- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- GL - Enter & Analyze Journals

GL - Enter & Analyze Journals

In every journal entry that is recorded, the debits and credits must be equal to ensure that the accounting equation is matched. In this article, we will focus on how to analyze and recorded transactional accounting information by applying the rule of credit and debit. We will also focus on some efficient methods of recording and analyzing transactions.

The accounting equation serves as the basic foundation for the accounting systems of all companies. From the smallest business, such as the local convenience store, to the largest business, such as large companies accounting equation remains valid. In the previous article, we gained an understanding of the concept of the accounting equation. In this article, we will focus on how to analyze and recorded transactional accounting information by applying the rule of credit and debit.

If you're not a bookkeeper or an accountant and have not received the formal education in accounting or finance, the whole system of debiting certain accounts and crediting others can seem overwhelming, however, don't be discouraged. If you can focus on understanding the fundamentals of double-entry accounting; the logic for debiting and crediting to various accounts will be clear for you. One of the optimum uses of ERP and Automated Accounting packages is that the users only enter real business transactions and ERPs will trace the accounts, calculate and enter the debits and credits.

Understanding “T” Account

Companies have to record and summarize thousands or millions of transactions daily that result as a result of their business operations. To cater to this, accounting systems are designed to show the increases and decreases in each financial statement item as a separate record. This record is called an account. An account, in its simplest form, has three parts. First, each account has a title, which is the name of the item recorded in the account. Second, each account has a space for recording increases in the amount of the item. Third, each account has a space for recording decreases in the amount of the item. The account form is called a T account because it resembles the letter, T. The left side of the account is called the debit side, and the right side is called the credit side. Amounts entered on the left side of an account are debits, and amounts entered on the right side of an account credit.

Asset Account

---------------------------------|-------------------------------------------

Debit | Credit

---------------------------------|---------------------------------------------

Accountants make use of “T” Accounts to analyze complex transactions, as it helps to simplify the thought process. Many ERP’s also represent accounts in the “T” format for an easier understanding of the accounting impacts.

Understand Your Transactions:

The rule of debit and credit is a fundamental theory behind accounting procedures. This rule is derived from the concept of double-entry accounting, which states that transactions are recorded in two or more accounts, where an amount is entered on the debit side and an equal amount is entered on the credit side. The practice of recording amounts on two sides is intended to minimize errors.

Recording transactions in accounts must follow certain rules. For example, increases in assets are recorded on the debit (left side) of an account. Likewise, decreases in assets are recorded on the credit (right side) of an account. The excess of the debits of an asset account over its credits is the balance of the account. To apply the rule of debit and credit, and properly record amounts, every transaction is first analyzed to determine the following:

What is being exchanged?

To begin analyzing the transaction, first determine what items are exchanged. Remember that a transaction is defined as the sale or exchange of goods or services.

What accounts are affected?

The next step in analyzing the transaction is to identify the affected accounts. The three categories of accounts in which a business records its transactions are assets, liabilities, and owner's equity.

Which of the accounts is increasing or decreasing?

Most transactions benefit—or increase—the business's resources in one area, and creates a corresponding decrease in another. But a transaction does not always cause this effect. A transaction can result in just an increase or just a decrease.

Are the amounts debits or credits?

The final step in the analysis is to determine whether to record the amounts on the debit side or the credit side of the affected accounts.

Rule of Debit & Credit:

The rule of debit and credit states that for whatever amount is entered in the debit side, an equal amount must be recorded on the credit side. To determine whether accounts are debited or credited, an analysis of the effect of the transaction must occur first as detailed above. An understanding of the rule of debit and credit is fundamental to performing accurate accounting procedures and the double-entry accounting system has specific rules of debit and credit for recording transactions in the accounts. Given below is a brief discussion on how to use various rules to determine the last two steps of analyzing transactions, whether the accounts in increasing or decreasing, and amounts should be debits or credits.

Balance Sheet Accounts:

The double-entry accounting system is based on the accounting equation and specific rules for recording debits and credits. The debit and credit rules for balance sheet accounts are as follows:

1. ASSETS:

The debit for increases and credit for decreases

2. LIABILITIES:

The debit for decreases and credit for increases

3. OWNER'S EQUITY:

The debit for decreases and credit for increases

Income Statement Accounts:

The debit and credit rules for income statement accounts are based on their relationship with the owner’s equity. As shown above, the owner’s equity accounts are increased by credits. Since revenues increase owner’s equity, revenue accounts are increased by credits and decreased by debits. Since the owner’s equity accounts are decreased by debits, expense accounts are increased by debits and decreased by credits. Thus, the rules of debit and credit for revenue and expense accounts are as follows:

4. REVENUE ACCOUNTS:

The debit for decreases and Credit for increases

5. EXPENSE ACCOUNTS:

The debit for increases and Credit for decreases

Owner Withdrawals:

Common types of owner's equity accounts include Capital, Withdrawals, Revenue, and Expenses. The debit and credit rules for recording owner withdrawals are based on the effect of owner withdrawals on owner’s equity. Since the owner’s withdrawals decrease the owner’s equity, the owner’s drawing account is increased by debits. Likewise, the owner’s drawing account is decreased by credits.

Normal Balances:

The sum of the increases in an account is usually equal to or greater than the sum of the decreases in the account. Thus, the normal balance of an account is either a debit or credit depending on whether increases in the account are recorded as debits or credits. For example, since asset accounts are increased with debits, asset accounts normally have debit balances. Common types of asset accounts include Cash, Accounts Receivable, Equipment, Office Supplies, and Prepaid Expenses. Likewise, liability accounts normally have credit balances. Common types of liability accounts include Accounts Payable, Unearned Fees (money received in advance), and Notes Payable (money a business promises to pay at a future date).

Related Links

You May Also Like

-

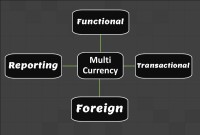

Multi Currency - Functional & Foriegn

Currency is the generally accepted form of money that is issued by a government and circulated within an economy. Accountants use different terms in the context of currency such as functional currency, accounting currency, foreign currency, and transactional currency. Are they the same or different and why we have so many terms? Read this article to learn currency concepts.

-

Network Organizational Structures

The newest, and most divergent, team structure is commonly known as a Network Structure (also called "lean" structure) has central, core functions that operate the strategic business. It outsources or subcontracts non-core functions. When an organization needs to control other organizations or agencies whose participation is essential to the success, a network structure is organized.

-

A legal entity is an artificial person having separate legal standing in the eyes of law. A Legal entity represents a legal company for which you prepare fiscal or tax reports. A legal entity is any company or organization that has legal rights and responsibilities, including tax filings.

-

What Is a General Ledger? General Ledger (also known in accounting as the GL or the Nominal Ledger) is at the heart of any accounting system. A general ledger is the master set of accounts that summarize all transactions occurring within an entity. Ledger is the skillful grouping and presentation of the Journal entries. Learn the accounting fundamentals, general ledger process, and general ledger flow.

-

There are five types of core accounts to capture any accounting transaction. Apart from these fundamental accounts, some other special-purpose accounts are used to ensure the integrity of financial transactions. Some examples of such accounts are clearing accounts, suspense accounts, contra accounts, and intercompany accounts. Understand the importance and usage of these accounts.

-

In this article, we will explain the general Ledger journal processing flow from entering journals to running the final financial reports. Understand the generic general ledger process flow as it happens in automated ERP systems. The accounting cycle explains the flow of converting raw accounting data to financial information whereas general ledger process flow explains how journals flow in the system.

-

Introduction to Legal Entities Concept

Modern business organizations operate globally and leverage a large number of registered legal entities, and operate through complex matrix relationships. To stay competitive in the current global business environment, they must often develop highly diverse and complex organizational structures that cross international borders. Learn more about Legal Entities and their importance for businesses.

-

GL - Different Accounting Methods

The accounting method refers to the rules a company follows in reporting revenues and expenses. Understand the two common systems of bookkeeping, single, and double-entry accounting systems. Learners will also understand the two most common accounting methods; cash and accrual methods of accounting and the advantages and disadvantages of using them.

-

A joint venture (JV) is a business agreement in which the parties agree to develop, for a finite time, a new entity and new assets by contributing equity. They exercise control over the enterprise and consequently share revenues, expenses and assets. A joint venture takes place when two or more parties come together to take on one project.

-

Legal Structures in Businesses

Businesses not only vary in size and industry but also in their ownership. Most businesses evolve from being owned by just one person to a small group of people and eventually being managed by a large numbers of shareholders. Different ownership structures overlap with different legal forms that a business can take. A business’s legal and ownership structure determines many of its legal responsibilities.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved