- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- GL - Adjustment Entries

GL - Adjustment Entries

In this article, we will describe how to determine if an account needs adjustment entries due to the application of the matching concept. Learners will get a thorough understanding of the adjustment process and the nature of the adjustment entries. We will discuss the four types of adjustments resulting from unearned revenue, prepaid expenses, accrued expenses, and accrued revenue.

The Adjusting Process:

At the end of an accounting period, many of the balances of accounts in the ledger can be reported as they have been summarized in the general ledger system, without any changes, and financial statements can be generated for them. For example, the balances of the cash and land accounts are normally the amount reported on the balance sheet because we cash reflected in the balance sheet should be equal to the physical cash in hand, and the land is generally carried in the books at a historic cost.

Under the accrual basis, however, some accounts in the general ledger require updating (adjustment). For example, the balances listed for expenses that have been paid in advance like the advance rental for the lease period, are normally overstated because the use of these assets is not recorded on a day-to-day basis. The balance of the supplies accounts usually represents the cost of supplies at the beginning of the period plus the cost of supplies acquired during the period. To record the daily use of supplies would require many entries with small amounts. In addition, the total amount of supplies is small relative to other assets, and managers usually do not require day-to-day information about supplies.

This analysis and resulting updating of accounts at the end of the accounting period before the financial statements are prepared is called the adjusting process.

The Adjusting Entries:

The journal entries that bring the accounts up to date at the end of the accounting period are called adjusting entries. Adjusting entry is an accounting entry made at the end of the accounting period to allocate items between accounting periods. Generally adjusting entries are recorded at the end of the accounting period to adjust ledger accounts for any changes that relate to the current accounting period but have not yet been recorded.

Not all journal entries recorded at the end of a period are adjusting entries. The main purpose of adjusting entries is to match revenues and expenses to the current accounting period which is a requirement of the matching principle of accounting or to reconcile the different books of accounts like management books, consolidation books, and local statutory books by eliminating or adding entries requiring different treatment as per the different accounting standards or laws.

All adjusting entries generally affect at least one income statement account and one balance sheet account. Thus, an adjusting entry will always involve revenue or an expense account and an asset or a liability account.

Types of Adjusting Entries:

Most adjusting entries could be classified in the following four ways:

1. Prepayments/Deferral:

Cash has been paid or received before the actual consumption. These can be further classified as:

(A) Unearned Revenue: Revenues received in cash before they are earned

(B) Prepaid expenses: Expenses paid in cash before they are used

2. Accruals - Expenses / Revenues:

Actual consumption has happened and cash is yet to be received. These can be further classified as:

(A) Accrued Expenses: Expenses incurred not yet paid in cash

(B) Accrued Revenues: Revenues earned not yet received in cash

Similarly on the other hand an organization might have received services or products but has not paid them in cash or has provided services or products to its customers but not received the sales proceeds in cash. In both these cases, these accruals will result in adjusting entries. For example, there may be interest owed on debt or salaries owed but not yet paid to employees. Calculations must be done to determine those expense accruals—both an expense and a liability that is building over time. Revenue accruals are also possible. For example, interest may be accruing on an entity's investments and therefore an interest income accrual would need to be recognized that would have the effect of increasing assets (interest receivable) and increasing revenue (interest income). There are many types of accruals that may need to be recognized through a series of adjustments at the end of a period.

3. Prepayments or Deferrals:

Deferrals or prepayments are also a possible source of adjusting entries. There can be both deferred revenues and deferred expenses. Adjusting entries for prepayments are necessary to account for cash that has been received prior to the delivery of goods or completion of services. A company receiving the cash for benefits yet to be delivered will have to record the amount in an unearned revenue liability account. Then, an adjusting entry to recognize the revenue is used as necessary.

If cash or something of value has been received for future products or work to be performed, since the product hasn't been delivered or the service provided, the income must be deferred to a future date. Deferred income is recorded as an asset (most likely cash) and a liability (deferred revenue). Prepaid rent received by a landlord is an example of a deferral.

Similarly, Expenses can also be deferred. For example, if your company pays its insurance bill in advance for a period covering the next three years, only the amount attributed to this period’s insurance coverage would be an expense, while the remainder of the payment would be classified as a deferred expense. In this case, an asset called prepaid insurance would be established for the insurance paid representing future coverage.

In case of advance payments, when the cash is paid, it is first recorded in a prepaid expense asset account; the account is to be expensed either with the passage of time (e.g. rent, insurance) or through use and consumption (e.g. supplies).

Adjusted Trial Balance:

An Adjusted Trial Balance is a list of the balances of ledgers which is made after the adjusting entries are done. Adjusted trial balance contains balances of revenues and expenses along with those of assets, liabilities, and equities after the changes occur due to adjusting entries.

Adjusting Entries –Summary:

Based on the above discussion now let’s take a look at some accrual/deferral related concepts:

- Deferred income is recorded as an asset (most likely cash) and a liability (deferred revenue).

- In case of advance payments, when the cash is paid, it is first recorded in a prepaid expense asset account; the account is to be expensed either with the passage of time

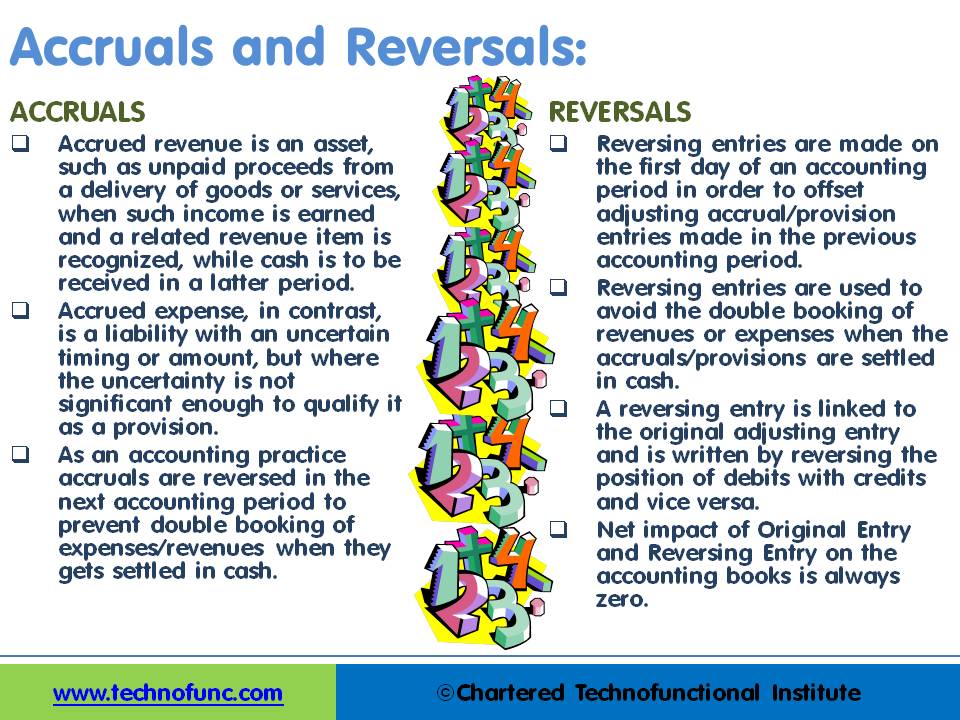

- Accrued revenue is an asset, such as unpaid proceeds from a delivery of goods or services, when such income is earned and a related revenue item is recognized, while cash is to be received in a later period.

- Accrued expense, in contrast, is a liability with an uncertain timing or amount, but where the uncertainty is not significant enough to qualify it as a provision.

- As an accounting practice expense and revenue accruals are reversed in the next accounting period to prevent double-booking of expenses/revenues when they get settled in cash.

Related Links

You May Also Like

-

An organizational design is the process by which a company defines and manages elements of structure so that an organization can control the activities necessary to achieve its goals. Good organizational structure and design helps improve communication, increase productivity, and inspire innovation. Organizational structure is the formal system of task and activity relationships to clearly define how people coordinate their actions and use resources to achieve organizational goals.

-

GL - Unearned / Deferred Revenue

Unearned revenue is a liability to the entity until the revenue is earned. Learn the concept of unearned revenue, also known as deferred revenue. Gain an understanding of business scenarios in which organizations need to park their receipts as unearned. Look at some real-life examples and understand the accounting treatment for unearned revenue. Finally, look at how the concept is treated in the ERPs or automated systems.

-

Five Core General Ledger Accounts

Typically, the accounts of the general ledger are sorted into five categories within a chart of accounts. Double-entry accounting uses five and only five account types to record all the transactions that can possibly be recorded in any accounting system. These five accounts are the basis for any accounting system, whether it is a manual or an automated accounting system. These five categories are assets, liabilities, owner's equity, revenue, and expenses.

-

Explore the concept of journal reversals and understand the business scenarios in which users may need to reverse the accounting entries that have been already entered into the system. Understand the common sources of errors resulting in the reversal of entries and learn how to correct them. Discuss the reversal of adjustment entries and the reversal functionalities in ERPs.

-

The sole trader organization (also called proprietorship) is the oldest form of organization and the most common form of organization for small businesses even today. In a proprietorship the enterprise is owned and controlled only by one person. This form is one of the most popular forms because of the advantages it offers. It is the simplest and easiest to form.

-

Different Types of Organizational Structures

Modern business organizations run multiple product and service lines, operate globally, leverage large number of registered legal entities, and operate through complex matrix relationships. To stay competitive in the current global business environment, they must often develop highly diverse and complex organizational structures that cross international borders.

-

GL - Accrued / Unbilled Revenue

Accrued revenues (also called accrued assets) are revenues already earned but not yet paid by the customer or posted to the general ledger. Understand what we mean by the terms accrued revenue, accrued assets, and unbilled revenue. Explore the business conditions that require recognition of accrued revenue in the books of accounts and some industries where this practice is prevalent.

-

Functional Organizational Structures

A functional organizational structure is a structure that consists of activities such as coordination, supervision and task allocation. The organizational structure determines how the organization performs or operates. The term organizational structure refers to how the people in an organization are grouped and to whom they report.

-

Record to report (R2R) is a finance and accounting management process that involves collecting, processing, analyzing, validating, organizing, and finally reporting accurate financial data. R2R process provides strategic, financial, and operational feedback on the performance of the organization to inform management and external stakeholders. R2R process also covers the steps involved in preparing and reporting on the overall accounts.

-

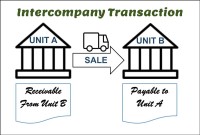

After reading this article the learner should be able to understand the meaning of intercompany and different types of intercompany transactions that can occur. Understand why intercompany transactions are addressed when preparing consolidated financial statements, differentiate between upstream and downstream intercompany transactions, and understand the concept of intercompany reconciliations.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved