- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- Equity and Liability Accounts

Equity and Liability Accounts

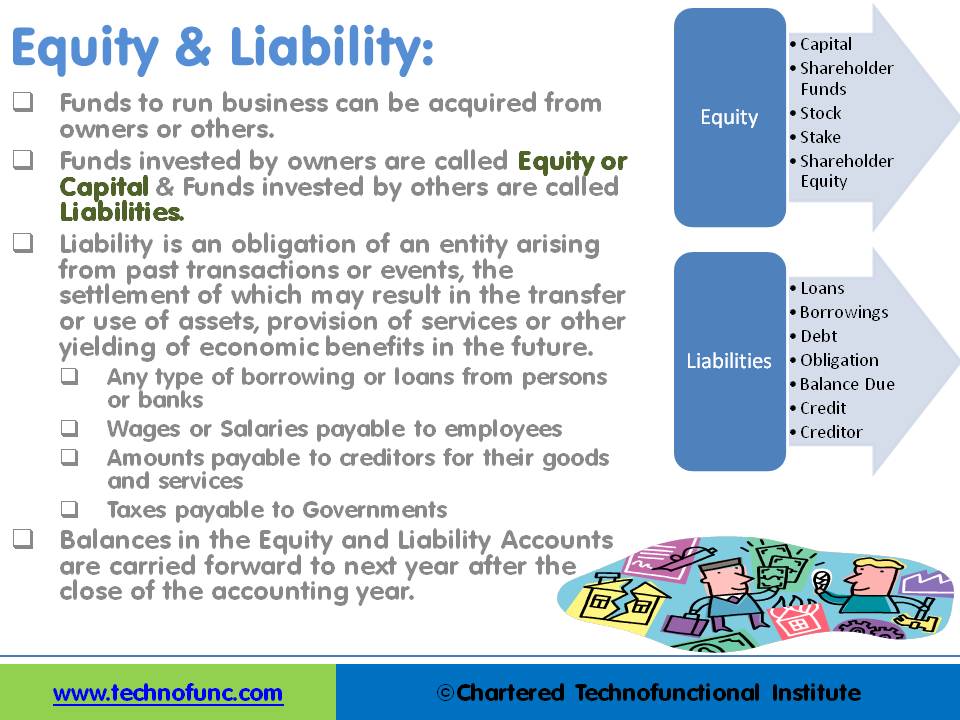

Funds contributed by owners in any business are different from all other types of funds. Equity is the residual value of the business enterprise that belongs to the owners or shareholders. The funds contributed by outsiders other than owners that are payable to them in the future. Liabilities are generally classified as Short Term (Current) and Long Term Liabilities. Current liabilities are debts payable within one year.

Equity Accounts:

The amount of the funds contributed by the owners (the stockholders) added or subtracted by accumulated gains and losses. Equity is the residual value of the business enterprise that belongs to the owners or shareholders.

Funds contributed by owners in any business are different from all other types of funds. Generally, they don’t have any cost of carrying for the business and in the event of winding up of the business, shareholders are entitled to the residual value of the business after discharging all other liabilities. They are expected to remain invested in the business for a long period of time and no immediate payback is anticipated in case of a going concern.

Equity accounts are also referred to as “Capital Account”, “Shareholder’s Funds” or “Accounts”, “Stock, Stake” and “Shareholder Equity”. Normally they have a credit balance and are reflected on the left side of the balance sheet. Profits and losses from each accounting year are added to Equity at the end of each year.

Balances in the Retained Earnings Account are transferred to “Equity” at the end of each accounting year. While running a revaluation of balances, equity is revalued using the historical rates in accordance with the accounting standards. Equity is a separate account type in ERP’s to segregate funds from owners and others.

Liability Accounts:

The number of funds contributed by outsiders other than owners that are payable to them in the future. Liability is an obligation of an entity arising from past transactions or events, the settlement of which may result in the transfer or use of assets, provision of services, or another yielding of economic benefits in the future.

Liabilities are generally classified as Short Term (Current) and Long Term Liabilities. Current liabilities are debts payable within one year, while long-term liabilities are debts payable over a longer period.

Liabilities can be from a lot of sources like Loans, External Borrowings, Debt – Secured and Unsecured, Obligation for services received Balance Due or Credit due to Creditors. Some generally known examples of liabilities are any type of borrowing or loans from persons or banks or wages or salaries paid to employees or amounts payable to creditors for their goods and services and taxes payable to Governments.

Balances in the Equity and Liability Accounts are carried forward to next year after the close of the accounting year. While running a revaluation of balances, liability is revalued using the period end rates in accordance with the accounting standards. Liability is a separate account type in ERP’s to segregate funds from owners and others.

Intercompany transactions also result in receivables and liabilities (payables) between different units of the same entity. Such transactions are settled in cash if they are in the normal course of business. At the time of the final consolidation of accounts, these intercompany liabilities and assets need to be eliminated from the books of the parent entity. We will discuss this concept in detail in the Intercompany chapter.

Related Links

You May Also Like

-

Accrued expenses, sometimes referred to as accrued liabilities, are expenses that have been incurred but have not been recorded in the accounts. Discuss the need to record accrued liabilities and why they require an adjustment entry. Understand the treatment for these entries once the accounting period is closed and learn to differentiate when the commitments become liabilities.

-

For any company that has a large number of transactions, putting all the details in the general ledger is not feasible. Hence it needs to be supported by one or more subsidiary ledgers that provide details for accounts in the general ledger. Understand the concept of the subsidiary ledgers and control accounts.

-

In most of the automated financial systems, you can define more than 12 accounting periods in a financial year. This article will explain the concept of the adjustment period and the benefits of having adjustment periods. Adjustment periods have their inherent challenges for the users of financial statements and there is a workaround for those who don’t want to use adjustment periods.

-

Legal Structures in Businesses

Businesses not only vary in size and industry but also in their ownership. Most businesses evolve from being owned by just one person to a small group of people and eventually being managed by a large numbers of shareholders. Different ownership structures overlap with different legal forms that a business can take. A business’s legal and ownership structure determines many of its legal responsibilities.

-

A joint venture (JV) is a business agreement in which the parties agree to develop, for a finite time, a new entity and new assets by contributing equity. They exercise control over the enterprise and consequently share revenues, expenses and assets. A joint venture takes place when two or more parties come together to take on one project.

-

Concept of Representative Office

A representative office is the easiest option for a company planning to start its operations in a foreign country. The company need not incorporate a separate legal entity nor trigger corporate income tax, as long as the activities are limited in nature.

-

Learn the typical accounting cycle that takes place in an automated accounting system. We will understand the perquisites for commencing the accounting cycle and the series of steps required to record transactions and convert them into financial reports. This accounting cycle is the standard repetitive process that is undertaken to record and report accounting.

-

In this article we will discuss various types of "Management Entities". Various types of operational units, are created by management, to effectively run, manage and control their business. Different types of functional units, and divisional units, are widely used across industry.

-

When the quantum of business is expected to be moderate and the entrepreneur desires that the risk involved in the operation be shared, he or she may prefer a partnership. A partnership comes into existence when two or more persons agree to share the profits of a business, which they run together.

-

Divisional Organizational Structures

The divisional structure or product structure consists of self-contained divisions. A division is a collection of functions which produce a product. It also utilizes a plan to compete and operate as a separate business or profit center. Divisional structure is based on external or internal parameters like product /customer segment/ geographical location etc.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved