suspense Posting:

Suspense posting puts the remaining amount in the suspense account in case the debits and credits of the journal are not matching. In case it is not required, Journal Import should reject all invalid lines that do not balance.

2. Duplicate Batch Name:

If the batch name is a unique field then Journal Import should ensure that a batch with the same name does not already exist for the same period in the General Ledger application. Similarly, it must also check to ensure that more than one journal entry with the same name does not exist for a batch.

3. Other Attributes:

Attributes that can be validated to ensure that journals contain the appropriate accounting data could be accounting books, period, source, currency, category, accounting date, reversal period, account validation, account code combinations, effective date, roll date, and any other required validations.

Import Using Excel:

In today’s accounting world, financial and operational data typically is stored in a variety of programs and formats. Excel is one of such tools, most widely used by the accountants! When accountants need to prepare a report based on data from various systems, the first step is to export the data into Excel. Many times accounting information is stored in chronological order in excels by the accountants, and examples include adjusting entries and recurring entries.

Benefits of using the excel upload feature are that it makes life much easier for data operator and accounts executives. The great flexibility of excel based application increases productivity and results in reduced training costs as most users are already familiar with the excel functionalities and also improves user acceptance for automated systems. The biggest benefit comes from the fact that excel upload can also work in disconnected environments.

Typically, most of the automated systems provide the functionality to import accounting data from Excel to the general ledger and create journals. Most ERPs provide the ability to upload journals using the MS Excel worksheet. You can create journals in Excel Template and upload directly to General Ledger.

Related Links

You May Also Like

-

In this article we will help you understand the double-entry accounting system and state the accounting equation and define each element of the equation. Then we will describe and illustrate how business transactions can be recorded in terms of the resulting change in the elements of the accounting equation.

-

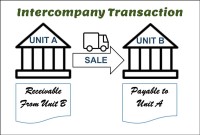

After reading this article the learner should be able to understand the meaning of intercompany and different types of intercompany transactions that can occur. Understand why intercompany transactions are addressed when preparing consolidated financial statements, differentiate between upstream and downstream intercompany transactions, and understand the concept of intercompany reconciliations.

-

What Is a General Ledger? General Ledger (also known in accounting as the GL or the Nominal Ledger) is at the heart of any accounting system. A general ledger is the master set of accounts that summarize all transactions occurring within an entity. Ledger is the skillful grouping and presentation of the Journal entries. Learn the accounting fundamentals, general ledger process, and general ledger flow.

-

For any company that has a large number of transactions, putting all the details in the general ledger is not feasible. Hence it needs to be supported by one or more subsidiary ledgers that provide details for accounts in the general ledger. Understand the concept of the subsidiary ledgers and control accounts.

-

Legal Structures in Businesses

Businesses not only vary in size and industry but also in their ownership. Most businesses evolve from being owned by just one person to a small group of people and eventually being managed by a large numbers of shareholders. Different ownership structures overlap with different legal forms that a business can take. A business’s legal and ownership structure determines many of its legal responsibilities.

-

Reversing Journals are special journals that are automatically reversed after a specified date. A reversing entry is a journal entry to “undo” an adjusting entry. When you create a reversing journal entry it nullifies the accounting impact of the original entry. Reversing entries make it easier to record subsequent transactions by eliminating the need for certain compound entries. See an example of reversing journal entry!

-

Funds contributed by owners in any business are different from all other types of funds. Equity is the residual value of the business enterprise that belongs to the owners or shareholders. The funds contributed by outsiders other than owners that are payable to them in the future. Liabilities are generally classified as Short Term (Current) and Long Term Liabilities. Current liabilities are debts payable within one year.

-

Divisional Organizational Structures

The divisional structure or product structure consists of self-contained divisions. A division is a collection of functions which produce a product. It also utilizes a plan to compete and operate as a separate business or profit center. Divisional structure is based on external or internal parameters like product /customer segment/ geographical location etc.

-

Explore the concept of journal reversals and understand the business scenarios in which users may need to reverse the accounting entries that have been already entered into the system. Understand the common sources of errors resulting in the reversal of entries and learn how to correct them. Discuss the reversal of adjustment entries and the reversal functionalities in ERPs.

-

Learn the typical accounting cycle that takes place in an automated accounting system. We will understand the perquisites for commencing the accounting cycle and the series of steps required to record transactions and convert them into financial reports. This accounting cycle is the standard repetitive process that is undertaken to record and report accounting.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved