- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Industry Knowledge

- Banking Domain

- Banking Operations: Different Types of Payments & Payment Systems

Banking Operations: Different Types of Payments & Payment Systems

Everyday people trade goods use services and need to make payments using cash as cash money is the major medium of exchange. Banks have developed various payment methods to facilitate the exchange of money that stimulates the growth of commerce, helps economic development and facilitates flexibility with lower transaction costs with security. Various payment systems exist today, ranging from cheque, wire transfer, cards to online transfer. In this article, we will discuss different types of payment methods that are available today with banking channels.

As the commerce and economy expand, volume and variety of transactions expand where there is a need to exchange the money. Using cash for each of these transactions is neither feasible nor practically possible. There are concerns regarding the security and transportation of cash in cases where large amounts of money are involved. Banks support ease and velocity in such cases by offering various payment systems as solutions.

What are Payment Systems?

A Payment System is a mechanism that facilitates the transfer of value between a payer and a beneficiary by which the payer discharges the payment obligations to the beneficiary. Payment Systems are the medium to transfer funds from one person to another that facilitate businesses and economies. The payment system enables a two-way flow of payments in exchange for goods and services in the economy. Payment systems help consumers to transfer funds to each other. Cash is the traditional and most widely used payment instrument that consumers use in their daily lives to purchase goods and services. Banking channels also provide other payment instruments through different platforms and these are also widely used in commerce. Payment systems comprise of instruments through which payments can be made, rules, regulations, and procedures that guide these payments, institutions which facilitate payment mechanisms and legal systems, etc. that are established to facilitate the transfer of funds between different participant institutions. Payment systems are used by individuals, banks, companies, governments, etc. to make payments to one another.

A Payment System is a mechanism that facilitates the transfer of value between a payer and a beneficiary by which the payer discharges the payment obligations to the beneficiary. Payment Systems are the medium to transfer funds from one person to another that facilitate businesses and economies. The payment system enables a two-way flow of payments in exchange for goods and services in the economy. Payment systems help consumers to transfer funds to each other. Cash is the traditional and most widely used payment instrument that consumers use in their daily lives to purchase goods and services. Banking channels also provide other payment instruments through different platforms and these are also widely used in commerce. Payment systems comprise of instruments through which payments can be made, rules, regulations, and procedures that guide these payments, institutions which facilitate payment mechanisms and legal systems, etc. that are established to facilitate the transfer of funds between different participant institutions. Payment systems are used by individuals, banks, companies, governments, etc. to make payments to one another.

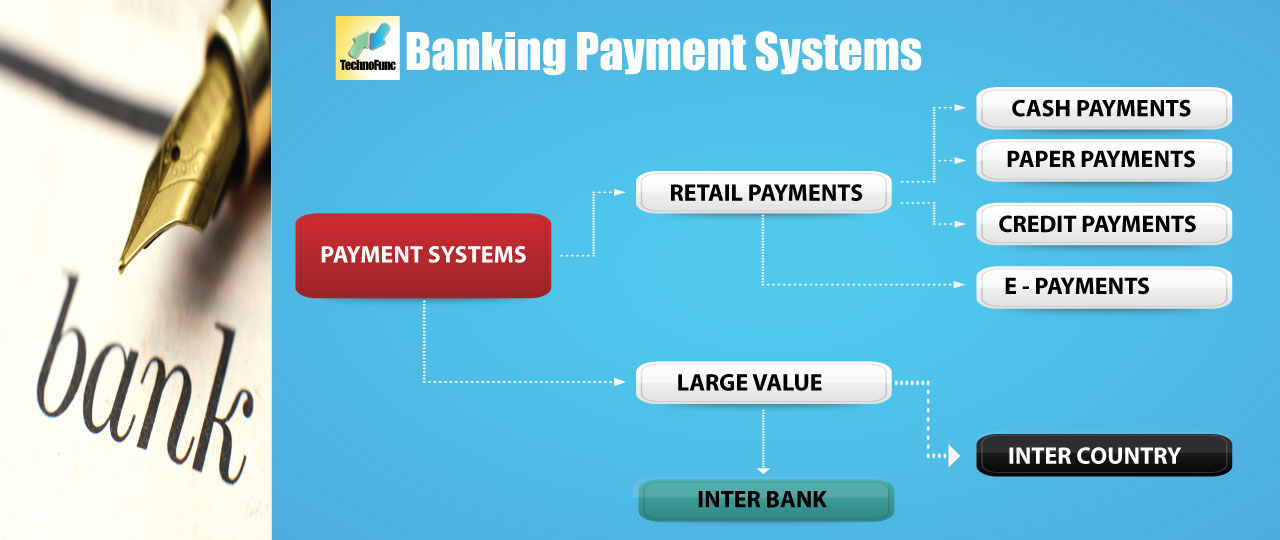

Classification of Payment Methods

Payment Systems can be broadly classified into Large Value Systems and Retail Payment Systems. For the purpose of making things easy to understand we have classified the various payment methods in the following format:

Payment Systems can be broadly classified into Large Value Systems and Retail Payment Systems. For the purpose of making things easy to understand we have classified the various payment methods in the following format:

- Large Value Payment System:

- Retail Payment System:

- Cash Payment

- Paper-Based Payments

- Cheques

- Demand Drafts

- Payment Orders or Banker’s Cheques:

- Card-Based Payments

- Credit Card

- Debit Card

- Electronic Payments and Remittances

- Electronic Clearing Services:

- Electronic Funds Transfer:

- Real-Time Gross Settlement:

- Internet Banking:

- Mobile Banking:

1. Large Value Payment System:

Large value systems typically process high-value critical payments. It is an essential payment system that ensures the smooth functioning of the economy and the financial system. If this system fails, it could trigger disruptions or transmit shocks within the economy. These systems mostly relate to interbank / inter-financial institutional transactions. Generally, these large value systems are strictly regulated by the Central Banks of respective countries and are electronic-based. . These systems enable payments to be made electronically and instantly in real-time. They offer speed, reliability, safety, convenience, cost, and accuracy. Some examples of Large Value Payment Systems are:

Large value systems typically process high-value critical payments. It is an essential payment system that ensures the smooth functioning of the economy and the financial system. If this system fails, it could trigger disruptions or transmit shocks within the economy. These systems mostly relate to interbank / inter-financial institutional transactions. Generally, these large value systems are strictly regulated by the Central Banks of respective countries and are electronic-based. . These systems enable payments to be made electronically and instantly in real-time. They offer speed, reliability, safety, convenience, cost, and accuracy. Some examples of Large Value Payment Systems are:

- Inter-Bank Cheques Clearing Systems (the Inter-bank Clearing)

- High-Value Cheques Clearing System (the High-Value Clearing)

- Government Securities Clearing System (the G-Sec Clearing)

- Foreign Exchange Clearing System (the Forex Clearing)

- Real-Time Gross Settlement (RTGS) System

- Systemically Important Payment Systems (SIPS)

- FIJICLEAR to make large value payments in Fiji

- SWIFT (Society for the Worldwide Interbank Financial Telecommunication)

- Large Value Transfer System (LVTS) in Canada

2. Retail Payment System:

Retail payment systems generally cater to the payment of transactions related mainly to settlement of obligations arising from the purchase of goods and services. This payment system is as important as the large-value payment system and has a larger user group. They typically handle transactions that are low in value, but very large in number, relating to individuals firms and corporates. The retail payment systems in any country comprise both paper-based as well as electronic-based systems. A person with a payment card of any kind is part of the retail payment system. At the retail level, most transactions involve cash, cheques, cards or electronic transfers. Retail payments can be classified as:

Retail payment systems generally cater to the payment of transactions related mainly to settlement of obligations arising from the purchase of goods and services. This payment system is as important as the large-value payment system and has a larger user group. They typically handle transactions that are low in value, but very large in number, relating to individuals firms and corporates. The retail payment systems in any country comprise both paper-based as well as electronic-based systems. A person with a payment card of any kind is part of the retail payment system. At the retail level, most transactions involve cash, cheques, cards or electronic transfers. Retail payments can be classified as:

Types of Bank Payments:

- Cash Payment

- Paper-Based Payments

- Card-Based Payments

- Electronic Payments and Remittances

- 2(a) Cash Payment:

2(a) Cash Payment:

Cash payment is the oldest, most common payment system which is well known and is the most preferred method for small payments because it involves no credit. With cash, you can usually purchase goods and services easily as it widely accepted. Carrying too much cash is risky as it can lead to theft and other problems. However, people still carry cash for its convenience and flexibility. From the payee’s point of view, transactions are completed immediately and this cash can be re-used for other transactions. This system is suited for small amounts of payments.

Cash payment is the oldest, most common payment system which is well known and is the most preferred method for small payments because it involves no credit. With cash, you can usually purchase goods and services easily as it widely accepted. Carrying too much cash is risky as it can lead to theft and other problems. However, people still carry cash for its convenience and flexibility. From the payee’s point of view, transactions are completed immediately and this cash can be re-used for other transactions. This system is suited for small amounts of payments.

2(b) Paper-Based Payments:

Paper-based payments are in the form of cheques, demand drafts, payment orders, banker’s cheques, refund orders, warrants, etc. These are also referred to as negotiable instruments. For simplicity, they are generally referred to as cheques. The advantages of paper-based payments are that they are safer than cash for example a crossed cheque can only be deposited into the payee’s account. They are preferred for large amounts and a large number of payments to avoid carrying large sums of cash. Payments can be made at the payer’s convenience and posted to the payee. The biggest disadvantage of paper-based payments is that it can take up to 3 – 4 working days before funds are available to use. Moreover, there is no guarantee that the payer has sufficient funds and hence the cheque may become dishonored (bounce) by the bank and it is advisable to use demand draft or banker’s cheque in such circumstances where trust is a factor. There are extra costs if the payee wants an immediate clearance of funds. Paper-based instruments have other administrative costs associated with it.

Paper-based payments are in the form of cheques, demand drafts, payment orders, banker’s cheques, refund orders, warrants, etc. These are also referred to as negotiable instruments. For simplicity, they are generally referred to as cheques. The advantages of paper-based payments are that they are safer than cash for example a crossed cheque can only be deposited into the payee’s account. They are preferred for large amounts and a large number of payments to avoid carrying large sums of cash. Payments can be made at the payer’s convenience and posted to the payee. The biggest disadvantage of paper-based payments is that it can take up to 3 – 4 working days before funds are available to use. Moreover, there is no guarantee that the payer has sufficient funds and hence the cheque may become dishonored (bounce) by the bank and it is advisable to use demand draft or banker’s cheque in such circumstances where trust is a factor. There are extra costs if the payee wants an immediate clearance of funds. Paper-based instruments have other administrative costs associated with it.

2(b)(i) Cheques:

A cheque is an order to transfer funds from the payer’s bank to the account of the payee. Cheques are simply a payment instruction from the account holder to his/her banker directing that a certain sum of money should be paid to a specific individual or to the bearer of the instrument. On receipt of cheques, the beneficiary will deposit it with his banker who will collect the money through a clearinghouse system, where banks in a city exchange cheques with one another and settle the payments by arriving at a net amount of payables and receivables. After the exchange of cheque, the account of the issuer of the cheque is debited and the credit is passed on to the banker of the beneficiary.

2(b)(ii)Demand Drafts:

Demand drafts are used when one person wants to send or transfer money (remit) to another person who is in another city. The person wanting to send money deposits cash in a bank or issue a cheque in favor of the issuing bank, which issues him a demand draft. The demand draft is sent to the person who is to receive the money. The receiver gives it to the branch/bank where he holds an account and receives the payment. Banks normally charge a commission for issuing demand drafts.

2(b)(iii) Payment Orders or Banker’s Cheques:

Payment orders or Banker’s Cheques are similar to demand drafts but are usually issued for payments within a city. These are usually valid for a shorter period of time compared to other instruments. Banks may charge a commission for issuing Payment Orders and Banker’s Cheques.

2(c) Card Based Payments:

Card-based payments are made by using a credit card or a debit card or an ATM Card. The major advantage of card payments is that it will only be accepted if the cardholder has sufficient funds in his/her account and safer than cash and faster than the paper-based payments. Can also be used for mail order or online purchases and carries lesser risk than holding cash. The risk of theft is mitigated by having pin codes. Some major disadvantages are that for the merchant it might take up to three days for the money to be received and acknowledged and cards are operated at a fee payable to the bank generally both by the cardholder and the merchant.

2(c)(i) Credit Card:

A credit card system is a credit facility extended to a user who is issued a plastic card that can be used in place of cash for making any type of payment/purchase. Credit Card enables its holder to buy goods and services with a credit line given by credit card issuer. The institution which issues the card has a tie-up with the concerned merchant establishment and the card-issuing organization, if different, to facilitate this arrangement. The amounts charged to the customer are paid by the card issuer to the merchant and subsequently billed to the customer. Funds are settled at a later date. Cardholders are billed on a monthly basis and bear financial charges (interest) on outstanding amounts if payments are not made by the due date. Credit cards are issued through commercial banks and/or other issuers. A credit cardholder may not be an account holder in the bank which issues the credit card.

A credit card system is a credit facility extended to a user who is issued a plastic card that can be used in place of cash for making any type of payment/purchase. Credit Card enables its holder to buy goods and services with a credit line given by credit card issuer. The institution which issues the card has a tie-up with the concerned merchant establishment and the card-issuing organization, if different, to facilitate this arrangement. The amounts charged to the customer are paid by the card issuer to the merchant and subsequently billed to the customer. Funds are settled at a later date. Cardholders are billed on a monthly basis and bear financial charges (interest) on outstanding amounts if payments are not made by the due date. Credit cards are issued through commercial banks and/or other issuers. A credit cardholder may not be an account holder in the bank which issues the credit card.

2(c)(ii) Debit Card:

Debit Card is a payment card where the transaction amount is deducted directly from the card holder’s bank account upon authorization. Debit cards can be of two types, one which is linked to an account and is issued by banks to account holders only. Second could be pre-loaded cards where a certain amount is stored in the card. Generally, debit cards are also ATM cards. The mode of using debit cards and credit cards is generally the same.

2(d) Electronic Payments and Remittances:

With the advent of computers and electronic communications, a large number of alternative electronic payment systems have emerged. These include electronic funds transfers, direct credits, direct debits, internet banking, and e-commerce payment systems. Payment systems are used in lieu of tendering cash in domestic and international transactions and consist of a major service provided by banks and other financial institutions. Standardization has allowed some of these systems and networks to grow to a global scale, but there are still many country and product-specific systems.

2(d)(i) Electronic Clearing Services:

These are electronic payments offered by banking channels for receiving or making payments. Electronic Clearing Service is a mode of payment by an institution and receipt by individuals for interest, dividend, salary, pension, etc. This is an electronic money transfer facility in which money is transferred automatically from a payer’s to payee’s bank accounts. A large number of investors, shareholders, employees, ex-employees can receive their dues electronically directly into their accounts on due dates without using paper cheques/instruments. Similarly, bank customers can make small value repetitive payments such as electricity bills, telephone bills, loan installments, insurance premiums, club fees, etc. The payer instructs their bank to make direct debit payments and the payee provides amounts and dates of the payments. The process operates on the basis of a large number of small debts and one consolidated credit from users to the service provider. The system provides the convenience of paperless payment on due dates by direct debit to the customer’s account. This facility can be used for paying different amounts and is useful for paying regular bills. The advantages of this system are guaranteed payments and no need to remember payment dates.

2(d)(ii) Electronic Funds Transfer:

This electronic mode of remittance of funds is enabled by the participating banks under the supervision of the central bank of the country. The amount sent from the sender’s bank branch is credited to the receiver’s bank branch on the same day or at the most the next day. This facility saves the effort of sending a demand draft through the post and the inherent delay in reaching the money to the receiver. Banks may charge a commission for using this service.

This electronic mode of remittance of funds is enabled by the participating banks under the supervision of the central bank of the country. The amount sent from the sender’s bank branch is credited to the receiver’s bank branch on the same day or at the most the next day. This facility saves the effort of sending a demand draft through the post and the inherent delay in reaching the money to the receiver. Banks may charge a commission for using this service.

2(d)(iii) Real Time Gross Settlement:

The real-time gross settlement system facilitates the instant transfer of money from one account to another across cities. This is basically a large value remittance system where funds are required to be transferred quickly. While all the above payment and remittance systems are settled between banks on a net basis, this system is settled on a gross basis which means that each transaction is settled independently. This facility is useful to banks for their fund's management, for companies to transfer large amounts for individuals who require urgent payments.

2(d)(iv) Internet Banking:

Online banking (or Internet banking or E-banking) allows customers of a financial institution to conduct financial transactions on a secure website operated by the institution. This is a very fast and convenient way of performing banking transactions such as transferring funds from your savings to the current account or to a third party account. The major advantages are that the payments are made at the convenience of the account holder and are secured by the user name and password. This facility can be used at any time and from anywhere in the world with internet access. The only disadvantage is that for making this payment access to computers and internet services is required and the internet comes at an additional cost.

Online banking (or Internet banking or E-banking) allows customers of a financial institution to conduct financial transactions on a secure website operated by the institution. This is a very fast and convenient way of performing banking transactions such as transferring funds from your savings to the current account or to a third party account. The major advantages are that the payments are made at the convenience of the account holder and are secured by the user name and password. This facility can be used at any time and from anywhere in the world with internet access. The only disadvantage is that for making this payment access to computers and internet services is required and the internet comes at an additional cost.

2(d)(v) Mobile Banking:

Mobile banking is a service provided through the combined effort of a bank and a mobile service provider, to perform common banking transactions. An active bank account is needed and a mobile phone equipped with features required by the bank. The advantages of this system are that it is secured and available to user at all times, a very fast and convenient way of making payments as the payments can be made from anywhere that has mobile network coverage. Some disadvantages are security as mobiles need to be kept safely, otherwise, misuse may occur.

In a monetized economy there are many different types of transactions that are conducted daily that facilitate the transfer of goods and services from one person to another and need to be settled by way of payment. Payment systems play an important role in any country and are very important for the effective functioning of the economy. The central banks of the country are an integral part of the payment systems as it monitors, supervisors, and regulates the whole payment system processes.

Banking Domain Knowledge - Resources

Related Links

You May Also Like

-

Definition of Bank: Meaning of the term Bank and the Business of Banking

What do we mean by the word bank? How did the word bank originate? What is the most simple and concise definition of a bank that explains the fundamentals of the banking process? Does the definition of banking vary from country to country? What are the key differentiators between any other business and a Bank? Get answers to all these questions and explore the basics of bank and banking as an industry.

-

History of Banking: Evolution of Banking as an Industry

Banking is one of the oldest industries and banking in the form that we know of began at about 2000BC of the ancient world. It started with merchants making grain loans to farmers and traders while carrying goods between cities. Since then, the banking industry has evolved from a simplistic barter system and gift economies of earlier times to modern complex, globalized, technology-driven, and internet-based e-banking model. In this article, we will take you through the major events and developments in the history of the banking industry.

-

History of Banking: Famous Banks from the Past

Seven hundred years ago a bank was established in Venice, which made transactions resembling modern banking. In 1407, another bank was founded in Italy under the name of Banco di San Giorgio which was one of the oldest chartered banks in Europe. Sveriges Riksbank (Riksbanken), is the central bank of Sweden and the world's oldest central bank. The Bank of England is the second oldest central bank in the world, and most modern central banks have been based on that model. Let us explore some interesting events as we learn more about these early banking institutions.

-

History of Banking: The Gold Standard & Fractional Reserve Banking

Gold has always been considered as a safe economic investment and treated like a currency. All of the economically advanced countries of the world were on the gold standard for a relatively brief time. Under a gold standard, the value of a unit of currency, such as a dollar, is defined in terms of a fixed weight of gold and banknotes or other paper money are convertible into gold accordingly. Explore the fascinating history of the gold standard through the lens of history and also learn why banks hold back a certain fraction of deposits as reserves.

-

Overview of Banking Industry: The Industry Basics

Banks play a key role in the entire financial system by mobilizing deposits from households spread across the nation and making these funds available for investment, either by lending or buying securities. Today the banking industry has become an integral part of any nation’s economic progress and is critical for the financial wellbeing of individuals, businesses, nations, and the entire globe. In this article, we will provide an overview of key industry concepts, main sectors, and key aspects of the banking industry’s business model and trends.

-

Banking Sector, Segments & It's Classifications

The banking industry players deal in a variety of products from savings accounts to loans and mortgages, offer various services from check cashing to underwriting, caters to different types of customers from individuals to large corporates, serve diverse geographies from rural villages to cross-border operations. Thus the banking industry is made up of several types of banks, with their own objectives, roles, and functions. In this article, we will explore the various sectors, segments, and classifications of banking based on parameters like products, customers, types, etc.

-

Type of Banks: Different Types of Banks in India & their Functions

This article explains the banking structure in India and how different banks are classified as per RBI Norms. The Indian banking industry has been divided into two parts, organized and unorganized sectors. The organized sector consists of Reserve Bank of India, Commercial Banks and Co-operative Banks, and Specialized Financial Institutions (IDBI, ICICI, IFC, etc.). The unorganized sector, which is not homogeneous, is largely made up of money lenders and indigenous bankers. Learn what we mean by nationalized banks, scheduled banks, public sector banks, private banks, and foreign banks.

-

Types of Banks: Different Banks & their Classifications (Global)

The banking industry caters to various sections of society thus the focus of banking becomes varied, catering to the diverse needs of clients through different products, services, and methods. To meet this, we need distinctive kinds of banks addressing complex business & social needs. In this article, we will explain various types of banking institutions ranging from retail banks, commercial banks, co-operative banks, investment banks, central banks to various other types of specialized banks.

-

Banking Operations: Understanding Various Transactions & Activities

Banks perform a variety of operations ranging from basic or primary functions like day to day transactions at a branch to others that maybe the agency or general utility services in nature. The transactions that are incidental to revenue/sales or sustaining the business are an important element of the banking industry value chain. In this article, we will look at the key operations performed in the course of banking.

-

Banking Industry Business Model - Understanding How the Banking System Works

Banks are commercial profitable institutions and need to increase their business, grow their revenue, and provide returns to their owners. Unlike other stores and shops, banks are providing services rather than selling their products. Learn how banks get their funds and how they make money on services. Read more to learn how the banks earn their profit!

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved