- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- Asset Management

- Fixed Assets - Process Flow

Fixed Assets - Process Flow

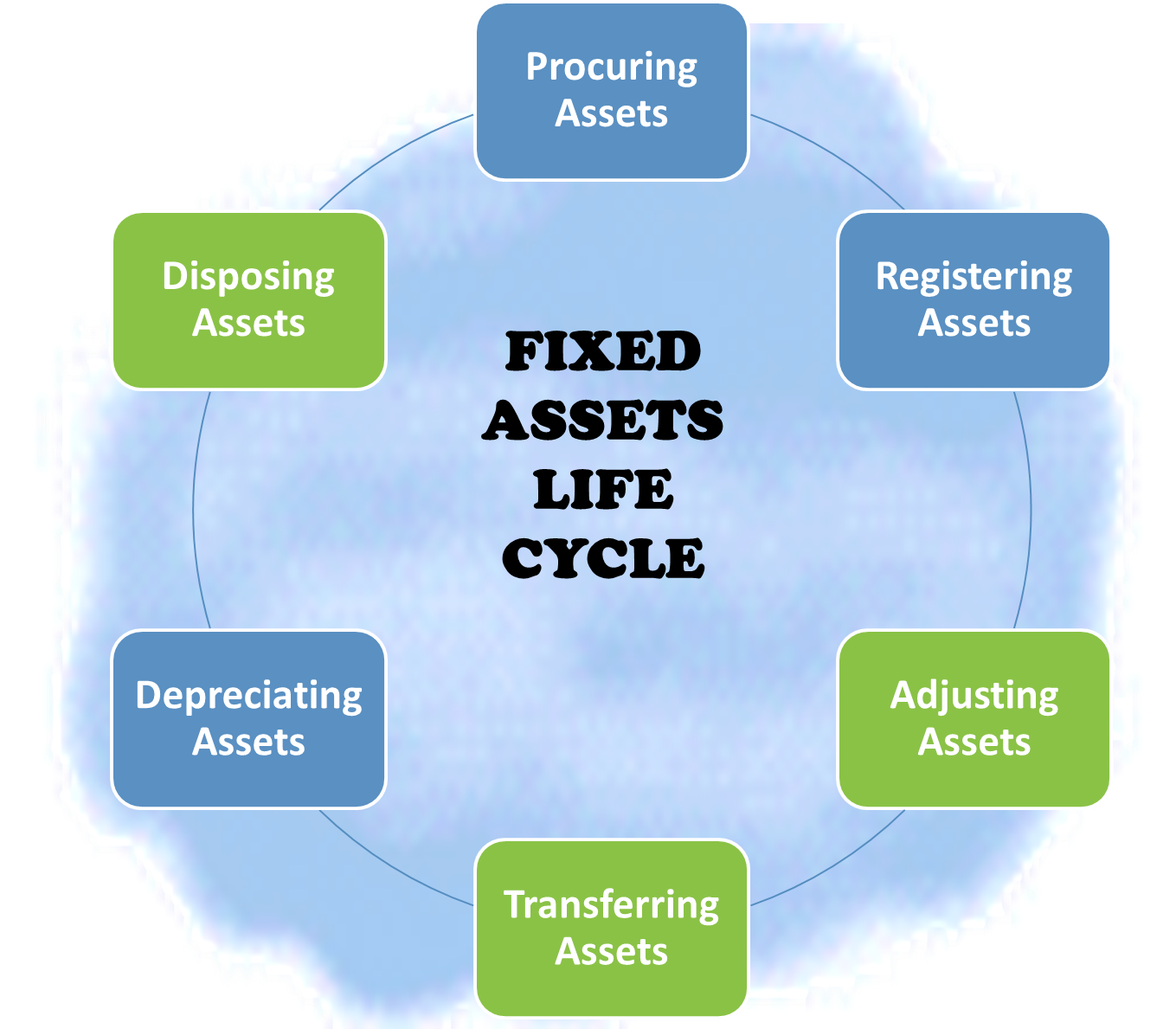

“Fixed Assets” is a six-step process and starts with initiating and approving the request to acquire the asset and after maintaining and depreciating for useful life ends with the final disposal of the fixed asset. These steps are cyclic in nature and most of them happen in any fixed management lifecycle. Some optional steps may happen only in certain business scenarios or in specific industries.

Process Steps or the chevrons for “Fixed Assets” process can be summarized as:

- Initiate

- Acquire - Procuring an asset

- Maintain - Registering/Adding an asset

- Depreciating/Appreciating Assets

- Dispose & Retire – Transfer/ Adjust/ Dispose

- Report

1. Initiate:

The Fixed Asset process usually begins with an approved asset requisition (A/R). Any person who is authorized to request a fixed asset prepares an Appropriation Request (AR) form providing details of the requested fixed asset and submits it for review and approval.

2. Acquire - Procuring an asset:

A fixed asset could be a self-constructed asset or maybe an acquired asset. Once the AR is approved a Purchase Order is issued in case the asset needs to be procured from a Vendor. An asset is most often entered into the accounting system; when the invoice for the asset is entered; into the accounts payable; or purchasing module of the system. Assets can also be directly entered in the Fixed Asset Management System.

3. Maintain:

Most organizations need to deal with hundreds or even thousands of physical assets. In such a case, it’s important to know the operating condition and location of the assets owned by them at periodical intervals. Identifying, tracking, and controlling assets are a critical step in ‘Asset Maintenance’. Registering or Adding an asset: Most of the information needed to set up the asset for depreciation is available at the time the invoice is entered. Information entered at this stage includes; acquisition date, placed-in-service date, description, asset type, cost basis, depreciable basis, etc. Some information will flow automatically based on the asset type selected based on the relationships that need to be defined in the system.

Sometimes a fixed asset is transferred to another subsidiary, reporting entity, or department within the company. These inter-company and intra-company transfers may result in changes that impact the asset’s depreciable basis, depreciation, or other asset data. This needs to be reflected accurately in the fixed assets management system

4. Depreciate:

The decline in an asset’s economic and physical value is called depreciation. According to GAAP, depreciation is an expense, that must be periodically reflected, on a company’s books, and allocated to the accounting periods, to match income and expenses. Sometimes, the revaluation of an asset may also result in an appreciation of its value. The cost of an asset must be spread on a rational, systematic basis over the periods of its useful life. Advanced FA accounting systems automatically calculates depreciation each month based on the information established in each fixed asset record. The system may have the capability to calculate separate depreciation for Company GAAP, Local GAAP, and Tax purposes. Adjustments to existing asset information are often needed to be made for events may occur that can change the depreciable basis of an asset. There may be improvements or repairs made to assets that either adds value to the asset or extend its economic life.

5. Dispose & Retire:

Items of fixed assets that have been removed, not being used, are obsolete or beyond repair, or identified to be retired from active use are held for disposal. When an asset is taken out of service, depreciation cannot be charged on it. An item of a fixed asset is eliminated from the financial statements on disposal and any profit/loss arising out of disposal/retirement should be recognized in the profit and loss statement. When a fixed asset is, no longer in use, becomes obsolete, is beyond repair, the asset is typically disposed of. When an asset is taken out of service, depreciation cannot be charged on it. There are multiple types of disposals, such as abandonments, sales, and trade-ins. Any difference between the book value, and realized value, is reported as a gain or loss.

6. Reporting for Fixed Assets:

‘Fixed Asset’ compliance reporting and planning needs for multinational corporations are varied and complex. There exists a multitude of depreciation methods and different regulations/statues prescribe different rates and methods to calculate depreciation for the same asset. A company needs to prepare financial (US GAAP), statutory (Local GAAP) and tax (Income Tax, Property Tax, VAT, GST) depreciation schedules and compliance reports. The FA system should provide for the capability of reporting on these different dimensions and the ability to perform analytical reviews. At the month-end, the accounting period in the FA System is closed and FA System transfers to G/L the monthly fixed asset activity. Reconciliations must be done between the FA sub-ledger and the G/L for all fixed asset accounts. Generate all of the necessary fixed asset reports to complete the closing process.

Related Links

You May Also Like

-

Key challenges in managing FA process

As organizations grow in scale they need a more detailed justification of capital expenditure. This leads to many functions getting involved in the fixed asset management process with significant “hand-offs” at each step/stage. In this chapter, we will address a broad array of issues involved in the process of fixed assets in any large scale organization.

-

Costs subsequent to acquisition of fixed assets

Costs related to plant assets that are incurred after the asset is placed in use are either added to the fixed asset account (capitalized) or charged against operations (expensed) when incurred. In this article, we will discuss underlying principles for this accounting event.

-

Physical assets are frequently out in the field for use; undergo repairs, sold, updated, removed or stolen. From purchase to disposal and all of the steps in between, an asset’s history can be easily traced and reviewed using an asset management system that utilizes asset tags or asset labels.

-

Fixed Assets - Key Terminology

In this article, we have explained the meaning and usage of key generic terms that are used in almost every FA management system/ Fixed Assets process. Understanding these terms is a prerequisite to building a solid understanding of the fixed assets business process.

-

A fixed asset register (FAR) is accounting book with a list of fixed assets belonging to particular entity. Traditionally the fixed asset register was maintained in written form by the accountant using a book that was set aside specifically for tracking fixed assets. Now with the advent of IT systems for bookkeeping it is more often held in electronic format. Learn the importance of maintaining a FAR.

-

Introduction to Capital Asset Planning

Before you purchase an asset in any organization, you must justify the decision to purchase the asset and get requisite approvals to make investment and release the funds. These series of analysis steps where cost-benefit analysis is performed to justify the decision to purchase a prospective asset is called the process of capital asset planning or simply as capital budgeting.

-

“Fixed Assets” is a six-step process and starts with initiating and approving the request to acquire the asset and after maintaining and depreciating for useful life ends with the final disposal of the fixed asset. These steps are cyclic in nature and most of them happen in any fixed management lifecycle. Some optional steps may happen only in certain business scenarios or in specific industries.

-

An asset is anything that will probably bring future economic benefit. Every company must take actions to safeguard, control, and manage the assets it owns. Cash Assets needs to be managed effectively to safeguard and utilize them efficiently. In this section, we will start with understanding what are assets, what are various classification of assets and then we will focus on Asset Management.

-

Asset Maintenance – Tagging & Physical Verification

Most organizations need to deal with hundreds or even thousands of physical assets. In such a case, it’s important to know the operating condition and location of the assets owned by them at periodical intervals. Identifying, tracking, and controlling assets are a critical step in ‘Asset Maintenance’.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved