- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- Multi Currency - Functional & Foriegn

Multi Currency - Functional & Foriegn

Currency is the generally accepted form of money that is issued by a government and circulated within an economy. Accountants use different terms in the context of currency such as functional currency, accounting currency, foreign currency, and transactional currency. Are they the same or different and why we have so many terms? Read this article to learn currency concepts.

What is Currency?

Currency is the generally accepted form of money that is issued by a government and circulated within an economy. Currency is used as a medium of exchange for goods and services. Every nation has its own currency and global trade results in the exchange of currencies of different countries. Currency is the basis for trade and when the trade involves two different countries, generally two different currencies come to play. To obtain another country’s currency, it is necessary to buy it using the appropriate exchange rate, and the price of a currency compared to another is called the exchange rate.

What is Exchange Rate?

Exchange Rate is the price of one country's currency expressed in terms of another country's currency. In other words, the rate at which one currency can be bought or exchanged for another currency. For example, the higher the exchange rate for one Euro in terms of one Dollar, the lower is the relative value of the Dollar. Exchange rates are determined by the foreign exchange market, where continuous trading happens between a wide range of different types of buyers and sellers. There are different types of rates that get referenced with respect to General Ledger. The Spot Exchange Rate refers to the current exchange rate. The Forward Exchange Rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date. Historical Exchange Rate refers to the exchange rate prevalent on the date of the original transaction.

1. What is Accounting Currency?

Accounting Currency is the monetary unit used while recording transactions in the company's financial books. The accounting currency may not necessarily be the same as the currency used by the customers when conducting the transaction. Multinational companies are likely to use their home country's currency when recording transactions, even if the sale was denominated in a foreign currency.

For example, an American firm conducting business in Japan will likely use the Dollar as the accounting currency, even if sales transactions are conducted using the yen. The American company is under a legal obligation to consolidate its accounts for operations all over the world in the US Dollars for reporting its results in the US. Hence for its US consolidation books, it will always account for in the US Dollar.

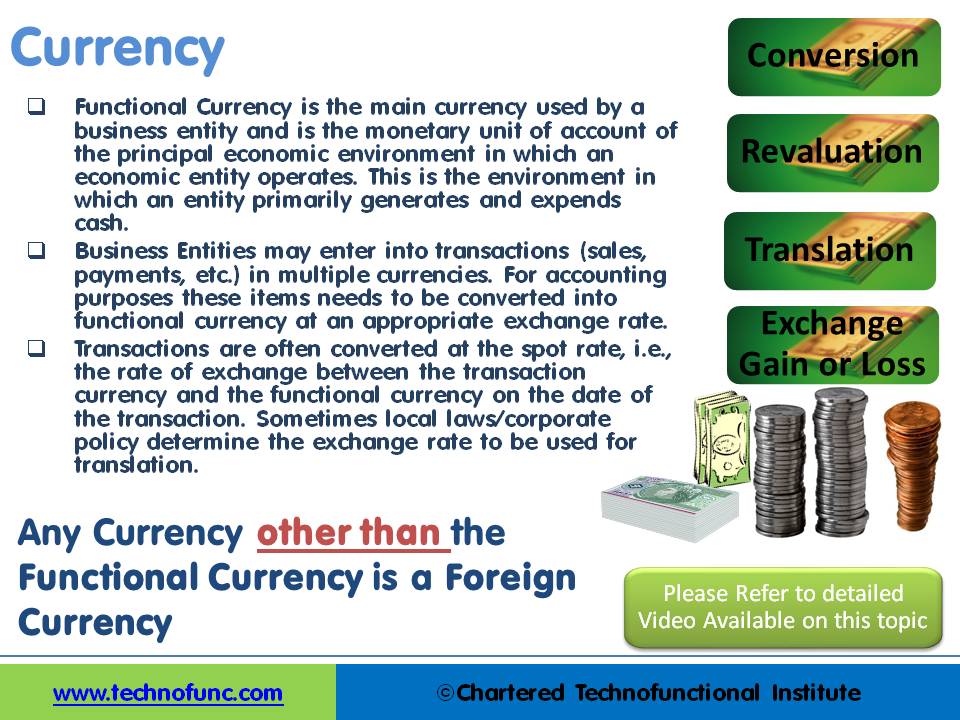

2. What is Functional Currency?

Functional Currency is the main currency used by a business entity. It is the monetary unit of account of the principal economic environment in which an economic entity operates. This is the environment in which an entity primarily generates and expends cash. SFAS 52 introduced the concept of functional currency, defined as "the currency of the primary economic environment in which the entity operates; normally, that is, the currency of the environment in which an entity primarily generates and expends cash."

To understand these learners need to understand the context in which the functional currency term is being used. The functional currency term is generally used in the context of an entity. It is the main currency of the economic environment in which the entity operates. Hence if a US Corporation, registered in the US, is operating in India as a separate registered Indian legal entity, then the functional currency for the Indian legal entity will be INR as that is the currency of the main economic environment. However, if the parent entity drives its 90% of revenues from operations in the US then the functional currency for the parent entity still remains US Dollar.

As a general practice, the functional currency is used as an accounting currency for the respective legal entity. The main reason is that many countries have laws and standards that sometimes prescribe accounting books to be maintained in the functional currency for local statutory reporting needs. Businesses may enter into transactions (sales, payments, etc.) in multiple currencies. Each legal business entity of the business translates these items to its functional currency at an appropriate exchange rate. It then prepares periodic reports of its position (balance sheet) and activity (income and cash flow statements) in that functional currency. When various legal entities are combined, these reports are translated and consolidated to become financial statements. The translation and consolidation need to happen in the functional currency of the parent entity.

3. What is Transacting Currency?

Transacting currency is the currency that customers see and deal with when conducting a transaction, such as a sale. The accounting currency may not necessarily be the same as the transacting currency. Companies are likely to use their home country's currency (Accounting Currency) when recording transactions, even if the sale was denominated in some other currency (Foreign Currency). For example, a US Company conducting business in India will most likely use “US Dollar(USD)” as the accounting currency, even if sales transactions are conducted using the “Indian Rupee(INR)”. In this scenario, the US Dollar is the accounting currency and Indian Rupee is the transacting currency.

For companies having operations in different countries across the globe, managing multiple currencies could be a complicated task due to the interplay of foreign exchange rates and the need to make conversions from one currency to another. Whenever the business entities enter into transactions (sales, payments, etc.) in multiple currencies, for the purposes of accounting, these items need to be converted into accounting currency (the functional currency) at an appropriate exchange rate. Transactions are often converted at the spot rate, i.e., the rate of exchange between the transacting currency and the functional/accounting currency on the date of the transaction. Sometimes local laws/corporate policy determine the exchange rate be used for this conversion.

4. What is Foreign Currency?

From a functional and business perspective Foreign Currency is the currency of another country. From an accounting perspective, any Currency other than the Accounting Currency is a Foreign Currency. For a company that maintains its accounting books in US Dollars any other currency apart from US Dollars is a foreign currency and needs to be converted to US Dollars for recording transactions in the financial books for that entity.

5. What is Basic Currency?

Some accountants use the term basic currency or base currency. They are generally referring to the accounting currency. The amounts referring to different currencies cannot be totaled directly. It is necessary to have a basic currency to refer to and to use for the totals. The main point of accounting is that the totals of the “debit” balances must correspond to the totals of the “credit” balances. To verify that the accounting is balanced, there must be a single currency with which to do the totals. If there are different currencies, the basic currency must be indicated before anything else. This basic currency becomes the accounting currency for recording transactions.

6. What is Account Currency?

Most of the automated accounting systems provide the functionality to record both the transacting currency balances as well as accounting currency balances side by side against each transaction. Uses can enter the transactions in foreign currency and they are translated using the daily exchange rate to the accounting currency. Users can associate a currency with an account to specify the currency in which all transactions pertaining to that account will be entered. For example, you have some foreign currency deposits with the bank. You may specify that currency to prevent errors in your deposit account. In that case, such accounts will have its own currency symbol which indicates in which currency the account will be administered. Once the user indicates what the currency of the account will be, such accounts will then have their own balance expressed in their own currency. Only entries in the specified currency will be permitted on such accounts. If the account is in Euro, then there can only be Euro entries on such account; if the account is in USD, then there can only be entries in the specified USD currency on that account. For each account, alongside the balance in the account’s own currency, the balance in accounting currency will also be kept, in order to calculate the trial balance in accounting currency.

7. Reporting Currency

A company may want to report its financial results in any currency that is other than the functional or the transacting currency. Such a currency being used for reporting the financials is called Reporting Currency. A process of translation is used to convert the balances from one currency to the reporting currency. Currency specific adjustments are made and accounts are reported,

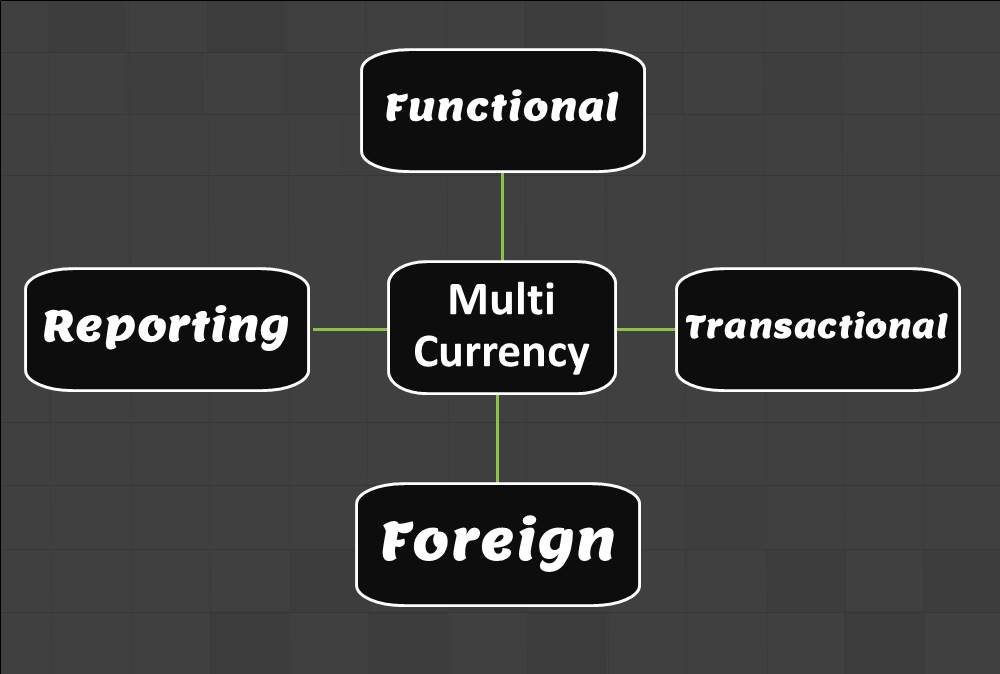

Multi-Currency Concepts

For companies or accounting users managing multiple currencies, the interplay of foreign exchange rates and conversions can make the maintenance of the books a complicated task. Translation of statements may result in translation differences, which are accounted for as a cumulative translation adjustment. Businesses using the accrual method of accounting may recognize revenue or expense in one period and receive or pay it in another. In the intervening period, the exchange rate may have changed. When an accrued item is settled, the difference due to exchange rate movement in the amount accrued and the amount settled is treated as foreign exchange gain or loss. Applicability of multi-currency creates a need to understand some foreign currency concepts like conversion, translation, revaluation, and currency exchange gain & loss. These concepts have been covered in our tutorial on Multi-Currency Concepts.

Related Links

You May Also Like

-

The general ledger is the central repository of all accounting information in an automated accounting world. Summarized data from various sub-ledgers are posted to GL that eventually helps in the creation of financial reports. Read more to understand the role and benefits of an effective general ledger system in automated accounting systems and ERPs.

-

A Company (also called corporation) may be understood as an association of persons in which money is contributed by them, to carry on some business or undertaking. Persons who contribute the money are called the shareholders or the members of the company. A corporation is an artificial being, invisible, intangible and existing only in contemplation of law. Being the mere creature of law, it possesses only those properties which the charter of its creation confers upon it.

-

Multi Currency - Functional & Foriegn

Currency is the generally accepted form of money that is issued by a government and circulated within an economy. Accountants use different terms in the context of currency such as functional currency, accounting currency, foreign currency, and transactional currency. Are they the same or different and why we have so many terms? Read this article to learn currency concepts.

-

General Ledger - Advanced Features

Modern automated general ledger systems provide detailed and powerful support for financial reporting and budgeting and can report against multiple legal entities from the single system. These systems offer many advanced functionalities right from journal capture to advanced reporting. This article will provide an overview of some advanced features available in today's General Ledgers.

-

This article explains the process of entering and importing general ledger journals in automated accounting systems. Learn about the basic validations that must happen before the accounting data can be imported from any internal or external sub-system to the general ledger. Finally, understand what we mean by importing in detail or in summary.

-

Divisional Organizational Structures

The divisional structure or product structure consists of self-contained divisions. A division is a collection of functions which produce a product. It also utilizes a plan to compete and operate as a separate business or profit center. Divisional structure is based on external or internal parameters like product /customer segment/ geographical location etc.

-

Reversing Journals are special journals that are automatically reversed after a specified date. A reversing entry is a journal entry to “undo” an adjusting entry. When you create a reversing journal entry it nullifies the accounting impact of the original entry. Reversing entries make it easier to record subsequent transactions by eliminating the need for certain compound entries. See an example of reversing journal entry!

-

Multitude of these legal and operational structures clubbed with accounting and reporting needs give rise to many reporting dimensions at which the organization may want to track or report its operational metrics and financial results. This is where business dimensions play a vital role.

-

Record to report (R2R) is a finance and accounting management process that involves collecting, processing, analyzing, validating, organizing, and finally reporting accurate financial data. R2R process provides strategic, financial, and operational feedback on the performance of the organization to inform management and external stakeholders. R2R process also covers the steps involved in preparing and reporting on the overall accounts.

-

Matrix Organizational Structures

In recent times the two types of organization structures which have evolved are the matrix organization and the network organization. Rigid departmentalization is being complemented by the use of teams that cross over traditional departmental lines.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved