- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- Complexities in GL System

Complexities in GL System

Although technically a general ledger appears to be fairly simple compared to other processes, in large organizations, the general ledger has to provide many functionalities and it becomes considerably large and complex. Modern business organizations are complex, run multiple products and service lines, leveraging a large number of registered legal entities, and have varied reporting needs.

These complexities create a need for advanced general ledger systems providing new functionalities. Let us understand some drivers for this complexity.

1. Specialized Software

For large organizations, the general ledger is hosted on a computerized system, integrated with multiple sub-ledgers and the legacy general ledgers. For the most part the journal entry is automated and fed into the general ledger through a complex import process. GL is the backbone of any enterprise resource planning (ERP) software and the general ledger stores the transactions into a database that is shared with other processes being managed through the ERP. In such cases a GL provides the following information:

- General ledger chart of accounts

- Administration of general ledger database reporting/consolidation structure

- Preparation and recording of journal entries

- Monitoring of the close process at unit and company levels

- Review and analysis of account and unit-level trial balances

- Preparation of consolidated company trial balance

- Generation and distribution of monthly system financial reports

- Reconciliation of balance sheet accounts and related bank statements

- Preparation of eliminating entries

- Finalization of monthly consolidated statements

- Calculation and consolidation of expense type (selling, general and administrative/cost of sales) information

- Maintenance of corporate/group overhead allocation pools and related rates

- Manual record retention/archiving and audit support specific to general accounting.

2. Multitude of Subsidiary Ledgers

For any company that has a large number of transactions, putting all the details in the general ledger is not feasible. Hence it needs to be supported by one or more subsidiary ledgers that provide details for accounts in the general ledger. Consider any one account in a general ledger, such as Accounts Payable. Perhaps you want to know how much money you currently owe to each of your suppliers and this information is very critical for you to manage your relationship with that supplier and to ensure that you are paying only for what you purchased and received. If you only have one or two suppliers, it is easily possible to compile this information directly in the general ledger by opening two natural accounts in the name of the suppliers. But what if you have hundreds or even thousands of suppliers? In that case, you may want to create subsidiary ledgers for accounts payable that will capture the complete master and transactional level details for each of your suppliers. This way, you can record the details of transactions involving each supplier in the relevant subsidiary ledger and then subsequently transfer the totals into a control account in the general ledger.

3. Complex Organizational Structure

Modern business organizations run multiple products and service lines, operate globally, leverage a large number of registered legal entities, and operate through complex matrix relationships. To stay competitive in the current global business environment, they must often develop highly diverse and complex organizational structures that cross international borders. These complexities create a need for advanced operational and supporting business processes to drive organization-wide effectiveness, efficiency, and achieve business objectives. This forces companies to create a diverse array of subsidiaries, legal entities, organizations, and accounting processes to ensure a smooth and profitable business flow. Tax considerations also impact how businesses construct these complex legal structures. General Ledger has to be structured in a fashion that it can cater to the reporting needs of every unit, department, and regulatory bodies in this complex structure.

It needs to collect and process data from these multiple units and provide a consolidated view of the enterprise for shareholders and management.

4. Legacy Systems

Mergers & Acquisitions (M&A) is the new normal for large companies, driving innovation and growth. The capability to successfully integrate or divest businesses is a major source of competitive advantage. There is a lack of flexibility to integrate mergers and acquisitions. All these corporate actions bring added complexity from a general ledger standpoint. Legacy data need to be transferred to the organizational chart of accounts system and accounting policies. Systems need to be established to collect and transform such data on an ongoing basis until the migration to the enterprise general ledger is done.

5. Multiple Charts of Accounts

In these large corporations, different business units within the company have different COAs and different reporting priorities and the standard reports don’t produce the information the organization needs to properly run the business or meet tax and/or regulatory needs. Complexity arises also because of accounts that are not used consistently across the organization, reducing the effectiveness of reporting and consolidation.

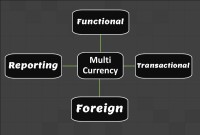

6. FX and Complex Currency Requirements

For international businesses with significant volumes of cross-border transactions, the management of currency risk is an essential task for the treasury department. There are businesses with varied and very complex FX management needs, either because they have higher transaction volumes or because they work with a larger number of currencies. In these cases, their General Ledger becomes very complex as it needs to manage various processes like multi-currency recording, translation, conversion, and revaluation. Some businesses also do FX leveling and sweep to manage the hedging risks.

7. Changing Regulatory Landscape

The global regulatory landscape is undergoing a fundamental change. In the years since the 2007/08 financial crisis, regulators across the globe have focused on a program of more robust supervision of financial services firms. The increasing weight of new regulatory legislation from regulators, coupled with the increasingly diverse risks to which firms are exposed, means that firms need to ensure that their general ledgers are updated and flexible enough to provide the data needed for these changing participants are required to adapt and evolve to address the regulatory and technological changes.

Related Links

You May Also Like

-

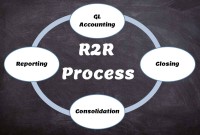

Record to report (R2R) is a finance and accounting management process that involves collecting, processing, analyzing, validating, organizing, and finally reporting accurate financial data. R2R process provides strategic, financial, and operational feedback on the performance of the organization to inform management and external stakeholders. R2R process also covers the steps involved in preparing and reporting on the overall accounts.

-

As the business grows, the company may want to transition to a branch structure as branches are allowed to conduct a much broader range of activity than representative offices. Branches can buy and sell goods, sign contracts, build things, render services, and generally everything that a regular business can do. A company expands its business by opening up its branch offices in various parts of the country as well as in other countries.

-

GL - Understanding Chart of Accounts

A chart of accounts (COA) is a list of the accounts used by a business entity to record and categorize financial transactions. COA has transitioned from the legacy accounts, capturing just the natural account, to modern-day multidimensional COA structures capturing all accounting dimensions pertaining to underlying data enabling a granular level of reporting. Learn more about the role of COA in modern accounting systems.

-

Matrix Organizational Structures

In recent times the two types of organization structures which have evolved are the matrix organization and the network organization. Rigid departmentalization is being complemented by the use of teams that cross over traditional departmental lines.

-

GL - Review & Approve Journals

Review and Approval mechanisms ensure that the accounting transaction is reasonable, necessary, and comply with applicable policies. Understand why we need review and approval processes, what are they, and how they are performed in automated general ledger systems. Learn the benefits of having journal approval mechanisms in place.

-

Generally Accepted Accounting Principles define the accounting procedures, and understanding them is essential to producing accurate and meaningful records. In this article we emphasize on accounting principles and concepts so that the learner can understand the “why” of accounting which will help you gain an understanding of the full significance of accounting.

-

A subsidiary is a company that is completely or partly owned by another corporation that owns more than half of the subsidiary's stock, and which normally acts as a holding corporation which at least partly or wholly controls the activities and policies of the daughter corporation.

-

What Is a General Ledger? General Ledger (also known in accounting as the GL or the Nominal Ledger) is at the heart of any accounting system. A general ledger is the master set of accounts that summarize all transactions occurring within an entity. Ledger is the skillful grouping and presentation of the Journal entries. Learn the accounting fundamentals, general ledger process, and general ledger flow.

-

What is Accounting & Book Keeping

Accounting is a process designed to capture the economic impact of everyday transactions. Each day, many events and activities occur in an entity, these events and activities are in the normal course of business; however, each of these events may or may not have an economic impact. Events or activities that have an effect on the accounting equation are accounting events.

-

Explore the concept of journal reversals and understand the business scenarios in which users may need to reverse the accounting entries that have been already entered into the system. Understand the common sources of errors resulting in the reversal of entries and learn how to correct them. Discuss the reversal of adjustment entries and the reversal functionalities in ERPs.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved