- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- GL - Reversing Journal Entry

GL - Reversing Journal Entry

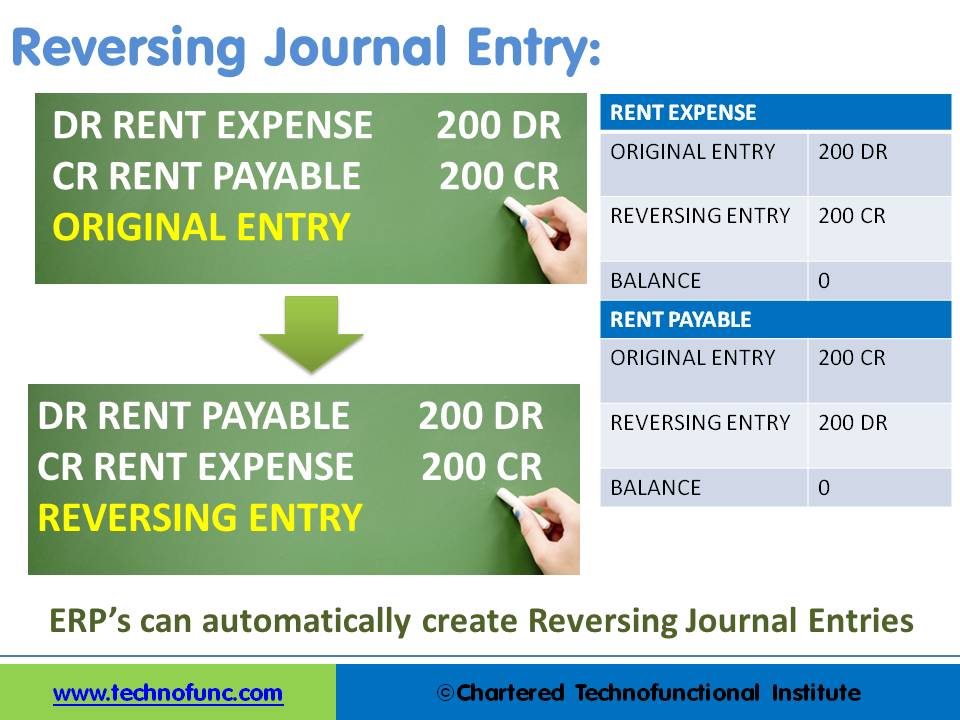

Reversing Journals are special journals that are automatically reversed after a specified date. A reversing entry is a journal entry to “undo” an adjusting entry. When you create a reversing journal entry it nullifies the accounting impact of the original entry. Reversing entries make it easier to record subsequent transactions by eliminating the need for certain compound entries. See an example of reversing journal entry!

What is a Reversing Journal Entry?

A reversing entry is a journal entry to “undo” an adjusting entry. When you create a reversing journal entry it nullifies the accounting impact of the original entry. Reversing entries make it easier to record subsequent transactions by eliminating the need for certain compound entries.

Reversing entry can be created in two ways. The first method is to use the same set of accounts with contra debits and credits, meaning that the accounts and amounts that were debited in the original entry will be credited with the same amount in the reversing journal “nullifying” the accounting impact. The second method is to create a journal with the same accounts but with negative amounts that will also nullify the accounting impact of the original transaction.

Automated Process Requirements:

- The accounts have been set up in the chart of accounts.

- The reversal criteria have been specified in the original adjustment or accrual journal, otherwise, the user generally needs to submit the journal manually for reversal.

- The date of the reversing journal has already been specified and the accounting period for that date is available for creating and posting transactions.

Process Flow Steps

- Enter a journal that reverses in the next month.

- Select the appropriate reversal option.

- At the beginning of the next period system creates a reversing entry dated the first day of the next accounting period.

Example of a reversing entry:

The business has taken premises on rent. The rent payable for each month is $200 and the invoice is raised by the landlord on the 15th of the subsequent month. The accounting department takes 5 days to process the payment and deposit the amount in the Landlord’s account. December is the close of the accounting year and the invoice for rent for the month of December will be received by the company on the 15th of January and payment will be made by the 20th of January.

Closing Books: On the 31st of December, the accounting department passes the rent accrual accounting entry, debiting the “Rent Expense” and crediting the “Rent Payable Account”. This entry records the rent for the month of Dec and creates a liability for “Rent Payable” to the landlord next month. At the beginning of the next accounting year, on day one this entry is reversed by debiting the “Rent Payable” and crediting the “Rent Account”.

Making Payment: Once the payment for Rent is made on 20th January (Again by Debiting “Rent Expense” and Crediting “Bank Account”) this reversal will ensure that the rent for last year is not impacting the current year financials as the net impact on the “Rent Expense” account will be zero.

Related Links

You May Also Like

-

When the quantum of business is expected to be moderate and the entrepreneur desires that the risk involved in the operation be shared, he or she may prefer a partnership. A partnership comes into existence when two or more persons agree to share the profits of a business, which they run together.

-

In this article, we will explain the general Ledger journal processing flow from entering journals to running the final financial reports. Understand the generic general ledger process flow as it happens in automated ERP systems. The accounting cycle explains the flow of converting raw accounting data to financial information whereas general ledger process flow explains how journals flow in the system.

-

Defining Organizational Hierarchies

A hierarchy is an ordered series of related objects. You can relate hierarchy with “pyramid” - where each step of the pyramid is subordinate to the one above it. One can use drill up or down to perform multi-dimensional analysis with a hierarchy. Multi-dimensional analysis uses dimension objects organized in a meaningful order and allows users to observe data from various viewpoints.

-

Concept of Representative Office

A representative office is the easiest option for a company planning to start its operations in a foreign country. The company need not incorporate a separate legal entity nor trigger corporate income tax, as long as the activities are limited in nature.

-

Driving Business Efficiency through Divisions and Departments

In case of a multi-divisional organizational structure, there is one parent company, or head-office. And that parent owns smaller departments, under the same brand name. Dividing the firm, into several self-contained, autonomous units, provides the optimal level of centralization, in a company.

-

Period End Accruals, Receipt Accruals, Paid Time-Off Accruals, AP Accruals, Revenue Based Cost Accruals, Perpetual Accruals, Inventory Accruals, Accruals Write Off, PO Receipt Accrual, Cost Accrual, etc. are some of the most complex and generally misconstrued terms in the context of general ledger accounting. In this article, we will explore what is the concept of accrual and how it impacts general ledger accounting.

-

Introduction to Legal Entities Concept

Modern business organizations operate globally and leverage a large number of registered legal entities, and operate through complex matrix relationships. To stay competitive in the current global business environment, they must often develop highly diverse and complex organizational structures that cross international borders. Learn more about Legal Entities and their importance for businesses.

-

Operational Structures in Business

Large organizations grow through subsidiaries, joint ventures, multiple divisions and departments along with mergers and acquisitions. Leaders of these organizations typically want to analyze the business based on operational structures such as industries, functions, consumers, or product lines.

-

There are five types of core accounts to capture any accounting transaction. Apart from these fundamental accounts, some other special-purpose accounts are used to ensure the integrity of financial transactions. Some examples of such accounts are clearing accounts, suspense accounts, contra accounts, and intercompany accounts. Understand the importance and usage of these accounts.

-

There are two commonly used methods of accounting - Cash Basis and the Accruals Basis. Understand the difference between accruals and reversals. Recap the earlier discussion we had on accruals and reversals and see the comparison between these two different but related accounting concepts. Understand how the action of accruing results in reversals subsequently in the accounting cycle.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved