- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- GL - Recurring Journal Entries

GL - Recurring Journal Entries

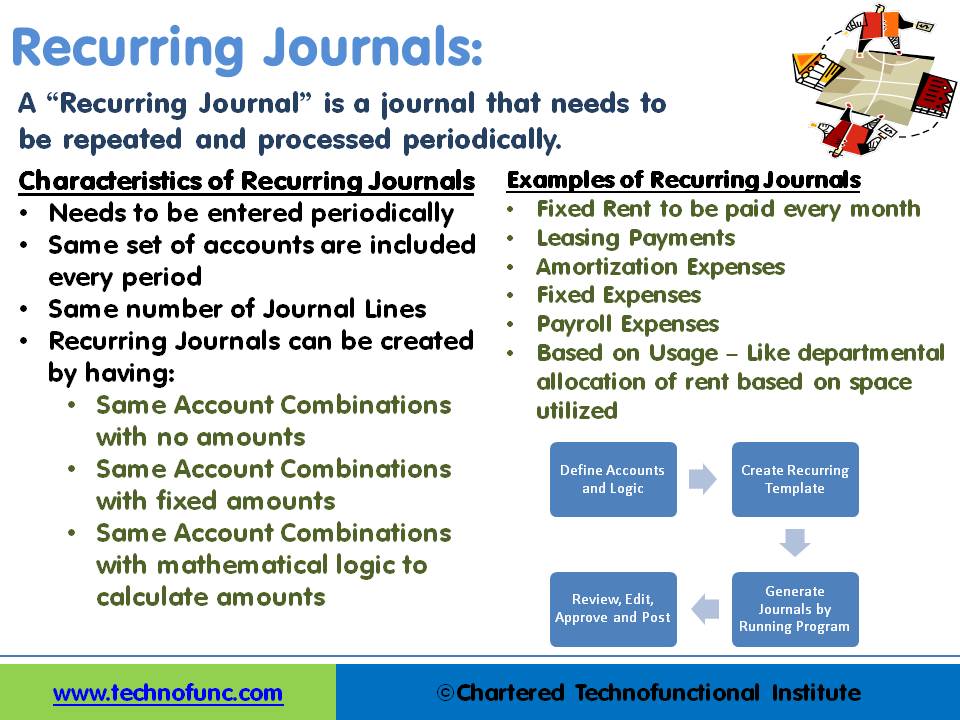

A “Recurring Journal” is a journal that needs to be repeated and processed periodically. Recurring Entries are business transactions that are repeated regularly, such as fixed rent or insurance to be paid every month. Learn the various methods that can be used to generate recurring journals. See some examples and explore the generic process to create recurring journals in any automated system.

What is a Recurring Journal?

A “Recurring Journal” is a journal that needs to be repeated and processed periodically. Recurring Entries are business transactions that are repeated regularly, such as fixed rent or insurance to be paid every month. Each accounting period the journal should have the same accounts but the amounts could be different. A recurring journal entry enables you to automate similar or repeating entries. For users who need to post certain transactions frequently with few or no changes, it is an advantage to use recurring journals.

Recurring entries allow for common repeatable transactions to be saved in a template and created in multiple accounting periods upon request, making it unnecessary to retype the entire transaction thereby improving productivity. The Auto-generation of recurring accounting entries minimizes the occurrence of errors and omissions. Systems allow the generation of recurring entries at weekly, monthly, or any other frequency.

Characteristics of Recurring Journals:

-

Needs to be entered periodically

-

The same set of accounts are included every period

-

The same number of Journal Lines

-

Logic exists to define the line selection criteria

-

Simplifies the process of recording repetitive journal entries

-

Creates same journal entries with varying or same amounts in different accounting periods

Methods to Create Recurring Journals:

1. Same Account Combinations with no amounts:

This is useful when the same accounts need to be used every period however the amounts get changed every time. In this scenario, the template is defined with no amounts, and amounts are entered manually every accounting period for which the entry needs to be generated.

2. Same Account Combinations with fixed amounts:

This is useful when both accounts and amounts can be pre-determined. A good example of this scenario is fixed rent payable each month on a specific date. In this case, the template is defined with actual amounts, and journals are created and posted for relevant accounting periods.

3. Same Account Combinations with mathematical logic to calculate amounts:

This is useful when accounts can be pre-determined and amounts will be based on some logic or pre-defined formula. A good example of this scenario could be defining salesmen accounts as the pre-determined accounts. The commission is to be paid to these salesmen as a fixed percentage of sales made by each salesman during the month and sales for each salesman are recorded in separate accounts. A recurring journal can be defined that can look for the balance in respective sales accounts at the end of the period and automatically calculate the commission and create the required accounting entry for commission payable.

Examples of Recurring Journals:

This method works best for repeatable transactions. For example annual expenses that can be charged through twelve equal monthly entries such as, rent or insurance expense allocation or annual lease rentals. Each month 1/12th of the total annual expense can be debited and credited to the appropriate accounts and appear as the current month’s actual transaction. Users can benefit by creating a recurring entry for some of the business scenarios listed below:

- Fixed Rent to be paid every month

- Fixed Insurance to be paid every month

- Leasing Payments

- Amortization Expenses

- Fixed Expenses

- Payroll Expenses

- Based on Usage – Like departmental allocation of rent based on space utilized

- Depreciation

- Allocations

Generic Process to Create Recurring Journals:

Users need to define recurring journal formulas for transactions that they want to repeat every accounting period, such as accruals, depreciation charges, and allocations. The formulas can be simple or complex but need to have some logic of ascertaining the amounts for each of the accounts that need to be repeated. Each formula can use fixed amounts and/or account balances and period-to-date or year-to-date balances from the current period, prior period, or same period last year. Given below is a generic process flow to define recurring journals:

- Define Accounts, Amounts or Formula or Logic

- Create Recurring Template

- Define the accounting periods for which the recurring journals need to be created

- Generate Journals by Running automated recurring journals creation program

- Enter missing data in case of Skelton journals – missing amounts

- Review, Edit, Approve and Post recurring journals

Allocations V/s Recurring Journals:

Recurring Journals are for transactions that repeat every accounting period as explained above and allocation Journals are for single journal entry using an accounting or mathematical formula to allocate revenues and expenses across a group of accounting dimensions like cost centers, departments, divisions, locations, or product lines depending upon usage factors.

Related Links

You May Also Like

-

This article explains the process of entering and importing general ledger journals in automated accounting systems. Learn about the basic validations that must happen before the accounting data can be imported from any internal or external sub-system to the general ledger. Finally, understand what we mean by importing in detail or in summary.

-

Learn the typical accounting cycle that takes place in an automated accounting system. We will understand the perquisites for commencing the accounting cycle and the series of steps required to record transactions and convert them into financial reports. This accounting cycle is the standard repetitive process that is undertaken to record and report accounting.

-

There are two commonly used methods of accounting - Cash Basis and the Accruals Basis. Understand the difference between accruals and reversals. Recap the earlier discussion we had on accruals and reversals and see the comparison between these two different but related accounting concepts. Understand how the action of accruing results in reversals subsequently in the accounting cycle.

-

GL - Accrued / Unbilled Revenue

Accrued revenues (also called accrued assets) are revenues already earned but not yet paid by the customer or posted to the general ledger. Understand what we mean by the terms accrued revenue, accrued assets, and unbilled revenue. Explore the business conditions that require recognition of accrued revenue in the books of accounts and some industries where this practice is prevalent.

-

Although technically a general ledger appears to be fairly simple compared to other processes, in large organizations, the general ledger has to provide many functionalities and it becomes considerably large and complex. Modern business organizations are complex, run multiple products and service lines, leveraging a large number of registered legal entities, and have varied reporting needs.

-

In this article we will discuss various types of "Management Entities". Various types of operational units, are created by management, to effectively run, manage and control their business. Different types of functional units, and divisional units, are widely used across industry.

-

In this article we will focus on and understand the accounting process which enables the accounting system to provide the necessary information to business stakeholders. We will deep dive into each of the steps of accounting and will understand how to identify accounting transactions and the process for recording accounting information and transactions.

-

In every journal entry that is recorded, the debits and credits must be equal to ensure that the accounting equation is matched. In this article, we will focus on how to analyze and recorded transactional accounting information by applying the rule of credit and debit. We will also focus on some efficient methods of recording and analyzing transactions.

-

What Is a General Ledger? General Ledger (also known in accounting as the GL or the Nominal Ledger) is at the heart of any accounting system. A general ledger is the master set of accounts that summarize all transactions occurring within an entity. Ledger is the skillful grouping and presentation of the Journal entries. Learn the accounting fundamentals, general ledger process, and general ledger flow.

-

Network Organizational Structures

The newest, and most divergent, team structure is commonly known as a Network Structure (also called "lean" structure) has central, core functions that operate the strategic business. It outsources or subcontracts non-core functions. When an organization needs to control other organizations or agencies whose participation is essential to the success, a network structure is organized.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved