- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- GL - Unearned / Deferred Revenue

GL - Unearned / Deferred Revenue

Unearned revenue is a liability to the entity until the revenue is earned. Learn the concept of unearned revenue, also known as deferred revenue. Gain an understanding of business scenarios in which organizations need to park their receipts as unearned. Look at some real-life examples and understand the accounting treatment for unearned revenue. Finally, look at how the concept is treated in the ERPs or automated systems.

What is unearned revenue?

Unearned revenues sometimes referred to as deferred revenues, are items that have been initially recorded as liabilities but are expected to become revenues over time or through the normal operations of the business. Unearned revenues (or deferred revenues) are revenues received in cash and recorded as liabilities prior to being earned. Unearned revenue is a liability to the entity until the revenue is earned.

Prepaid expenses and unearned revenues are created from transactions that involve the receipt or payment of cash. In both cases, the recording of the related expense or revenue is delayed until the end of the period or to a future accounting period as per accounting prudence and matching and accrual principles. It results from the company's receiving payments in advance for services or products that have not yet been provided. The company now ''owes'' that amount of services or products to its customer. This '' debt'' will be satisfied when those services or products are provided.

Examples of Unearned Revenue:

Some examples of unearned revenue are unearned rent, tuition received in advance by a school, an annual retainer fee received by an attorney, premiums received in advance by an insurance company, and magazine subscriptions received in advance by a publisher. Another example of unearned revenue would be if the customer paid a deposit for a custom ordered machine that has not been delivered, the deposit would be recorded as unearned revenue. A magazine subscription results in deferred revenue for the publisher because the payment is received in advance; it will be converted into actual revenue as issues of the magazine are delivered.

An airline that receives advance payment for tickets should also record the transactions as unearned revenue. Similarly, professional service providers such as accounting, legal, and contracting firms that accept deposits should record them as unearned revenue. Companies that provide warranties to their customers for an extended time period and charge for these warranties also deal with unearned incomes.

Accounting Treatment of Deferred Revenue:

Companies using the accrual accounting method should adhere to the revenue recognition principles and matching principles. Companies should recognize revenue only in the same accounting period in which it is earned. Consequently, when companies accept deposits or advance payments, they should record them as unearned revenues at the time of the receipt. Then, in the future when the goods or services are provided to the customers, they should adjust the entries as earned income.

Unearned revenue is treated as a short- or long-term (or both) liability on a company's balance sheet, based on the nature of the entry and underlying business contract. This type of adjusting entry will be adjusted by another entry as and when the revenue will be earned to recognize revenue and offset the deferred revenue.

Examples of industries having unearned revenue:

Unearned revenue can be applied in almost all industries however it becomes very important in the case of some industries where advance payments are the norm like subscriptions for magazines. Companies providing extended warranties need to treat their sales as unearned revenues at the time of sale.

Industries dealing in products that require installation services are accounted for as multiple-element arrangements, where the fair value of the installation service is deferred when the product is delivered and recognized when the installation is complete. For installations with customer acceptance provisions, all revenue is generally deferred until customer acceptance.

Warranty billings are generally invoiced to the customer at the beginning of the contract term. Revenue from extended warranties is deferred and recognized ratably over the duration of the contract. When a dealer sells (sells being the keyword) a service contract not all of the revenue is recognized at the time of sale. Instead, it is recognized over the life of the contract and recorded as Deferred Service Contract Revenue in the liability section of the balance sheet. Each month and or year a portion of the deferred revenue is moved from liabilities to income. Unearned extended warranty revenue is reflected as unearned revenues in accrued liabilities in the balance sheets.

Revenue from separately priced, self-insured service contracts is deferred at the point of sale and generally recognized on a straight-line basis over the life of the contract for GAAP presentation.

Accounting Entries for Unearned Revenue:

In automated systems, you can define rules that can determine the event which triggers the revenue recognition. Till the time that recognition event is triggered, the amount remains parked in an unearned revenue account as a liability. If you enter an invoice with a Bill in Advance invoicing rule, Receivables creates the following journal entries.

In the first period of the rule:

Debit: Receivables

Credit: Unearned Revenue

In all periods of the rule for the portion that is recognized:

Debit: Unearned Revenue

Credit: Revenue

Related Links

You May Also Like

-

Funds contributed by owners in any business are different from all other types of funds. Equity is the residual value of the business enterprise that belongs to the owners or shareholders. The funds contributed by outsiders other than owners that are payable to them in the future. Liabilities are generally classified as Short Term (Current) and Long Term Liabilities. Current liabilities are debts payable within one year.

-

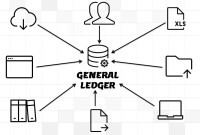

The general ledger is the central repository of all accounting information in an automated accounting world. Summarized data from various sub-ledgers are posted to GL that eventually helps in the creation of financial reports. Read more to understand the role and benefits of an effective general ledger system in automated accounting systems and ERPs.

-

This article explains the process of entering and importing general ledger journals in automated accounting systems. Learn about the basic validations that must happen before the accounting data can be imported from any internal or external sub-system to the general ledger. Finally, understand what we mean by importing in detail or in summary.

-

Hierarchical Organization Structures

Hierarchical structure is typical for larger businesses and organizations. It relies on having different levels of authority with a chain of command connecting multiple management levels within the organization. The decision-making process is typically formal and flows from the top down.

-

GL - Recurring Journal Entries

A “Recurring Journal” is a journal that needs to be repeated and processed periodically. Recurring Entries are business transactions that are repeated regularly, such as fixed rent or insurance to be paid every month. Learn the various methods that can be used to generate recurring journals. See some examples and explore the generic process to create recurring journals in any automated system.

-

Legal Structures in Businesses

Businesses not only vary in size and industry but also in their ownership. Most businesses evolve from being owned by just one person to a small group of people and eventually being managed by a large numbers of shareholders. Different ownership structures overlap with different legal forms that a business can take. A business’s legal and ownership structure determines many of its legal responsibilities.

-

Although technically a general ledger appears to be fairly simple compared to other processes, in large organizations, the general ledger has to provide many functionalities and it becomes considerably large and complex. Modern business organizations are complex, run multiple products and service lines, leveraging a large number of registered legal entities, and have varied reporting needs.

-

GL - Different Accounting Methods

The accounting method refers to the rules a company follows in reporting revenues and expenses. Understand the two common systems of bookkeeping, single, and double-entry accounting systems. Learners will also understand the two most common accounting methods; cash and accrual methods of accounting and the advantages and disadvantages of using them.

-

Accrued expenses, sometimes referred to as accrued liabilities, are expenses that have been incurred but have not been recorded in the accounts. Discuss the need to record accrued liabilities and why they require an adjustment entry. Understand the treatment for these entries once the accounting period is closed and learn to differentiate when the commitments become liabilities.

-

GL - Accrued / Unbilled Revenue

Accrued revenues (also called accrued assets) are revenues already earned but not yet paid by the customer or posted to the general ledger. Understand what we mean by the terms accrued revenue, accrued assets, and unbilled revenue. Explore the business conditions that require recognition of accrued revenue in the books of accounts and some industries where this practice is prevalent.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved