- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- Hierarchical Organization Structures

Hierarchical Organization Structures

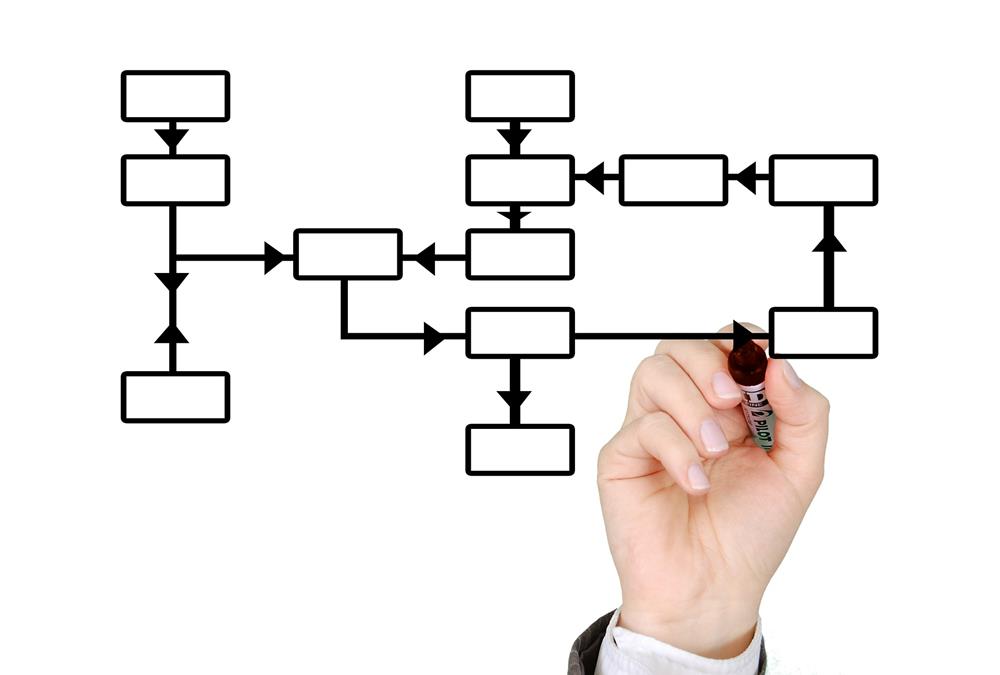

Hierarchical structure is typical for larger businesses and organizations. It relies on having different levels of authority with a chain of command connecting multiple management levels within the organization. The decision-making process is typically formal and flows from the top down.

Hierarchical structure is typical for larger businesses and organizations. It relies on having different levels of authority with a chain of command connecting multiple management levels within the organization. The decision-making process is typically formal and flows from the top down. This creates a tall organizational structure where each level of management has clear lines of responsibility and control. As the organization grows, the number of levels increases and the structure grows taller.

Often, the number of managers in each level gives the organization the resemblance of a pyramid. This structure gets wider as you move down - usually with one chief executive at the top, followed by senior management, middle managers and finally workers. Employees' roles are clearly defined within the organization, as is the nature of their relationship with other employees.

Two popular types of hierarchical organizational designs are Functional Structures and Divisional Structures.

1. Functional Structure

In a Functional Structure, functions (accounting, marketing, H.R., and so on) are separate, each led by a senior executive who reports to the CEO. This can be a very efficient way of working, allowing for economies of scale as specialists work for the whole organization. There should be clear lines of communication and accountability. However, there's a danger that functional goals can end up overshadowing the overall aims of the organization. And there may be little scope for creative interplay between people in different teams.

2. Divisional Structure

In a Divisional Structure, the company is organized by office or customer location. Each division is autonomous and has a manager who reports to the CEO. A key advantage is that each division is free to concentrate on its own performance, and its people can build up strong local links. However, there may be some duplication of duties. People may also feel disconnected from the company as a whole, and enjoy fewer opportunities to gain training across the business.

The Simple/Flat Structure is common in small businesses. It may have only two or three levels, and people tend to work as a large team, with everyone reporting to one person. It can be a very efficient way of working, with clear responsibilities – as well as a useful level of flexibility.

A potential disadvantage, however, is that this structure can hold back progress when the company grows to a point where the founder or CEO can no longer make all the decisions.

Related Links

You May Also Like

-

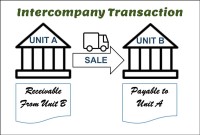

There are five types of core accounts to capture any accounting transaction. Apart from these fundamental accounts, some other special-purpose accounts are used to ensure the integrity of financial transactions. Some examples of such accounts are clearing accounts, suspense accounts, contra accounts, and intercompany accounts. Understand the importance and usage of these accounts.

-

In this article we will focus on and understand the accounting process which enables the accounting system to provide the necessary information to business stakeholders. We will deep dive into each of the steps of accounting and will understand how to identify accounting transactions and the process for recording accounting information and transactions.

-

After reading this article the learner should be able to understand the meaning of intercompany and different types of intercompany transactions that can occur. Understand why intercompany transactions are addressed when preparing consolidated financial statements, differentiate between upstream and downstream intercompany transactions, and understand the concept of intercompany reconciliations.

-

The purpose of the general ledger is to sort transaction information into meaningful categories and charts of accounts. The general ledger sorts information from the general journal and converts them into account balances and this process converts data into information, necessary to prepare financial statements. This article explains what a general ledger is and some of its major functionalities.

-

Although technically a general ledger appears to be fairly simple compared to other processes, in large organizations, the general ledger has to provide many functionalities and it becomes considerably large and complex. Modern business organizations are complex, run multiple products and service lines, leveraging a large number of registered legal entities, and have varied reporting needs.

-

GL - Different Accounting Methods

The accounting method refers to the rules a company follows in reporting revenues and expenses. Understand the two common systems of bookkeeping, single, and double-entry accounting systems. Learners will also understand the two most common accounting methods; cash and accrual methods of accounting and the advantages and disadvantages of using them.

-

In this article we will help you understand the double-entry accounting system and state the accounting equation and define each element of the equation. Then we will describe and illustrate how business transactions can be recorded in terms of the resulting change in the elements of the accounting equation.

-

The general ledger is the central repository of all accounting information in an automated accounting world. Summarized data from various sub-ledgers are posted to GL that eventually helps in the creation of financial reports. Read more to understand the role and benefits of an effective general ledger system in automated accounting systems and ERPs.

-

GL - Review & Approve Journals

Review and Approval mechanisms ensure that the accounting transaction is reasonable, necessary, and comply with applicable policies. Understand why we need review and approval processes, what are they, and how they are performed in automated general ledger systems. Learn the benefits of having journal approval mechanisms in place.

-

What is Accounting & Book Keeping

Accounting is a process designed to capture the economic impact of everyday transactions. Each day, many events and activities occur in an entity, these events and activities are in the normal course of business; however, each of these events may or may not have an economic impact. Events or activities that have an effect on the accounting equation are accounting events.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved