- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- Record to Report Process

Record to Report Process

Record to report (R2R) is a finance and accounting management process that involves collecting, processing, analyzing, validating, organizing, and finally reporting accurate financial data. R2R process provides strategic, financial, and operational feedback on the performance of the organization to inform management and external stakeholders. R2R process also covers the steps involved in preparing and reporting on the overall accounts.

Definition of Record to Report Process

This function helps to assist the companies in the preparation and submission of various statutory reports that require in-depth and specialized domain knowledge. This process enables companies to consolidate global performance across various channels and create global income statements and balance sheets. This provides visibility to various channel heads to understand and comment on the key variance drivers with reference to plans and past years' performance. All the activities from recording to reporting of transactions are included in the "Record to Report" process also known as "R2R", “Account to Report”, “A2R”, General Ledger, “Finance & Accounting” process. People with extensive training/experience with knowledge of client/country-specific requirements are important for building an effective “Record to Report” process.

The R2R Process

The record-to-Report process is an end-to-end process that includes, general accounting, sub-ledger accounting, tax compliance, regulatory compliance, financial analysis, and reporting and interacts with the functions of budgeting and forecasting and internal and external audit. It includes all subsequent activities after the recording financial transactions related to the financial close consolidation, through the external reporting of the Company’s financial results. The R2R process ends with the completion of account reconciliations of balances generated during the financial close process.

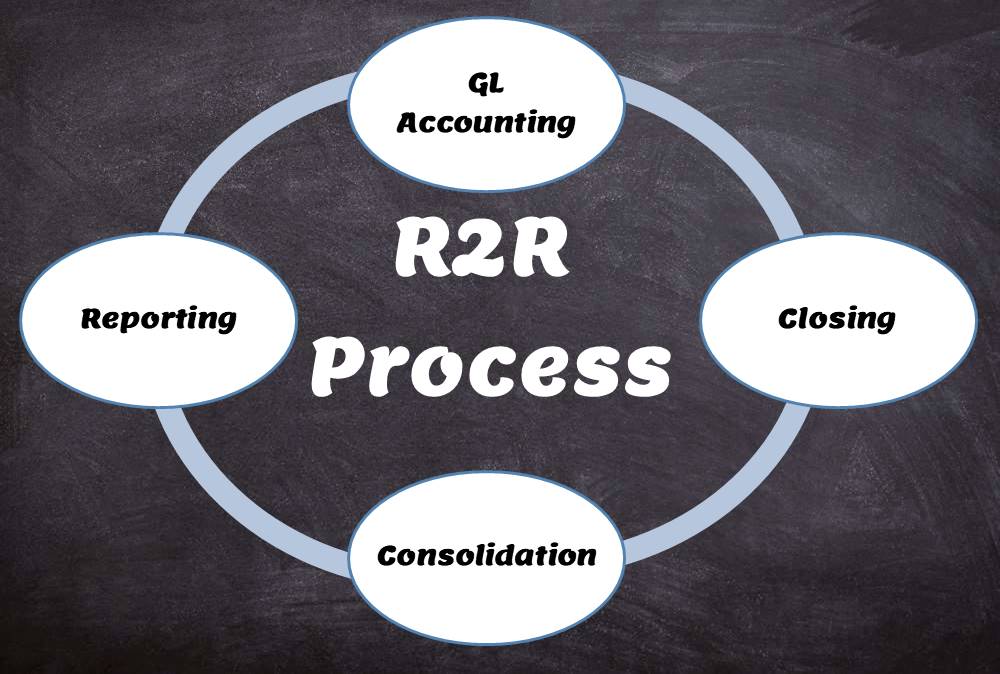

The four core steps in the record to report process are

- General Ledger Accounting

- Closing of Books

- Consolidation of Accounts

- Reporting of Financials

1. General Ledger Accounting:

The processing cycle is where the majority of data required for the Record to Report process is generated. The R2R process begins when recording occurs in a general ledger singly or jointly on Management GAAP and Statutory accounting basis. This step happens once the maintenance and closure of sub-ledgers are completed. Recording transactions includes documenting revenues (by invoices or sales receipts), and entering purchases (in the account payable account) and expenditures (in the check register). This step sometimes also involves high-level accounting tasks, such as recording sales orders, tracking prospective customers, and projecting sales opportunities and cash flow.

To record and classify a transaction to appropriate accounts, a proper understanding of the accounting equation is and accounting standards and practices is a must. Calculating and summarizing transactions in a traditional accounting system is a tedious process and automated accounting frees accountants from these repetitive tasks by calculating and summarizing hundreds or thousands of individual transactions and generating reports to satisfy a variety of stakeholders.

2. The Closing Cycle:

Once the processing cycle is complete, the next cycle is to close the books. Closing of Management GAAP books is done following the common R2R Organizational Global Closing Calendar along with the closing of statutory accounting books. Close Cycle is the elapsed time for posting transactions to the general ledger and financial reporting systems through locking down the general ledger.

3. The Consolidation Cycle:

The consolidation cycle is the next pivotal step in the Record to Report process and this step allows companies to perform eliminations, reconcile intercompany balances and produce the data required to generate financial statements by entities. The consolidation cycle must address both internal and external reporting needs. Consolidation and elimination include completion of within and outside own Business eliminations, intercompany reconciliations, and other post-close activities leading to final financial statements at the consolidated “Consolidating Entity” segment level.

4. Reporting Cycle:

The reporting cycle is the formal process of data gathering, assimilating, performing analysis, and distributing the results. Throughout a leading practice close and consolidation cycle, management is receiving reports that address key indicators and statistics. The key to this process is the flow of the information necessary to provide accuracy in an efficient manner. This would include information from all source systems and sometimes requires a support process to accomplish it. Reporting cycle includes submission of financial data and commentary to the Organization’s Corporate Headquarters, external reporting, and government reporting.

The accounting system records the economic data about business activities and events, the next logical step is to prepare the business reports and provide them to the stakeholders according to their informational needs. The double-entry system enables accountants to prepare some standard reports like trial balance, profit and loss account, and balance sheet. Accounting reports are based on generally accepted accounting standards and these reports are powerful tools to help the business owner, accountant, banker, or investor analyze the results of their operations. Stakeholders use accounting reports as a primary source of information on which they base their decisions. They use other information as well. For example, in deciding whether to extend credit to a company, a banker might use economic forecasts to assess the future demand for the company’s products. The banker might inquire about the ability and reputation of the managers of the business.

Importance of Record to Report:

The accuracy and integrity of the financial statements largely depend on the efficiency of transactional bookkeeping activities. People with extensive training/experience with knowledge of client/country-specific requirements are important for building an effective “Record to Report” process. This function helps to assist the companies in the preparation and submission of various statutory reports that require in-depth and specialized domain knowledge. This process enables companies to consolidate global performance across various channels and create global income statements and balance sheets. This provides visibility to various channel heads to understand and comment on the key variance drivers with reference to plans and past years' performance.

Related Links

You May Also Like

-

Generally Accepted Accounting Principles define the accounting procedures, and understanding them is essential to producing accurate and meaningful records. In this article we emphasize on accounting principles and concepts so that the learner can understand the “why” of accounting which will help you gain an understanding of the full significance of accounting.

-

What is a Business Eco System?

The goal of a business is to generate capital appreciation and profits for its owners or stakeholders by engaging in provision of goods and services to customers within the eco system/framework governed by respective laws(local/international). The eco system involves various entities that the business works with for delivery of a product or service.

-

A legal entity is an artificial person having separate legal standing in the eyes of law. A Legal entity represents a legal company for which you prepare fiscal or tax reports. A legal entity is any company or organization that has legal rights and responsibilities, including tax filings.

-

Five Core General Ledger Accounts

Typically, the accounts of the general ledger are sorted into five categories within a chart of accounts. Double-entry accounting uses five and only five account types to record all the transactions that can possibly be recorded in any accounting system. These five accounts are the basis for any accounting system, whether it is a manual or an automated accounting system. These five categories are assets, liabilities, owner's equity, revenue, and expenses.

-

There are five types of core accounts to capture any accounting transaction. Apart from these fundamental accounts, some other special-purpose accounts are used to ensure the integrity of financial transactions. Some examples of such accounts are clearing accounts, suspense accounts, contra accounts, and intercompany accounts. Understand the importance and usage of these accounts.

-

GL - Understanding Chart of Accounts

A chart of accounts (COA) is a list of the accounts used by a business entity to record and categorize financial transactions. COA has transitioned from the legacy accounts, capturing just the natural account, to modern-day multidimensional COA structures capturing all accounting dimensions pertaining to underlying data enabling a granular level of reporting. Learn more about the role of COA in modern accounting systems.

-

A subsidiary is a company that is completely or partly owned by another corporation that owns more than half of the subsidiary's stock, and which normally acts as a holding corporation which at least partly or wholly controls the activities and policies of the daughter corporation.

-

General Ledger - Advanced Features

Modern automated general ledger systems provide detailed and powerful support for financial reporting and budgeting and can report against multiple legal entities from the single system. These systems offer many advanced functionalities right from journal capture to advanced reporting. This article will provide an overview of some advanced features available in today's General Ledgers.

-

Matrix Organizational Structures

In recent times the two types of organization structures which have evolved are the matrix organization and the network organization. Rigid departmentalization is being complemented by the use of teams that cross over traditional departmental lines.

-

Explore the concept of journal reversals and understand the business scenarios in which users may need to reverse the accounting entries that have been already entered into the system. Understand the common sources of errors resulting in the reversal of entries and learn how to correct them. Discuss the reversal of adjustment entries and the reversal functionalities in ERPs.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved