- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- Concept of Foreign Branches

Concept of Foreign Branches

As the business grows, the company may want to transition to a branch structure as branches are allowed to conduct a much broader range of activity than representative offices. Branches can buy and sell goods, sign contracts, build things, render services, and generally everything that a regular business can do. A company expands its business by opening up its branch offices in various parts of the country as well as in other countries.

As the business grows, the company may want to transition to a branch structure as branches are allowed to conduct a much broader range of activity than representative offices. Branches can buy and sell goods, sign contracts, build things, render services, and generally everything that a regular business can do. A company expands its business by opening up its branch offices in various parts of the country as well as in other countries.

A branch office refers to an establishment which carries on substantially the same business and activity as is carried out by its Head Office. Foreign Branch of a company refers to the branch of a company that operates in the foreign country. It is a branch of a company operating outside the country of its registration.

Some attributes of foreign branch offices are:

- Does not require opening a separate legal entity in the country of operations

- The branch is legally part of the company and is not a separate entity

- The range of the activities that can be undertaken, substantially increase as compared to a representative office

- Branches generally a constitute taxable presence in a foreign country and must account for and file prescribed returns with the local authorities

- Attributing the profits to the branch activities require arm’s length transaction

- Foreign branch is subject to special tax considerations.

- A subsidiary of a foreign corporation generally is taxed as any other domestic corporation, that is, as a separate taxable entity apart from its foreign parent. In contrast, a branch of a foreign corporation is not treated as a separate taxable entity; instead, the code and regulations employ a set of special rules to determine the tax liability of the branch both in domestic country and foreign country of operations.

Such branch offices help the company in:

- Spreading its business to diverse locations and thus increasing the customer base

- Expanding the size of the market for a company's product by attracting more customers

- Bringing its product closer to the customers by increasing their accessibility to it

- Making the distribution and marketing of its goods and services easier and more effective

- Widening the scope of its trading and manufacturing activities

- Bringing more opportunities and opening unexplored avenues

- Fuel the growth of the company

- Enhance its profitability

Related Links

You May Also Like

-

Team-Based Organizational Structure

Team-based structure is a relatively new structure that opposes the traditional hierarchical structure and it slowly gaining acceptance in the corporate world. In such a structure, employees come together as team in order to fulfill their tasks that serve a common goal.

-

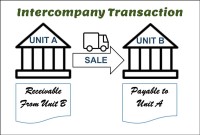

After reading this article the learner should be able to understand the meaning of intercompany and different types of intercompany transactions that can occur. Understand why intercompany transactions are addressed when preparing consolidated financial statements, differentiate between upstream and downstream intercompany transactions, and understand the concept of intercompany reconciliations.

-

Legal Structures in Businesses

Businesses not only vary in size and industry but also in their ownership. Most businesses evolve from being owned by just one person to a small group of people and eventually being managed by a large numbers of shareholders. Different ownership structures overlap with different legal forms that a business can take. A business’s legal and ownership structure determines many of its legal responsibilities.

-

In this article we will help you understand the double-entry accounting system and state the accounting equation and define each element of the equation. Then we will describe and illustrate how business transactions can be recorded in terms of the resulting change in the elements of the accounting equation.

-

Functional Organizational Structures

A functional organizational structure is a structure that consists of activities such as coordination, supervision and task allocation. The organizational structure determines how the organization performs or operates. The term organizational structure refers to how the people in an organization are grouped and to whom they report.

-

Period End Accruals, Receipt Accruals, Paid Time-Off Accruals, AP Accruals, Revenue Based Cost Accruals, Perpetual Accruals, Inventory Accruals, Accruals Write Off, PO Receipt Accrual, Cost Accrual, etc. are some of the most complex and generally misconstrued terms in the context of general ledger accounting. In this article, we will explore what is the concept of accrual and how it impacts general ledger accounting.

-

GL - Recurring Journal Entries

A “Recurring Journal” is a journal that needs to be repeated and processed periodically. Recurring Entries are business transactions that are repeated regularly, such as fixed rent or insurance to be paid every month. Learn the various methods that can be used to generate recurring journals. See some examples and explore the generic process to create recurring journals in any automated system.

-

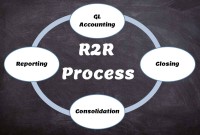

Record to report (R2R) is a finance and accounting management process that involves collecting, processing, analyzing, validating, organizing, and finally reporting accurate financial data. R2R process provides strategic, financial, and operational feedback on the performance of the organization to inform management and external stakeholders. R2R process also covers the steps involved in preparing and reporting on the overall accounts.

-

Defining Organizational Hierarchies

A hierarchy is an ordered series of related objects. You can relate hierarchy with “pyramid” - where each step of the pyramid is subordinate to the one above it. One can use drill up or down to perform multi-dimensional analysis with a hierarchy. Multi-dimensional analysis uses dimension objects organized in a meaningful order and allows users to observe data from various viewpoints.

-

As the business grows, the company may want to transition to a branch structure as branches are allowed to conduct a much broader range of activity than representative offices. Branches can buy and sell goods, sign contracts, build things, render services, and generally everything that a regular business can do. A company expands its business by opening up its branch offices in various parts of the country as well as in other countries.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved