- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- Legal Structures for Multinational Companies

Legal Structures for Multinational Companies

A multinational company generally has offices and/or factories in different countries and a centralized head office where they coordinate global management. A multinational company (MNC)is a corporate organization that owns or controls the production of goods or services in at least one country other than its home country.

Due to advent of information age and globalization, the traditional hierarchy of the industrial age is rapidly disappearing and new large groups that are spread across the globe are fast emerging. A multinational corporation is a company with headquarters in one country but they operate in many countries. The post Second World War period saw the rapid growth of multinationals in Europe, America and Japan. As the world economy is opening up with a fall in regulatory barriers to foreign investment, better transport and communications, freer capital movements, etc., international companies are finding it easier to invest where they choose to cheaply, and with less risk. With the advent of globalization, companies started expanding to international markets and establishing marketing, manufacturing, or research and development facilities in several foreign countries.

What are multi-national companies?

A multinational company generally has offices and/or factories in different countries and a centralized head office where they coordinate global management. A multinational company (MNC)is a corporate organization that owns or controls the production of goods or services in at least one country other than its home country. One of the first multinational business organizations, the East India Company, was established in 1601. After the East India Company, came the Dutch East India Company in 1603, which would become the largest company in the world for nearly 200 years.

Some current examples are big multi national companies like Apple, Google, Amazon, Coca-Cola, Starbucks, IBM, FedEx, Accenture, Samsung or General Electric etc. Nestle and Shell Oil are two examples of European multinational. Most of the largest and most influential companies of the modern age are publicly traded multinational corporations, including Forbes Global 2000 companies.

What are Conglomerates?

A conglomerate is a combination of two or more corporations engaged in entirely different businesses that fall under one corporate group, usually involving a parent company and many subsidiaries. Often, a conglomerate is a multi-industry company. Conglomerates are often large and multinational.

Features of MNCs & Conglomerates

Some of the attributes associated with these large multi-national corporations are:

- These multinational groups operate across the boundaries of nations

- They employ and serve thousands of people with different cultures.

- Their annual sales turnover is in billions of dollars.

- They raise money in different stock markets.

- In spite of all these diversities they may be part of the same global group.

- These companies operate as individual entities in different countries/markets and consolidate with the group.

- Domestic corporations are taxed on their worldwide income at the federal (country) and state levels.

- Compliance (without overpaying) makes the products & services of these conglomerates more competitive, earnings more attractive to investors & company a more responsible corporate citizen.

Evolution of Legal Structures for MNCs/Conglomerates

They are dynamic organizations that are constantly changing and evolving, acquiring and merging many companies, opening their offices in all parts of world and operating under the ambit of ever-changing complex organizational structures.

Fundamentally a corporation must be legally domiciled in a particular country and engage in other countries through foreign direct investment and the creation of foreign branches or foreign subsidiaries.

All these large groups have smaller companies within them. The conglomerate may be constituted of different units which may represent separate legal entities constituted in different countries having multiple layers of ownership (which might be added to the group through mergers, acquisitions or could be joint ventures). Multinational corporations can select from a variety of jurisdictions for various subsidiaries, but the ultimate parent company can select a single legal domicile.

Global operations of these corporations are conducted with multiple subsidiaries, branch offices and joint venture partners working together, constantly evolving and changing their legal structures through mergers, acquisitions and takeovers. These subsidiaries and partners are responsible for their own P&L. They have their own Fixed Assets (such as assets held for the purpose of producing or providing goods/services) and their own markets where their own or their other group concern’s products are sold and eventually consolidate with the group.

Multinational corporations may be subject to the laws and regulations of both their domicile and the additional jurisdictions where they are engaged in business. In some cases, the jurisdiction can help to avoid burdensome laws. Corporations can legally engage in tax avoidance through their choice of jurisdiction, but must be careful to avoid illegal tax evasion. These MNCs should comply fully with all statutory and tax laws & regulations around the world and ensure payment of the correct amount of taxes in every country where it operates.

Aside from setting up a private limited company as subsidiary, foreign companies have two other options for entering the foreign market – a Branch Office or a Representative Office. Both are registered locally in the country of operations, follow local procedures, and need to pay official fees for registration.

Related Links

You May Also Like

-

When the quantum of business is expected to be moderate and the entrepreneur desires that the risk involved in the operation be shared, he or she may prefer a partnership. A partnership comes into existence when two or more persons agree to share the profits of a business, which they run together.

-

Understand what we mean by GAAP to STAT adjustments. This article discusses the different standards that are used for multiple representations of the financial results for global organizations. Understand the meaning of US GAAP, Local GAAP, STAT, IFRS, and STAT. Finally, understand why accounting differences arise and how they are adjusted for different financial representations.

-

Business Metrics for Management Reporting

Business metric is a quantifiable measure of an organization's behavior, activities, and performance used to access the status of the targeted business process. Traditionally many metrics were finance based, inwardly focusing on the performance of the organization. Businesses can use various metrics available to monitor, evaluate, and improve their performance across any of the focus areas like sales, sourcing, IT or operations.

-

An organizational design is the process by which a company defines and manages elements of structure so that an organization can control the activities necessary to achieve its goals. Good organizational structure and design helps improve communication, increase productivity, and inspire innovation. Organizational structure is the formal system of task and activity relationships to clearly define how people coordinate their actions and use resources to achieve organizational goals.

-

What is Accounting & Book Keeping

Accounting is a process designed to capture the economic impact of everyday transactions. Each day, many events and activities occur in an entity, these events and activities are in the normal course of business; however, each of these events may or may not have an economic impact. Events or activities that have an effect on the accounting equation are accounting events.

-

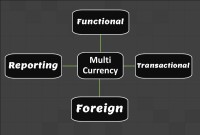

Multi Currency - Functional & Foriegn

Currency is the generally accepted form of money that is issued by a government and circulated within an economy. Accountants use different terms in the context of currency such as functional currency, accounting currency, foreign currency, and transactional currency. Are they the same or different and why we have so many terms? Read this article to learn currency concepts.

-

Explore the concept of journal reversals and understand the business scenarios in which users may need to reverse the accounting entries that have been already entered into the system. Understand the common sources of errors resulting in the reversal of entries and learn how to correct them. Discuss the reversal of adjustment entries and the reversal functionalities in ERPs.

-

GL - Journal Posting and Balances

In this tutorial, we will explain what we mean by the posting process and what are the major differences between the posting process in the manual accounting system compared to the automated accounting systems and ERPs. This article also explains how posting also happens in subsidiary ledgers and subsequently that information is again posted to the general ledger.

-

General Ledger - Advanced Features

Modern automated general ledger systems provide detailed and powerful support for financial reporting and budgeting and can report against multiple legal entities from the single system. These systems offer many advanced functionalities right from journal capture to advanced reporting. This article will provide an overview of some advanced features available in today's General Ledgers.

-

McKinsey 7S Framework is most often used as an organizational analysis tool to assess and monitor changes in the internal situation of an organization. The model is based on the theory that, for an organization to perform well, seven elements need to be aligned and mutually reinforcing.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved