- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- GL - Accruals and Reversals

GL - Accruals and Reversals

There are two commonly used methods of accounting - Cash Basis and the Accruals Basis. Understand the difference between accruals and reversals. Recap the earlier discussion we had on accruals and reversals and see the comparison between these two different but related accounting concepts. Understand how the action of accruing results in reversals subsequently in the accounting cycle.

What is Accounting Accruals:

There are two commonly used methods of accounting - Cash Basis and the Accruals Basis. In cash basis of accounting, income is recognized in books when it is received in cash, and expenses are offset when they are actually paid.

Contrary to Cash Basis Accounting, in Accrual Basis Accounting, financial items are accounted for when they are earned and deductions are claimed when expenses are incurred, irrespective of the actual cash flow. The Accrual accounting method measures the financial performance of a company by recognizing accounting events regardless of when corresponding cash transactions occur. Accrual follows the matching principle in which the revenues are matched (or offset) to expenses in the accounting period in which the transaction occurs rather than when payment is made (or received).

Accrual Accounting

Accrual accounting is considered to be the standard accounting practice for most companies and is the most widely used accounting method in the automated accounting system. This method provides a more accurate picture of the company's current condition, but as all income and expenses need to be recognized based on their occurrence and matching, it is relatively complex when compared to cash accounting, which recognizes transactions only when there is an exchange of cash. The need for this method arose out of the increasing complexity of business transactions and investor demand for more timely and accurate financial information.

Accrual - Example

To help you understand this concept let’s look at an example. A company has sold merchandise on credit to a customer who is creditworthy and there is the absolute certainty that the payment will be received in the future. The company earns a profit of $500 on the total sales price of $2000. The accounting for this transaction will be different in the two methods. The revenue generated by the sale of the merchandise will only be recognized by the cash method when the money is received by the company which might happen next month or next year. However in the Accrual Method, the revenue will be recognized in the same period, an “Accounts Receivable” will be created to track future credit payments from the customer.

Accrual Concepts

Based on the above discussion now let’s take a look at some accrual/deferral related concepts:

-

Accrued revenue is an asset, such as unpaid proceeds from a delivery of goods or services, when such income is earned and a related revenue item is recognized, while cash is to be received in a later period.

-

Accrued expense, in contrast, is a liability with an uncertain timing or amount, but where the uncertainty is not significant enough to qualify it as a provision.

-

As an accounting practice expense and revenue accruals are reversed in the next accounting period to prevent double-booking of expenses/revenues when they get settled in cash

Concept of Reversals:

At the beginning of each accounting period, there is an accounting practice to use reversing entries to cancel out the adjusting/accrual entries that were made to accrue revenues and expenses at the end of the previous accounting period. The use of Reversing Entries makes it easier to record subsequent transactions by eliminating the possibility of duplication.

-

Reversing entries are made on the first day of an accounting period in order to offset adjusting accrual/provision entries made in the previous accounting period.

-

Reversing entries are used to avoid the double booking of revenues or expenses when the accruals/provisions are settled in cash.

-

A reversing entry is linked to the original adjusting entry and is written by reversing the position of debits with credits and vice versa.

-

The net impact of Original Entry and Reversing Entry on the accounting books is always zero.

-

In Automated Accounting Systems, it is not possible to delete transactions once the posting has been made. In such systems reversals is the recommended way to correct the erroneous entries. An example is that one interface feed has been posted by mistake twice. This has inflated many income expense accounts. A reversing entry with opposite debit and credit amounts to all the impacted accounts will nullify the impact of the mistake.

Related Links

You May Also Like

-

An allocation is a process of shifting overhead costs to cost objects, using a rational basis of allotment. Understand what is the meaning of allocation in the accounting context and how defining mass allocations simplifies the process of allocating overheads to various accounting segments. Explore types of allocations and see some practical examples of mass allocations in real business situations.

-

Accrued expenses, sometimes referred to as accrued liabilities, are expenses that have been incurred but have not been recorded in the accounts. Discuss the need to record accrued liabilities and why they require an adjustment entry. Understand the treatment for these entries once the accounting period is closed and learn to differentiate when the commitments become liabilities.

-

In most of the automated financial systems, you can define more than 12 accounting periods in a financial year. This article will explain the concept of the adjustment period and the benefits of having adjustment periods. Adjustment periods have their inherent challenges for the users of financial statements and there is a workaround for those who don’t want to use adjustment periods.

-

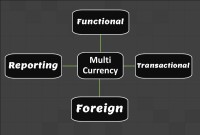

Multi Currency - Functional & Foriegn

Currency is the generally accepted form of money that is issued by a government and circulated within an economy. Accountants use different terms in the context of currency such as functional currency, accounting currency, foreign currency, and transactional currency. Are they the same or different and why we have so many terms? Read this article to learn currency concepts.

-

GL - Review & Approve Journals

Review and Approval mechanisms ensure that the accounting transaction is reasonable, necessary, and comply with applicable policies. Understand why we need review and approval processes, what are they, and how they are performed in automated general ledger systems. Learn the benefits of having journal approval mechanisms in place.

-

Global Business Services (GBS) Model

Global business services (GBS) is an integrated, scalable, and mature version of the shared services model. Global Business Services Model is a result of shared services maturing and evolving on a global scale. It is represented by the growth and maturity of the Shared services to better service the global corporations they support.

-

There are five types of core accounts to capture any accounting transaction. Apart from these fundamental accounts, some other special-purpose accounts are used to ensure the integrity of financial transactions. Some examples of such accounts are clearing accounts, suspense accounts, contra accounts, and intercompany accounts. Understand the importance and usage of these accounts.

-

Reversing Journals are special journals that are automatically reversed after a specified date. A reversing entry is a journal entry to “undo” an adjusting entry. When you create a reversing journal entry it nullifies the accounting impact of the original entry. Reversing entries make it easier to record subsequent transactions by eliminating the need for certain compound entries. See an example of reversing journal entry!

-

Internally, an organization can be structured in many different ways, depending on their objectives. The internal structure of an organization will determine the modes in which it operates and performs. Organizational structure allows the expressed allocation of responsibilities for different functions and processes to different entities such as the branch, department, workgroup and individual.

-

Functional Organizational Structures

A functional organizational structure is a structure that consists of activities such as coordination, supervision and task allocation. The organizational structure determines how the organization performs or operates. The term organizational structure refers to how the people in an organization are grouped and to whom they report.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved