- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

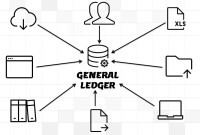

- General Ledger (Record to Report)

- Defining Internal Structures

Defining Internal Structures

Internally, an organization can be structured in many different ways, depending on their objectives. The internal structure of an organization will determine the modes in which it operates and performs. Organizational structure allows the expressed allocation of responsibilities for different functions and processes to different entities such as the branch, department, workgroup and individual.

Internally, an organization can be structured in many different ways, depending on their objectives. The internal structure of an organization will determine the modes in which it operates and performs. Organizational structure allows the expressed allocation of responsibilities for different functions and processes to different entities such as the branch, department, workgroup and individual.

We know that big multinational organizations operate in a matrix environment, constitute of many units and need different views of their operating and financial results. These different views may represent financials or profitability by geographies, countries, locations, businesses, segments, product lines, cost centers, functions, COE’s etc.

Various types of operational units, functional units and divisional units widely used across industry are briefly explained below:

|

Dimension |

Explanation |

|

Cost centers |

A cost center is part of an organization that does not produce direct profit and adds to the cost of running a company. Examples of cost centers include marketing & finance departments. It is an operating unit in which managers are accountable for budgeted and actual expenditures. Used for the management and operational control of business processes that may span legal entities. |

|

Business units/ Management Entity |

A semi-autonomous operating unit that is created to meet strategic business objectives. Used for financial reporting that is based on industries or product lines that the organization serves independently of legal entities. |

|

Value streams |

An operating unit that controls one or more production flows. Commonly used in lean manufacturing to control the activities and flows that is required to supply a product or service to consumers. |

|

Business Functions/ Departments / Divisions |

A department or division can be viewed as the intersection between a legal entity and a business unit. Departments can serve as profit centers. They can be used as cost accumulators and for revenue recognition. They may have profit and loss responsibility, and may consist of a group of cost centers. This operating unit defines academic areas, research units, or administrative offices with an appointed manager, that have programmatic, operational, fiscal and/or budgetary responsibility for a specific set of activities and projects/grants. |

|

Retail channels |

An operating unit that represents a brick and mortar store, an online store or an online marketplace. Used for the management and operational control of one or more stores within or across legal entities. |

|

Business Support Functions |

An operating unit that represents a category or functional part of an organization that performs a specific task to support inward-directed activity, such as sales or marketing to support business. Used to report on functional areas. A support function may have allocated budgets and may consist of a group of cost centers. |

|

Organization Support Functions |

Self-directed activity systems of an organization concerned with establishing and maintaining the organization as an entity. Each organization support function provides support to all functions, business, business support and other organization support functions. For example, corporate finance, IT functions, administration and knowledge management. An organization support function may have allocated budgets and may consist of a group of cost centers. |

|

Profit Center |

A profit center is a part of a corporation that directly adds to its profit, treated as a separate business and for which the profits or losses are calculated separately. This operating unit is held accountable for both revenues, and costs (expenses), and therefore, profits. Different profit centers are separated for accounting purposes so that the management can measure their relative efficiency and profit. |

|

Business Locations/ Countries/ Geography/ Supplier & Customer Locations |

Organizations operate from more than one location and may need to track where a particular financial transaction occurred. Some examples of need to track different locations could be transactions through sales offices, factories, subsidiaries etc. Organizations may even need to analyze the financial information based on the supplier’s or customer’s location may require a location segment dedicated to this. However this has very limited application in terms of usefulness. E.g. software companies cater to clients from all over the world & may like to make strategies based on which customer territory contributed how much to the revenue & hence a customer location is an important segment but for a manufacturing organization this will hold no relevance. |

|

Project Area

|

Certain organizations have their business models build around project activities. E.g. a property developer may like to have all its cost & revenue against individual projects. These organizations may have multiple projects running under same legal entity. There projects have their own budget & statutory requirements & hence their own trial balance. |

|

Product Lines/Service Lines

|

Some organizations deal in products which are low in volume but high in value. These organizations would like to analyze their costs & revenue for individual products. They also need to apportion indirect costs & revenues to these products/services so that the financials provide a full picture on product performance. On the other hand, a supermarket dealing in thousands of product might not have any interest in recording every transaction against the individual product or track financials at product level. Further each legal entity in the group may have its own set of released products that it wants to include in transaction documents. |

|

Accounts/Sub Accounts

|

Natural Accounts captures the nature of financial transactions such as Assets, Liabilities, Fund Equity, Revenues, and Expenditures. It captures the transactional information at detailed level that can be summarized to parent accounts for external and internal company-wide reporting. This hierarchy is helpful in organizing and summarizing reports. |

|

Business Employee Hierarchy |

Business employee hierarchy is the pyramidal type arrangement of the organizational employees. This vertical hierarchy helps in delegation of authority based on the span of control at multiple levels of employees. Each level in the hierarchy becomes an integral part of the chain of command and acts as the channel for transmission of authority to the succeeding lower level of the management. These hierarchical structures in organizations narrow down as we move in the upward direction and showcase centralization in the whole setup. At transactional level it is used to define the authority and set approval path and limits. |

|

Elimination Entity |

When a parent company does business with one or more subsidiary companies and uses consolidated financial reporting, any transactions between the companies must be removed, or eliminated, from the financial reports. These transactions are called elimination transactions. The destination company for eliminations is called the elimination company. |

|

Consolidation Entity |

A legal entity which is the consolidation company. During consolidation, transactions from several company accounts of subsidiaries is aggregated into a single company |

Related Links

You May Also Like

-

GL - Understanding Chart of Accounts

A chart of accounts (COA) is a list of the accounts used by a business entity to record and categorize financial transactions. COA has transitioned from the legacy accounts, capturing just the natural account, to modern-day multidimensional COA structures capturing all accounting dimensions pertaining to underlying data enabling a granular level of reporting. Learn more about the role of COA in modern accounting systems.

-

In this article, we will explain the general Ledger journal processing flow from entering journals to running the final financial reports. Understand the generic general ledger process flow as it happens in automated ERP systems. The accounting cycle explains the flow of converting raw accounting data to financial information whereas general ledger process flow explains how journals flow in the system.

-

GL - Unearned / Deferred Revenue

Unearned revenue is a liability to the entity until the revenue is earned. Learn the concept of unearned revenue, also known as deferred revenue. Gain an understanding of business scenarios in which organizations need to park their receipts as unearned. Look at some real-life examples and understand the accounting treatment for unearned revenue. Finally, look at how the concept is treated in the ERPs or automated systems.

-

Matrix Organizational Structures

In recent times the two types of organization structures which have evolved are the matrix organization and the network organization. Rigid departmentalization is being complemented by the use of teams that cross over traditional departmental lines.

-

An account inquiry is a review of any type of financial account, whether it be a depository account or a credit account. In this tutorial, you learn what we mean by drill through functionality in the context of the general ledger system. We will explain the concept of drill-down and how it enables users to perform account and transaction inquiry at a granular level and the benefits of using this functionality.

-

This article explains the process of entering and importing general ledger journals in automated accounting systems. Learn about the basic validations that must happen before the accounting data can be imported from any internal or external sub-system to the general ledger. Finally, understand what we mean by importing in detail or in summary.

-

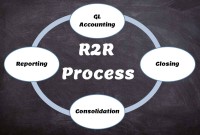

Record to report (R2R) is a finance and accounting management process that involves collecting, processing, analyzing, validating, organizing, and finally reporting accurate financial data. R2R process provides strategic, financial, and operational feedback on the performance of the organization to inform management and external stakeholders. R2R process also covers the steps involved in preparing and reporting on the overall accounts.

-

Horizontal or Flat Organizational Structures

Flat organizational structure is an organizational model with relatively few or no levels of middle management between the executives and the frontline employees. Its goal is to have as little hierarchy as possible between management and staff level employees. In a flat organizational structure, employees have increased involvement in the decision-making process.

-

Legal Structures for Multinational Companies

A multinational company generally has offices and/or factories in different countries and a centralized head office where they coordinate global management. A multinational company (MNC)is a corporate organization that owns or controls the production of goods or services in at least one country other than its home country.

-

GL - Review & Approve Journals

Review and Approval mechanisms ensure that the accounting transaction is reasonable, necessary, and comply with applicable policies. Understand why we need review and approval processes, what are they, and how they are performed in automated general ledger systems. Learn the benefits of having journal approval mechanisms in place.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved