- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- Legal Structures for Multinational Companies

Legal Structures for Multinational Companies

A multinational company generally has offices and/or factories in different countries and a centralized head office where they coordinate global management. A multinational company (MNC)is a corporate organization that owns or controls the production of goods or services in at least one country other than its home country.

Due to advent of information age and globalization, the traditional hierarchy of the industrial age is rapidly disappearing and new large groups that are spread across the globe are fast emerging. A multinational corporation is a company with headquarters in one country but they operate in many countries. The post Second World War period saw the rapid growth of multinationals in Europe, America and Japan. As the world economy is opening up with a fall in regulatory barriers to foreign investment, better transport and communications, freer capital movements, etc., international companies are finding it easier to invest where they choose to cheaply, and with less risk. With the advent of globalization, companies started expanding to international markets and establishing marketing, manufacturing, or research and development facilities in several foreign countries.

What are multi-national companies?

A multinational company generally has offices and/or factories in different countries and a centralized head office where they coordinate global management. A multinational company (MNC)is a corporate organization that owns or controls the production of goods or services in at least one country other than its home country. One of the first multinational business organizations, the East India Company, was established in 1601. After the East India Company, came the Dutch East India Company in 1603, which would become the largest company in the world for nearly 200 years.

Some current examples are big multi national companies like Apple, Google, Amazon, Coca-Cola, Starbucks, IBM, FedEx, Accenture, Samsung or General Electric etc. Nestle and Shell Oil are two examples of European multinational. Most of the largest and most influential companies of the modern age are publicly traded multinational corporations, including Forbes Global 2000 companies.

What are Conglomerates?

A conglomerate is a combination of two or more corporations engaged in entirely different businesses that fall under one corporate group, usually involving a parent company and many subsidiaries. Often, a conglomerate is a multi-industry company. Conglomerates are often large and multinational.

Features of MNCs & Conglomerates

Some of the attributes associated with these large multi-national corporations are:

- These multinational groups operate across the boundaries of nations

- They employ and serve thousands of people with different cultures.

- Their annual sales turnover is in billions of dollars.

- They raise money in different stock markets.

- In spite of all these diversities they may be part of the same global group.

- These companies operate as individual entities in different countries/markets and consolidate with the group.

- Domestic corporations are taxed on their worldwide income at the federal (country) and state levels.

- Compliance (without overpaying) makes the products & services of these conglomerates more competitive, earnings more attractive to investors & company a more responsible corporate citizen.

Evolution of Legal Structures for MNCs/Conglomerates

They are dynamic organizations that are constantly changing and evolving, acquiring and merging many companies, opening their offices in all parts of world and operating under the ambit of ever-changing complex organizational structures.

Fundamentally a corporation must be legally domiciled in a particular country and engage in other countries through foreign direct investment and the creation of foreign branches or foreign subsidiaries.

All these large groups have smaller companies within them. The conglomerate may be constituted of different units which may represent separate legal entities constituted in different countries having multiple layers of ownership (which might be added to the group through mergers, acquisitions or could be joint ventures). Multinational corporations can select from a variety of jurisdictions for various subsidiaries, but the ultimate parent company can select a single legal domicile.

Global operations of these corporations are conducted with multiple subsidiaries, branch offices and joint venture partners working together, constantly evolving and changing their legal structures through mergers, acquisitions and takeovers. These subsidiaries and partners are responsible for their own P&L. They have their own Fixed Assets (such as assets held for the purpose of producing or providing goods/services) and their own markets where their own or their other group concern’s products are sold and eventually consolidate with the group.

Multinational corporations may be subject to the laws and regulations of both their domicile and the additional jurisdictions where they are engaged in business. In some cases, the jurisdiction can help to avoid burdensome laws. Corporations can legally engage in tax avoidance through their choice of jurisdiction, but must be careful to avoid illegal tax evasion. These MNCs should comply fully with all statutory and tax laws & regulations around the world and ensure payment of the correct amount of taxes in every country where it operates.

Aside from setting up a private limited company as subsidiary, foreign companies have two other options for entering the foreign market – a Branch Office or a Representative Office. Both are registered locally in the country of operations, follow local procedures, and need to pay official fees for registration.

Related Links

You May Also Like

-

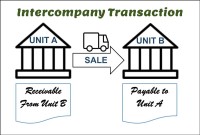

After reading this article the learner should be able to understand the meaning of intercompany and different types of intercompany transactions that can occur. Understand why intercompany transactions are addressed when preparing consolidated financial statements, differentiate between upstream and downstream intercompany transactions, and understand the concept of intercompany reconciliations.

-

Record to report (R2R) is a finance and accounting management process that involves collecting, processing, analyzing, validating, organizing, and finally reporting accurate financial data. R2R process provides strategic, financial, and operational feedback on the performance of the organization to inform management and external stakeholders. R2R process also covers the steps involved in preparing and reporting on the overall accounts.

-

Introduction to Organizational Structures

Organizations are systems of some interacting components. Levitt (1965) sets out a basic framework for understanding organizations. This framework emphasizes four major internal components such as: task, people, technology, and structure. The task of the organization is its mission, purpose or goal for existence. The people are the human resources of the organization.

-

The general ledger is the central repository of all accounting information in an automated accounting world. Summarized data from various sub-ledgers are posted to GL that eventually helps in the creation of financial reports. Read more to understand the role and benefits of an effective general ledger system in automated accounting systems and ERPs.

-

A subsidiary is a company that is completely or partly owned by another corporation that owns more than half of the subsidiary's stock, and which normally acts as a holding corporation which at least partly or wholly controls the activities and policies of the daughter corporation.

-

What Is a General Ledger? General Ledger (also known in accounting as the GL or the Nominal Ledger) is at the heart of any accounting system. A general ledger is the master set of accounts that summarize all transactions occurring within an entity. Ledger is the skillful grouping and presentation of the Journal entries. Learn the accounting fundamentals, general ledger process, and general ledger flow.

-

Team-Based Organizational Structure

Team-based structure is a relatively new structure that opposes the traditional hierarchical structure and it slowly gaining acceptance in the corporate world. In such a structure, employees come together as team in order to fulfill their tasks that serve a common goal.

-

GL - Different Accounting Methods

The accounting method refers to the rules a company follows in reporting revenues and expenses. Understand the two common systems of bookkeeping, single, and double-entry accounting systems. Learners will also understand the two most common accounting methods; cash and accrual methods of accounting and the advantages and disadvantages of using them.

-

GL - Unearned / Deferred Revenue

Unearned revenue is a liability to the entity until the revenue is earned. Learn the concept of unearned revenue, also known as deferred revenue. Gain an understanding of business scenarios in which organizations need to park their receipts as unearned. Look at some real-life examples and understand the accounting treatment for unearned revenue. Finally, look at how the concept is treated in the ERPs or automated systems.

-

Functional Organizational Structures

A functional organizational structure is a structure that consists of activities such as coordination, supervision and task allocation. The organizational structure determines how the organization performs or operates. The term organizational structure refers to how the people in an organization are grouped and to whom they report.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved