- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- Asset Management

- Need for Fixed Asset Register

Need for Fixed Asset Register

A fixed asset register (FAR) is accounting book with a list of fixed assets belonging to particular entity. Traditionally the fixed asset register was maintained in written form by the accountant using a book that was set aside specifically for tracking fixed assets. Now with the advent of IT systems for bookkeeping it is more often held in electronic format. Learn the importance of maintaining a FAR.

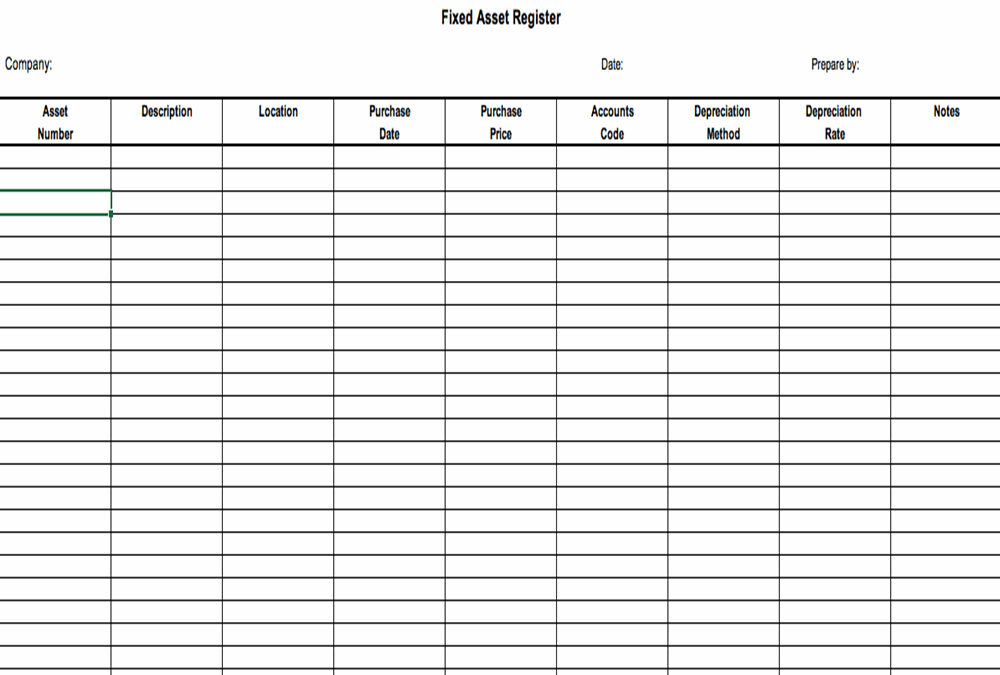

A fixed asset register is an item listing of all fixed assets owned by the business. It should include details such as:

- Description of the asset

- Location of the asset with business unit

- Purchase price and date

- The useful life of the asset

- Date put to use

- Expected value at the end of its useful life

- Depreciation expense (accumulated and current)

- Asset Block & asset category if applicable

- Gross book value and net book value

FAR & General Ledger

The main purpose of a fixed asset register is to keep track of the book value of the assets and determine depreciation to be calculated and recorded for management and taxation purposes. Keeping an up to date and accurate fixed asset register not only assists with ensuring compliance but also helps in short- and long-term capital investment planning.

In addition, it is important to keep a fixed asset register as it allows businesses to keep track of the book value of assets and their depreciation over time. General Ledger only has the total account balances and depreciation balance for a particular asset category and transactions in summary. It does not have all the details of the individual assets that comprise the total asset category and also no details of depreciation on each of these individual assets. Having so many details in the GL would clutter it too much. So it is best to have the Asset Line level details in a separate place. In large organizations, FAR is maintained by systems or asset management software solutions. The FAR serves as a FA sub-ledger for all accounting purposes.

Assets not under the direct control

It also records fixed assets that are not under the direct control of the company e.g. leased assets, assets under construction, and imported assets.

Compliance with Laws

The tax and accounting laws require the maintenance of this register. By tracking each movement in each fixed line item, the FAR ensures control better and prevents misappropriation. It allows for the computation of depreciation and for tax and insurance purposes.

Management Reporting

With the help of a FAR, reports like the location of assets, the value of individual assets in an asset category, depreciation on each asset in the category, the value of assets under construction or leased assets, etc. can be generated which enable the management in making capital budgeting decisions. FAR also assists in estimating the future capital investment in fixed assets and to determine business valuations in case of mergers or acquisitions.

Fixed Asset Reconciliation

At the end of each month/quarter (depending on company policy), relevant GL and FAR reports are pulled out to perform FA reconciliation. The total for each asset category in the GL should tie with the sum total of the individual assets in that category as provided by the FAR. In case, the two don't match, the reasons are analyzed and necessary action is taken to balance the two.

Besides, the total of depreciation as per the depreciation schedule should tie-up with the depreciation balance in the GL, which is calculated on the basis of the block of assets and not an individual asset. If there is a mismatch between the depreciation amounts, reconciliation is required to identify and resolve variances.

This is important to ensure that the GL balance of FA reported in the Balance sheet is correct and accurate.

Identification of Assets

A secondary purpose is to allow for the easy identification of an asset by assigning each asset a unique ID that may be printed on labels in the form of a barcode. FAR also helps in estimating the repairs and maintenance costs. In certain countries, subsidies are allowed on certain assets. The value of assets is determined by fixed asset registers.

Physical Verification of Assets

Besides the GL and sub-ledger reconciliation, there is a physical verification of FA. Assets are physically verified for quantity and location as per the FAR details. This is generally an annual process.

Related Links

You May Also Like

-

Fixed Assets - Key Terminology

In this article, we have explained the meaning and usage of key generic terms that are used in almost every FA management system/ Fixed Assets process. Understanding these terms is a prerequisite to building a solid understanding of the fixed assets business process.

-

Physical assets are frequently out in the field for use; undergo repairs, sold, updated, removed or stolen. From purchase to disposal and all of the steps in between, an asset’s history can be easily traced and reviewed using an asset management system that utilizes asset tags or asset labels.

-

Key challenges in managing FA process

As organizations grow in scale they need a more detailed justification of capital expenditure. This leads to many functions getting involved in the fixed asset management process with significant “hand-offs” at each step/stage. In this chapter, we will address a broad array of issues involved in the process of fixed assets in any large scale organization.

-

Introduction to Capital Asset Planning

Before you purchase an asset in any organization, you must justify the decision to purchase the asset and get requisite approvals to make investment and release the funds. These series of analysis steps where cost-benefit analysis is performed to justify the decision to purchase a prospective asset is called the process of capital asset planning or simply as capital budgeting.

-

An asset is anything that will probably bring future economic benefit. Every company must take actions to safeguard, control, and manage the assets it owns. Cash Assets needs to be managed effectively to safeguard and utilize them efficiently. In this section, we will start with understanding what are assets, what are various classification of assets and then we will focus on Asset Management.

-

A fixed asset register (FAR) is accounting book with a list of fixed assets belonging to particular entity. Traditionally the fixed asset register was maintained in written form by the accountant using a book that was set aside specifically for tracking fixed assets. Now with the advent of IT systems for bookkeeping it is more often held in electronic format. Learn the importance of maintaining a FAR.

-

Asset Maintenance – Tagging & Physical Verification

Most organizations need to deal with hundreds or even thousands of physical assets. In such a case, it’s important to know the operating condition and location of the assets owned by them at periodical intervals. Identifying, tracking, and controlling assets are a critical step in ‘Asset Maintenance’.

-

Costs subsequent to acquisition of fixed assets

Costs related to plant assets that are incurred after the asset is placed in use are either added to the fixed asset account (capitalized) or charged against operations (expensed) when incurred. In this article, we will discuss underlying principles for this accounting event.

-

“Fixed Assets” is a six-step process and starts with initiating and approving the request to acquire the asset and after maintaining and depreciating for useful life ends with the final disposal of the fixed asset. These steps are cyclic in nature and most of them happen in any fixed management lifecycle. Some optional steps may happen only in certain business scenarios or in specific industries.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved