- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- What are Management Entities?

What are Management Entities?

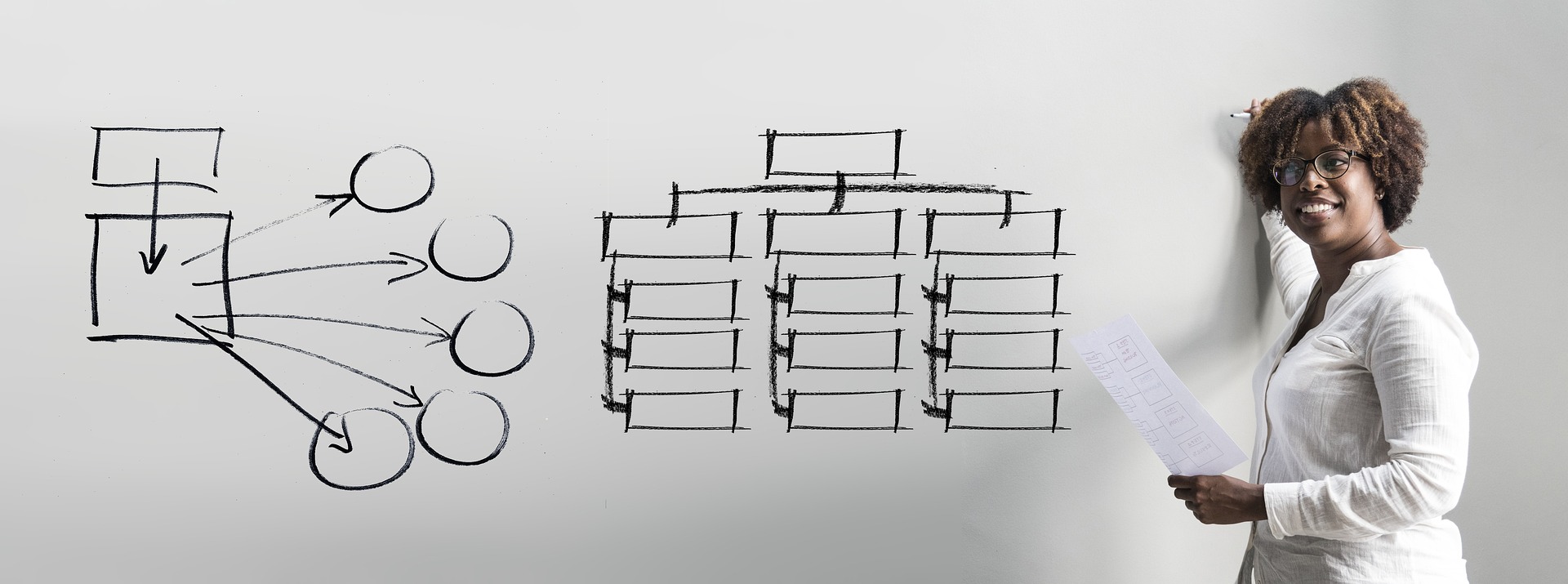

In this article we will discuss various types of "Management Entities". Various types of operational units, are created by management, to effectively run, manage and control their business. Different types of functional units, and divisional units, are widely used across industry.

In this article, we will discuss various types of "Management Entities".

Various types of operational units, are created by management, to effectively run, manage and control their business.

Different types of functional units, and divisional units, are widely used across industry.

What are some commonly used, "Management Entities"?

Various types of operational units, functional units and divisional units, that are widely used across industry are.

- Management Entity, or Business Units.

- Departments and Divisions.

- Business Functions.

- Cost centers.

- Profit Centers.

- Business Locations.

- Product Lines.

- Project Area.

Why Management Entities?

Internally, an organization can be structured in many different ways.

A large number of entities, can be created and tracked, depending on the management‘s objectives.

We have seen in our earlier article on Legal entities, that the legal entities are required, to be defined for external reporting, and compliance.

However, Management defines management entities, primarily for driving internal objectives.

They need these operational units, to efficiently manage their business, and effectively run it.

We know that big multinational organizations, operate in a matrix environment.

Management entities facilitate, division of responsibilities, and enables seamless flow of information, across the organization.

By defining required management entities, management can enable, tracking of various operations, financials, or profitability, for each of these entities.

These different views, can enable, granular tracking of business operations, by various dimensions, like, geographies, countries, locations, business segments, product lines, cost centres, functions, COE’s etc.

That's why, these entities are also, sometime referred to as "operating units".

Definition of Management Entity.

Actually, in real business parlance, A Management Entity, could mean anything, that the management wants.

It could be a business division, a specific type of unit, or department, or even a business function.

Some of the attributes, generally associated with management entities are.

Management of Funds; Management entities manage, on a discretionary basis, funds or portfolios, pursuant to a business mandate.

Used for financial reporting, and enables tracking of expenses, at a granular level.

These entities serve independently of legal entities.

Essentially, it is an autonomous, or a semi-autonomous, operating unit.

They are generally created to, meet strategic business objectives.

They help the management to better manage, their business activities.

They are created primarily, to promote business efficiency.

In our next articles, we will cover detailed discussions on, how companies use departments, functions, cost centres, locations, product lines etc., to create different management entities, and reporting dimensions.

Business Functions

An operating unit that represents a category or functional part of an organization that performs a specific task to support business activity, such as sales or marketing to support business development. Used to report on functional areas. A support function may have allocated budgets and may consist of a group of cost centers.

Organization Support Functions

Self-directed activity systems of an organization concerned with establishing and maintaining the organization as an entity. Each organization support function provides support to all functions, business, business support and other organization support functions. For example, corporate finance, IT functions, administration and knowledge management. An organization support function may have allocated budgets and may consist of a group of cost centers.

Cost centers

A cost center is part of an organization that does not produce direct profit and adds to the cost of running a company. Examples of cost centers include marketing & finance departments. It is an operating unit in which managers are accountable for budgeted and actual expenditures. Used for the management and operational control of business processes that may span legal entities.

Profit Centers

A profit center is a part of a corporation that directly adds to its profit, treated as a separate business and for which the profits or losses are calculated separately. This operating unit is held accountable for both revenues, and costs (expenses), and therefore, profits. Different profit centers are separated for accounting purposes so that the management can measure their relative efficiency and profit.

Business Locations/ Countries/ Geography/ Supplier & Customer Locations

Organizations operate from more than one location and may need to track where a particular financial transaction occurred. Some examples of need to track different locations could be transactions through sales offices, factories, subsidiaries etc. Organizations may even need to analyze the financial information based on the supplier’s or customer’s location may require a location segment dedicated to this. However this has very limited application in terms of usefulness. E.g. software companies cater to clients from all over the world & may like to make strategies based on which customer territory contributed how much to the revenue & hence a customer location is an important segment but for a manufacturing organization this will hold no relevance.

Product Lines/Service Lines

Some organizations deal in products which are low in volume but high in value. These organizations would like to analyze their costs & revenue for individual products. They also need to apportion indirect costs & revenues to these products/services so that the financials provide a full picture on product performance. On the other hand, a supermarket dealing in thousands of product might not have any interest in recording every transaction against the individual product or track financials at product level. Further each legal entity in the group may have its own set of released products that it wants to include in transaction documents.

Project Area

Certain organizations have their business models build around project activities. E.g. a property developer may like to have all its cost & revenue against individual projects. These organizations may have multiple projects running under same legal entity. There projects have their own budget & statutory requirements & hence their own trial balance.

Related Links

You May Also Like

-

What is Accounting & Book Keeping

Accounting is a process designed to capture the economic impact of everyday transactions. Each day, many events and activities occur in an entity, these events and activities are in the normal course of business; however, each of these events may or may not have an economic impact. Events or activities that have an effect on the accounting equation are accounting events.

-

What Is a General Ledger? General Ledger (also known in accounting as the GL or the Nominal Ledger) is at the heart of any accounting system. A general ledger is the master set of accounts that summarize all transactions occurring within an entity. Ledger is the skillful grouping and presentation of the Journal entries. Learn the accounting fundamentals, general ledger process, and general ledger flow.

-

Five Core General Ledger Accounts

Typically, the accounts of the general ledger are sorted into five categories within a chart of accounts. Double-entry accounting uses five and only five account types to record all the transactions that can possibly be recorded in any accounting system. These five accounts are the basis for any accounting system, whether it is a manual or an automated accounting system. These five categories are assets, liabilities, owner's equity, revenue, and expenses.

-

In this article we will help you understand the double-entry accounting system and state the accounting equation and define each element of the equation. Then we will describe and illustrate how business transactions can be recorded in terms of the resulting change in the elements of the accounting equation.

-

Accrued expenses, sometimes referred to as accrued liabilities, are expenses that have been incurred but have not been recorded in the accounts. Discuss the need to record accrued liabilities and why they require an adjustment entry. Understand the treatment for these entries once the accounting period is closed and learn to differentiate when the commitments become liabilities.

-

In this article, we explain some commonly used subsidiary ledgers like accounts receivable subsidiary ledger, accounts payable subsidiary ledger or creditors' subsidiary ledger, inventory subsidiary ledger, fixed assets subsidiary ledger, projects subsidiary ledger, work in progress subsidiary ledger, and cash receipts or payments subsidiary ledger.

-

Trial Balance in General Ledger

One of the greatest benefits of using a double-entry accounting system is the capability to generate a trial balance. What do we mean by trial balance? As the name suggests a trial balance is a report that must have its debits equals to credits. Understand the importance of trial balance and why it is balanced. Learn how it is prepared and in which format.

-

Multitude of these legal and operational structures clubbed with accounting and reporting needs give rise to many reporting dimensions at which the organization may want to track or report its operational metrics and financial results. This is where business dimensions play a vital role.

-

GL - Recurring Journal Entries

A “Recurring Journal” is a journal that needs to be repeated and processed periodically. Recurring Entries are business transactions that are repeated regularly, such as fixed rent or insurance to be paid every month. Learn the various methods that can be used to generate recurring journals. See some examples and explore the generic process to create recurring journals in any automated system.

-

As the business grows, the company may want to transition to a branch structure as branches are allowed to conduct a much broader range of activity than representative offices. Branches can buy and sell goods, sign contracts, build things, render services, and generally everything that a regular business can do. A company expands its business by opening up its branch offices in various parts of the country as well as in other countries.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved