- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- Asset Management

- Fixed Assets - Key Terminology

Fixed Assets - Key Terminology

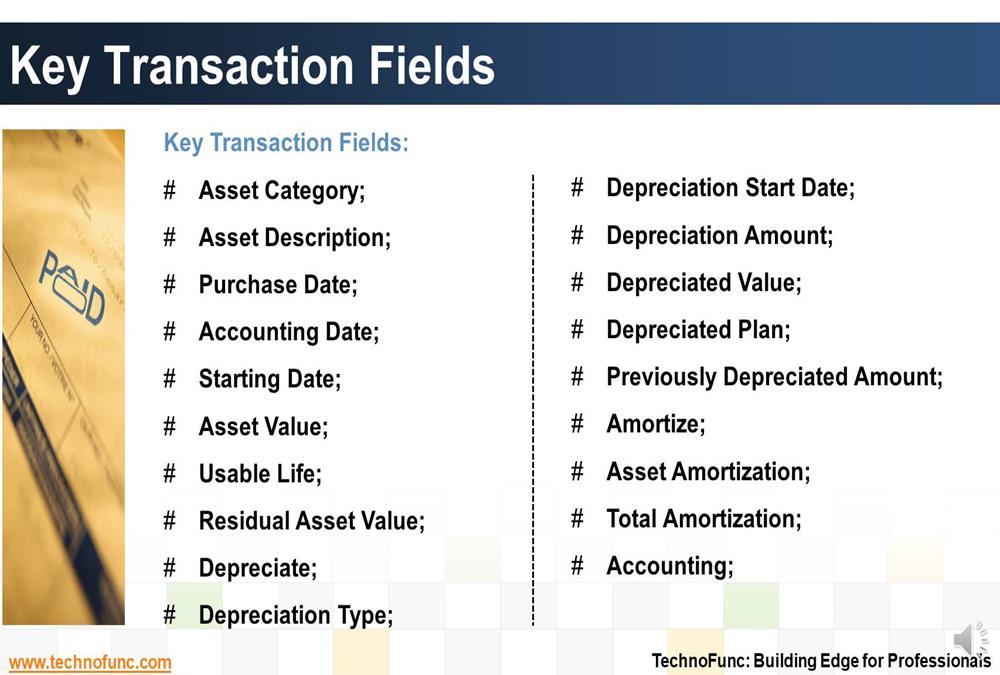

In this article, we have explained the meaning and usage of key generic terms that are used in almost every FA management system/ Fixed Assets process. Understanding these terms is a prerequisite to building a solid understanding of the fixed assets business process.

Meaning of Fixed Assets

An asset is a basic unit of economic value that is expected to provide benefits beyond a single period. The value of the asset is recorded on the company balance sheet. Examples of assets are cash, accounts receivable, inventory, prepaid insurance, land, buildings, equipment, trademarks, and certain deferred charges. There are two major asset classes; tangible assets; and intangible assets. Tangible assets are classified as either; current assets, or fixed assets. Current assets include inventory and receivables, while fixed assets include, buildings, property, equipment, land, machinery, and equipment.

Fixed Assets Management

Asset management refers to the system of monitoring and maintaining assets effectively and efficiently. It applies to both tangible assets and intangible assets. Asset management is a systematic process of operating, maintaining, and upgrading assets cost-effectively. Enterprise asset management refers to the business processes that support the management of an organization's assets.

Asset Appropriation Request (A/R)

The Fixed Asset process usually begins with an approved asset requisition (A/R). Any person who is authorized to request a fixed asset prepares an Appropriation Request (AR) form providing details of the requested fixed asset and submits it for review and approval.

Asset Category

Assets are grouped together belonging to the same category so that they can inherit some common properties. The selection of the Asset Category enables the inheriting of the accounting properties of the underlying category.

Asset Description

Description of the asset or enter any notes to identify the nature of the asset, its location, or other attributes helpful for easy recognition and identification.

Purchase Date

The date on which the asset was purchased. This data is useful for many accounting events examples to find the date of capitalization and in some cases to start charging depreciation on the asset.

Accounting Date

The date used to determine which period this posting belongs to within the general ledger. The accounting date is the date when the asset is formally entered into the accounting system. Starting Date. Determine which starting date the amortization is calculated for. This is the date from which the depreciation will be charged.

Historical Cost / Asset Value

This represents the initial value of an asset. Capture the initial cost of the asset to ensure you have the history available for reconciliation and audit purposes. The costs recorded for each asset acquired include the purchase price and anything necessary to make it ready for production. All expenditures involved in the acquisition of an asset and getting it ready for use are capitalized as part of the original cost. Included is the invoice price for the asset, transportation charges, and installation costs, including any construction or changes to the building necessary to house it. Other incidental costs are sales or use tax, duties on imported items, and testing and initial setup costs. The total costs of acquiring and putting the asset into actual production use should be capitalized.

Usable Life

The usable life of the asset represents the expected life duration of the asset when it is expected to provide economic value to the enterprise. It is calculated in Years or Months and generally used to depreciate the asset over.

Residual Asset Value

This represents the value of the asset at the end of the depreciation period. This is the value expected to be fetched from the asset once its usable life is over. Sometimes it may represent the salvage value of the asset. Scrap is the worth of a physical asset's individual components when the asset as a whole is deemed no longer usable. An item's scrap value is determined by the supply and demand for the materials it can be broken down into and the asset scrap may have some monetary value.

Depreciation Type

There exist different methods to calculate depreciation on fixed assets. One needs to determine which depreciation method will be used to calculate depreciation on the fixed asset.

Depreciation Start Date

Date from which to calculate the depreciation postings

Depreciation Amount

This indicates the amount of the initial value to depreciate. Most of the time it is a calculated value based on period and rate of the depreciation. The cost of an asset must be spread on a rational, systematic basis over the periods of its useful life. Advanced FA accounting systems automatically calculates depreciation each month based on the information established in each fixed asset record. The system may have the capability to calculate separate depreciation for Company GAAP, Local GAAP, and Tax purposes.

Depreciated Value

A term indicating how much of the depreciation value has already been posted to the general ledger. Depreciation is charged on a periodic basis and this depreciated value is used to keep track of such postings.

Depreciated Plan

A term indicating how much value of the asset will be depreciated until the end of asset life

Previously Depreciated Amount

The amount that has already been amortized before the asset was entered into the system

Amortize

Usually, a checkbox to define if amortization is calculated

Asset Amortization

Tracking depreciation installments

Total Amortization

Term identifying with the total amortization amount posted for a selected period

Asset Accounting

Specific accounting settings are for an asset like the different chart of accounts that will be used for that particular asset.

Tagging

Once the asset is procured/ placed in service, the organization affixes asset tags with descriptive information such as asset number, expenditure code, asset description, cost center, and a bar code.

Physical Verification

All entities conduct a physical count of all fixed assets at periodic intervals (ranging from 1 to 5 years) to verify actual assets in hand and value and ensure the accuracy of related financial records.

Idle Asset Review

Organizations make efforts to make full utilization of fixed assets in their possession and control. Hence they must make efforts to identify and make available idle, excess, and underutilized equipment to other departments that may need them.

Impairment

Impairment exists when the carrying amount of a fixed asset exceeds its fair value and is non-recoverable. Specific events/changes could trigger an impairment of an asset like a significant decrease in the market price of a fixed asset, a change in how the company uses an asset or changes in the business climate that could affect the asset’s value.

Asset Adjustments

Adjustments to existing asset information are often needed to be made. Events may occur that can change the depreciable basis of an asset like there may be improvements or repairs made to assets that either adds value to the asset or extend its economic life. Expenditure that increases the future benefits from the existing asset beyond its previously assessed standard of performance is included in the gross book value, e.g., an increase in capacity.

Asset Revaluation

The purpose of a revaluation is to bring into the books the fair market value of fixed assets. Events may occur that can lead the organization to revalue its assets for change in asset value due to inflation, deflation or appreciation.

Matching Principle:

The matching principle of accounting calls for the matching of costs with the accounting period those costs benefit. The purpose of the historical cost record is to ensure that the costs incurred in the purchase of assets in a past accounting period will be spread over the future accounting periods that benefit.

Key Roles in management of Fixed Assets

Key organizational roles that are generally required to manage the fixed asset process start from the requestor who is generally the end-user in the need of the particular asset. The request is placed with the “Procure-to-Pay’ department for acquiring the asset as per company policies and ensuring that the payment is made for the asset. A fixed asset could be a self-constructed asset or maybe an acquired asset. Once the AR is approved a Purchase Order is issued in case the asset needs to be procured from a Vendor. The finance department manages the accounting and depreciation aspects of assets on an ongoing basis. Most organizations need to deal with hundreds or even thousands of physical assets. In such a case, it’s important to know the operating condition and location of the assets owned by them at periodical intervals. Identifying, tracking and controlling assets is a critical step in ‘Asset Maintenance’

Related Links

You May Also Like

-

Key challenges in managing FA process

As organizations grow in scale they need a more detailed justification of capital expenditure. This leads to many functions getting involved in the fixed asset management process with significant “hand-offs” at each step/stage. In this chapter, we will address a broad array of issues involved in the process of fixed assets in any large scale organization.

-

Costs subsequent to acquisition of fixed assets

Costs related to plant assets that are incurred after the asset is placed in use are either added to the fixed asset account (capitalized) or charged against operations (expensed) when incurred. In this article, we will discuss underlying principles for this accounting event.

-

“Fixed Assets” is a six-step process and starts with initiating and approving the request to acquire the asset and after maintaining and depreciating for useful life ends with the final disposal of the fixed asset. These steps are cyclic in nature and most of them happen in any fixed management lifecycle. Some optional steps may happen only in certain business scenarios or in specific industries.

-

Physical assets are frequently out in the field for use; undergo repairs, sold, updated, removed or stolen. From purchase to disposal and all of the steps in between, an asset’s history can be easily traced and reviewed using an asset management system that utilizes asset tags or asset labels.

-

A fixed asset register (FAR) is accounting book with a list of fixed assets belonging to particular entity. Traditionally the fixed asset register was maintained in written form by the accountant using a book that was set aside specifically for tracking fixed assets. Now with the advent of IT systems for bookkeeping it is more often held in electronic format. Learn the importance of maintaining a FAR.

-

Introduction to Capital Asset Planning

Before you purchase an asset in any organization, you must justify the decision to purchase the asset and get requisite approvals to make investment and release the funds. These series of analysis steps where cost-benefit analysis is performed to justify the decision to purchase a prospective asset is called the process of capital asset planning or simply as capital budgeting.

-

Asset Maintenance – Tagging & Physical Verification

Most organizations need to deal with hundreds or even thousands of physical assets. In such a case, it’s important to know the operating condition and location of the assets owned by them at periodical intervals. Identifying, tracking, and controlling assets are a critical step in ‘Asset Maintenance’.

-

Fixed Assets - Key Terminology

In this article, we have explained the meaning and usage of key generic terms that are used in almost every FA management system/ Fixed Assets process. Understanding these terms is a prerequisite to building a solid understanding of the fixed assets business process.

-

An asset is anything that will probably bring future economic benefit. Every company must take actions to safeguard, control, and manage the assets it owns. Cash Assets needs to be managed effectively to safeguard and utilize them efficiently. In this section, we will start with understanding what are assets, what are various classification of assets and then we will focus on Asset Management.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved