- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- GL - Reversing Journal Entry

GL - Reversing Journal Entry

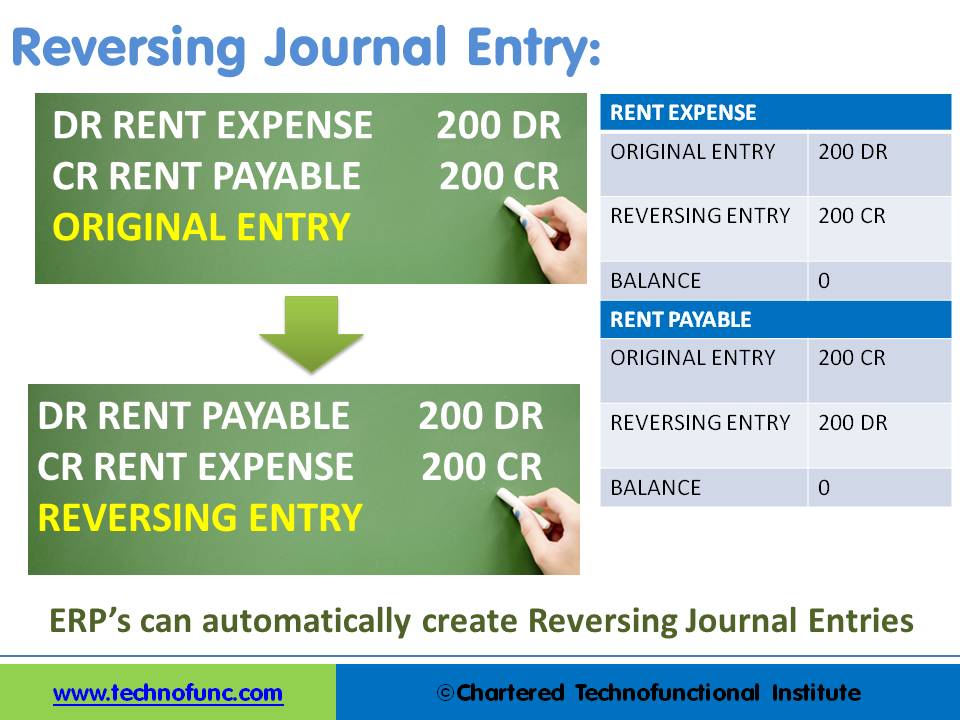

Reversing Journals are special journals that are automatically reversed after a specified date. A reversing entry is a journal entry to “undo” an adjusting entry. When you create a reversing journal entry it nullifies the accounting impact of the original entry. Reversing entries make it easier to record subsequent transactions by eliminating the need for certain compound entries. See an example of reversing journal entry!

What is a Reversing Journal Entry?

A reversing entry is a journal entry to “undo” an adjusting entry. When you create a reversing journal entry it nullifies the accounting impact of the original entry. Reversing entries make it easier to record subsequent transactions by eliminating the need for certain compound entries.

Reversing entry can be created in two ways. The first method is to use the same set of accounts with contra debits and credits, meaning that the accounts and amounts that were debited in the original entry will be credited with the same amount in the reversing journal “nullifying” the accounting impact. The second method is to create a journal with the same accounts but with negative amounts that will also nullify the accounting impact of the original transaction.

Automated Process Requirements:

- The accounts have been set up in the chart of accounts.

- The reversal criteria have been specified in the original adjustment or accrual journal, otherwise, the user generally needs to submit the journal manually for reversal.

- The date of the reversing journal has already been specified and the accounting period for that date is available for creating and posting transactions.

Process Flow Steps

- Enter a journal that reverses in the next month.

- Select the appropriate reversal option.

- At the beginning of the next period system creates a reversing entry dated the first day of the next accounting period.

Example of a reversing entry:

The business has taken premises on rent. The rent payable for each month is $200 and the invoice is raised by the landlord on the 15th of the subsequent month. The accounting department takes 5 days to process the payment and deposit the amount in the Landlord’s account. December is the close of the accounting year and the invoice for rent for the month of December will be received by the company on the 15th of January and payment will be made by the 20th of January.

Closing Books: On the 31st of December, the accounting department passes the rent accrual accounting entry, debiting the “Rent Expense” and crediting the “Rent Payable Account”. This entry records the rent for the month of Dec and creates a liability for “Rent Payable” to the landlord next month. At the beginning of the next accounting year, on day one this entry is reversed by debiting the “Rent Payable” and crediting the “Rent Account”.

Making Payment: Once the payment for Rent is made on 20th January (Again by Debiting “Rent Expense” and Crediting “Bank Account”) this reversal will ensure that the rent for last year is not impacting the current year financials as the net impact on the “Rent Expense” account will be zero.

Related Links

You May Also Like

-

Network Organizational Structures

The newest, and most divergent, team structure is commonly known as a Network Structure (also called "lean" structure) has central, core functions that operate the strategic business. It outsources or subcontracts non-core functions. When an organization needs to control other organizations or agencies whose participation is essential to the success, a network structure is organized.

-

As the business grows, the company may want to transition to a branch structure as branches are allowed to conduct a much broader range of activity than representative offices. Branches can buy and sell goods, sign contracts, build things, render services, and generally everything that a regular business can do. A company expands its business by opening up its branch offices in various parts of the country as well as in other countries.

-

GL - Accrued / Unbilled Revenue

Accrued revenues (also called accrued assets) are revenues already earned but not yet paid by the customer or posted to the general ledger. Understand what we mean by the terms accrued revenue, accrued assets, and unbilled revenue. Explore the business conditions that require recognition of accrued revenue in the books of accounts and some industries where this practice is prevalent.

-

What Is a General Ledger? General Ledger (also known in accounting as the GL or the Nominal Ledger) is at the heart of any accounting system. A general ledger is the master set of accounts that summarize all transactions occurring within an entity. Ledger is the skillful grouping and presentation of the Journal entries. Learn the accounting fundamentals, general ledger process, and general ledger flow.

-

GL - Recurring Journal Entries

A “Recurring Journal” is a journal that needs to be repeated and processed periodically. Recurring Entries are business transactions that are repeated regularly, such as fixed rent or insurance to be paid every month. Learn the various methods that can be used to generate recurring journals. See some examples and explore the generic process to create recurring journals in any automated system.

-

Legal Structures for Multinational Companies

A multinational company generally has offices and/or factories in different countries and a centralized head office where they coordinate global management. A multinational company (MNC)is a corporate organization that owns or controls the production of goods or services in at least one country other than its home country.

-

Internally, an organization can be structured in many different ways, depending on their objectives. The internal structure of an organization will determine the modes in which it operates and performs. Organizational structure allows the expressed allocation of responsibilities for different functions and processes to different entities such as the branch, department, workgroup and individual.

-

In this article, we will describe how to determine if an account needs adjustment entries due to the application of the matching concept. Learners will get a thorough understanding of the adjustment process and the nature of the adjustment entries. We will discuss the four types of adjustments resulting from unearned revenue, prepaid expenses, accrued expenses, and accrued revenue.

-

Hierarchical Organization Structures

Hierarchical structure is typical for larger businesses and organizations. It relies on having different levels of authority with a chain of command connecting multiple management levels within the organization. The decision-making process is typically formal and flows from the top down.

-

Introduction to Legal Entities Concept

Modern business organizations operate globally and leverage a large number of registered legal entities, and operate through complex matrix relationships. To stay competitive in the current global business environment, they must often develop highly diverse and complex organizational structures that cross international borders. Learn more about Legal Entities and their importance for businesses.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved