- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- Five Core General Ledger Accounts

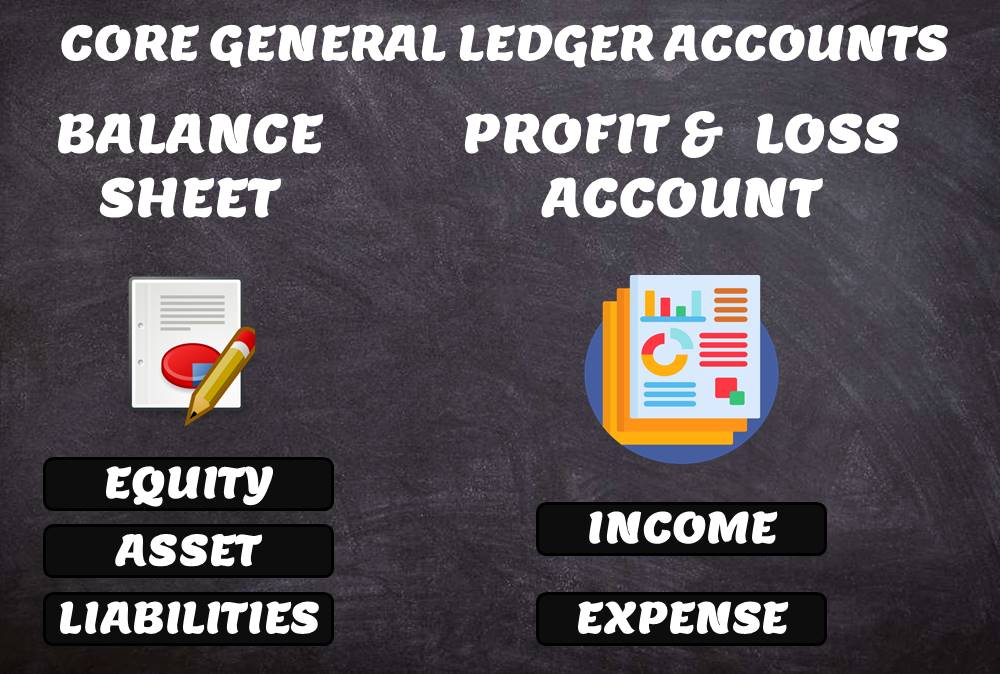

Five Core General Ledger Accounts

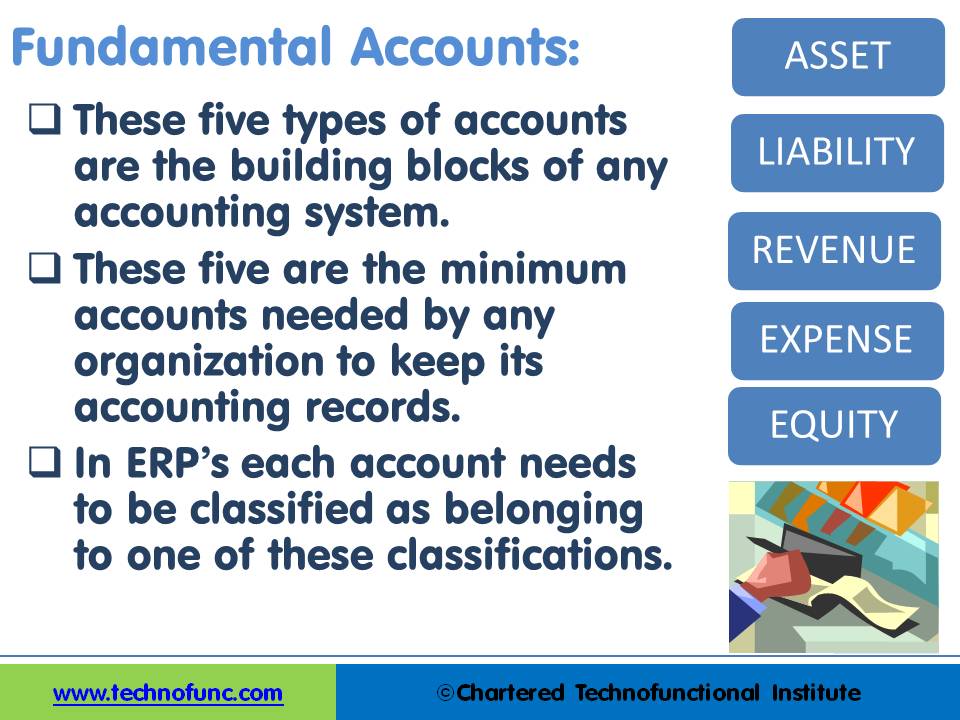

Typically, the accounts of the general ledger are sorted into five categories within a chart of accounts. Double-entry accounting uses five and only five account types to record all the transactions that can possibly be recorded in any accounting system. These five accounts are the basis for any accounting system, whether it is a manual or an automated accounting system. These five categories are assets, liabilities, owner's equity, revenue, and expenses.

The Five Account Types:

The five fundamental account types are the following:

Balance Sheet Accounts:

Funds can be invested by owners or outsiders known as equity & liabilities and can be used to acquire assets to perform business activities. In accounting, the economic resources of a business are categorized under the terms of assets, liabilities, and owner's equity. These terms also refer to the three types of accounts in which a business records its transactions.

1. Asset Accounts:

Assets are the things of value that are owned and used by the business. Examples of assets include cash, land, buildings, and equipment. According to the Financial Accounting Standards Board, assets are “probable future economic benefits obtained or controlled by a particular entity as a result of past transactions or events.” According to “The Institute of Management Accountants” assets is “any owned physical object (tangible) or right (intangible) having economic value to its owners; an item or source of wealth with continuing benefits for future periods, expressed, for accounting purposes, in terms of its cost, or other value, such as current replacement cost. Future periods refer to the following year or years.” An asset is anything that will probably bring future economic benefits. Every employee is responsible to follow policies and procedures to safeguard the company's assets.

2. Liability Accounts:

Liability accounts are debts that are owed by the business. These are the rights of the creditors or third parties over the assets of the business. Examples of liabilities include amounts due to suppliers, loans payable back to banks. The number of funds contributed by outsiders other than owners that are payable to them in the future. Liability is an obligation of an entity arising from past transactions or events, the settlement of which may result in the transfer or use of assets, provision of services, or another yielding of economic benefits in the future. Liabilities are generally classified as Short Term (Current) and Long Term Liabilities. Current liabilities are debts payable within one year, while long-term liabilities are debts payable over a longer period. Liabilities can be from a lot of sources like Loans, External Borrowings, Debt – Secured and Unsecured, Obligation for services received Balance Due or Credit due to Creditors. Some generally known examples of liabilities are any type of borrowing or loans from persons or banks or wages or salaries paid to employees or amounts payable to creditors for their goods and services and taxes payable to Governments.

3. Equity Accounts:

Equity is the owner's claim to business assets. These are the rights of the owners over the assets of the business. Examples include capital invested by the owners, the shares subscribed by the public, or the residual profit made by the business last year. The amount of the funds contributed by the owners (the stockholders) added or subtracted by accumulated gains and losses. Equity is the residual value of the business enterprise that belongs to the owners or shareholders. Funds contributed by owners in any business are different from all other types of funds. Generally, they don’t have any cost of carrying for the business and in the event of winding up of the business, shareholders are entitled to the residual value of the business after discharging all other liabilities. They are expected to remain invested in the business for a long period of time and no immediate payback is anticipated in case of a going concern. Equity accounts are also referred to as “Capital Account”, “Shareholder’s Funds” or “Accounts”, “Stock, Stake” and “Shareholder Equity”. Normally they have a credit balance and are reflected on the left side of the balance sheet. Profits and losses from each accounting year are added to Equity at the end of each year. Balances in the Retained Earnings Account are transferred to “Equity” at the end of each accounting year. While running a revaluation of balances, equity is revalued using the historical rates in accordance with the accounting standards. Equity is a separate account type in ERP’s to segregate funds from owners and others.

Profit and Loss Accounts:

Business operations may result in financial benefits or losses that arise as a difference in revenue gained from business activity and expenses, costs, and taxes needed to sustain the business activity. Any resultant profit or loss goes to the business owner. The operations of the business can either result in profit or loss. It may increase the economic value over a period of time in case of profit or might decrease the economic worth in case of loss. All such activities can be recorded using two types of profit and loss accounts:

4. Revenue Accounts:

Revenue is the increase in benefits during the accounting period. Revenue or income is measured from period to period and provides economic benefits to the company. The amounts earned from the sale of goods and services. Examples include sales, interest received on bank deposits, a commission earned by the business. Revenue accounts are credited when services are performed or billed and therefore will usually have credit balances. On the income statement, net income is computed by deducting all expenses from all revenues. Revenues are presented at the top part of the income statement, followed by the expenses.

5. Expense Accounts:

Expenses refer to costs incurred in conducting business. Technically, expenses are "decreases in economic benefits during the accounting period. Costs incurred in the course of business. Examples include purchases made for material, payment of rent, expenses for employee costs. The normal expense account balance is a debit.

Importance of Core Accounts

All general ledger accounts can be classified as belonging to either one of these categories – Equity, Liabilities, Assets, Revenue, and Expenses. These are the fundamental account types from the perspective of automated accounting systems. Based on this classification, closing balances are never carried forward in automated GL systems for Revenue and Expense Accounts. In ERP’s every account needs to be classified as belonging to one of these classifications.

Whenever IT professional starts working on any financial project, they encounter certain accounts and account types that are always seeded in the system, they are able to perform setups for those accounts after going through the manual of the software package, but usually explanation about the need and role of these accounts is not available in the product manual/guide. In this tutorial we have understood the minimum accounts types that need to be seeded in any financial system and "why" certain accounts have to be mandatory in nature before the automated accounting process can start.

The intended audience for this tutorial is anybody who has a need to work on any financial IT system. This will be helpful to everyone who wants to understand how to design and implement effective automated accounting systems like ERP. This tutorial focuses on these concepts from the perspective of an IT professional that is expected to work on any project involving design, build or interface to an automated GL system, rather than a student of accounting.

There can be thousands of sub-types; known as natural accounts which help in further classifying the nature of the transaction, but they all belong to one of the above lists, as practically all financial transactions can be recorded using these five types of accounts.

Related Links

You May Also Like

-

The sole trader organization (also called proprietorship) is the oldest form of organization and the most common form of organization for small businesses even today. In a proprietorship the enterprise is owned and controlled only by one person. This form is one of the most popular forms because of the advantages it offers. It is the simplest and easiest to form.

-

Legal Structures in Businesses

Businesses not only vary in size and industry but also in their ownership. Most businesses evolve from being owned by just one person to a small group of people and eventually being managed by a large numbers of shareholders. Different ownership structures overlap with different legal forms that a business can take. A business’s legal and ownership structure determines many of its legal responsibilities.

-

General Ledger - Advanced Features

Modern automated general ledger systems provide detailed and powerful support for financial reporting and budgeting and can report against multiple legal entities from the single system. These systems offer many advanced functionalities right from journal capture to advanced reporting. This article will provide an overview of some advanced features available in today's General Ledgers.

-

When the quantum of business is expected to be moderate and the entrepreneur desires that the risk involved in the operation be shared, he or she may prefer a partnership. A partnership comes into existence when two or more persons agree to share the profits of a business, which they run together.

-

Different Types of Organizational Structures

Modern business organizations run multiple product and service lines, operate globally, leverage large number of registered legal entities, and operate through complex matrix relationships. To stay competitive in the current global business environment, they must often develop highly diverse and complex organizational structures that cross international borders.

-

Introduction to Legal Entities Concept

Modern business organizations operate globally and leverage a large number of registered legal entities, and operate through complex matrix relationships. To stay competitive in the current global business environment, they must often develop highly diverse and complex organizational structures that cross international borders. Learn more about Legal Entities and their importance for businesses.

-

The general ledger is the central repository of all accounting information in an automated accounting world. Summarized data from various sub-ledgers are posted to GL that eventually helps in the creation of financial reports. Read more to understand the role and benefits of an effective general ledger system in automated accounting systems and ERPs.

-

A Company (also called corporation) may be understood as an association of persons in which money is contributed by them, to carry on some business or undertaking. Persons who contribute the money are called the shareholders or the members of the company. A corporation is an artificial being, invisible, intangible and existing only in contemplation of law. Being the mere creature of law, it possesses only those properties which the charter of its creation confers upon it.

-

In this article we will help you understand the double-entry accounting system and state the accounting equation and define each element of the equation. Then we will describe and illustrate how business transactions can be recorded in terms of the resulting change in the elements of the accounting equation.

-

Accrued expenses, sometimes referred to as accrued liabilities, are expenses that have been incurred but have not been recorded in the accounts. Discuss the need to record accrued liabilities and why they require an adjustment entry. Understand the treatment for these entries once the accounting period is closed and learn to differentiate when the commitments become liabilities.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved