- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Industry Knowledge

- Banking Domain

- Technology Risk – Example Banking IT

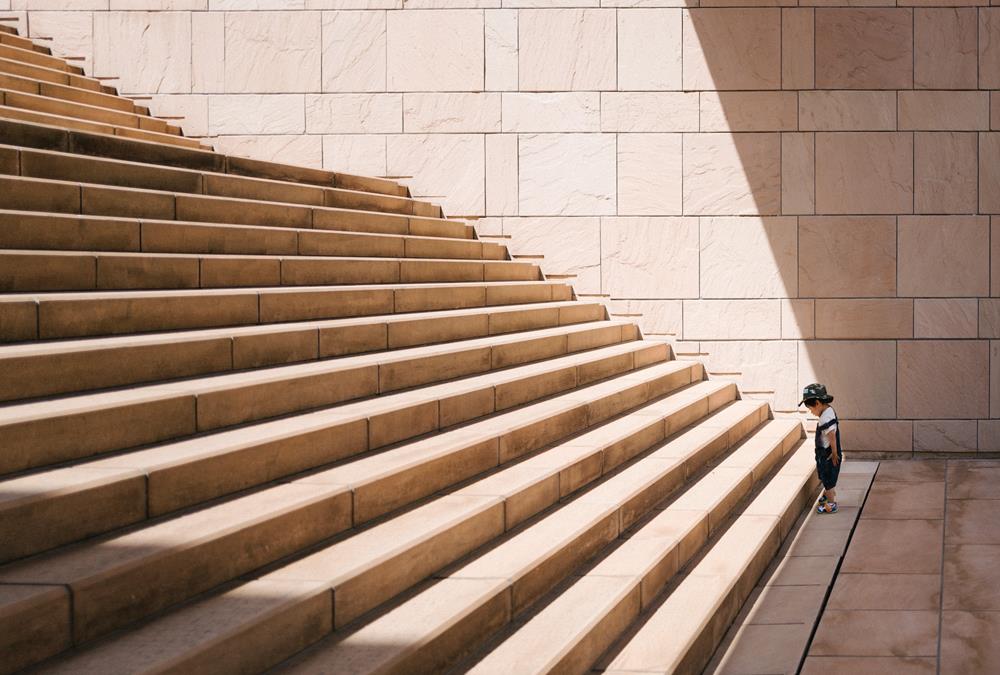

Technology Risk – Example Banking IT

As per a recent study, on an average bank spends 10% of its revenue on IT Costs. IT and IT cost structure play a decisive role in the performance of any bank. This article examines the challenges around ensuring the effectiveness and efficiency of IT Spend. How to ensure that spending on IT translates into increased operational efficiency. Banks face greater risk if there is a misalignment between business and IT strategies. Technology risk holds strategic, financial, operational, regulatory, and reputational implications

Digital disruption continues to change the banking landscape and puts pressure on the traditional banking model to increase its spend on IT. Historically, banks have offset some IT cost increases with improved operational efficiency, gains in competitive advantage, enhanced customer experience, and some productivity gains. IT demands are still escalating while pressures to keep costs down are intensifying. Typically, most banks and financial institutions today are trying to improve cost-effectiveness by optimizing the banking channels and reducing operating and IT expenses.

With the banking industry facing low margins and hefty compliance investments, banks need to remain vigilant and keep costs well under control. While there are several potential strategies to manage costs, banks need to determine which is the most effective for them. In this article, we will explore, how to create a project to look for ways to either control costs or increase value is driven out of IT through productivity gains?

IT risk functions need to revolve around seeking answers to some pertinent issues relevant to the enterprise. Information technology function needs to play a pivotal role in business transformation and growth in the Bank. On the other hand, it must also take into account the increasing expectations around digital banking experience from millennials and Gen Z’ers.

Technology is a great enabler, but it also presents a pervasive, potentially high-impact risk. IT risk-related challenges in financial services will grow in number and importance in the years ahead. Banks face greater risk if there is a misalignment between business and IT strategies. Technology risk holds strategic, financial, operational, regulatory, and reputational implications

What is the current business challenge?

The average bank spends ~$200MM & employ over 1000 IT professionals. How do we harness this to drive banking services advantages for the 21st century?

Key considerations

Focus on a product or service delivery feature with customer value that may be implemented across multiple businesses relatively simply (modest investment) and quickly (6-12 months or less). The scope would ideally be on a banking priority, such as funding, loans, cards or SME offerings & new distribution.

What is the goal of this project?

Identify significant technology-enabled improvement(s) that Bank can implement to enhance its banking capabilities with customer and market impact. Examples might include mobile banking, e-servicing, contactless payments, etc.

Banking Domain Knowledge - Resources

Related Links

You May Also Like

-

Definition of Bank: Meaning of the term Bank and the Business of Banking

What do we mean by the word bank? How did the word bank originate? What is the most simple and concise definition of a bank that explains the fundamentals of the banking process? Does the definition of banking vary from country to country? What are the key differentiators between any other business and a Bank? Get answers to all these questions and explore the basics of bank and banking as an industry.

-

History of Banking: Evolution of Banking as an Industry

Banking is one of the oldest industries and banking in the form that we know of began at about 2000BC of the ancient world. It started with merchants making grain loans to farmers and traders while carrying goods between cities. Since then, the banking industry has evolved from a simplistic barter system and gift economies of earlier times to modern complex, globalized, technology-driven, and internet-based e-banking model. In this article, we will take you through the major events and developments in the history of the banking industry.

-

History of Banking: Famous Banks from the Past

Seven hundred years ago a bank was established in Venice, which made transactions resembling modern banking. In 1407, another bank was founded in Italy under the name of Banco di San Giorgio which was one of the oldest chartered banks in Europe. Sveriges Riksbank (Riksbanken), is the central bank of Sweden and the world's oldest central bank. The Bank of England is the second oldest central bank in the world, and most modern central banks have been based on that model. Let us explore some interesting events as we learn more about these early banking institutions.

-

History of Banking: The Gold Standard & Fractional Reserve Banking

Gold has always been considered as a safe economic investment and treated like a currency. All of the economically advanced countries of the world were on the gold standard for a relatively brief time. Under a gold standard, the value of a unit of currency, such as a dollar, is defined in terms of a fixed weight of gold and banknotes or other paper money are convertible into gold accordingly. Explore the fascinating history of the gold standard through the lens of history and also learn why banks hold back a certain fraction of deposits as reserves.

-

Overview of Banking Industry: The Industry Basics

Banks play a key role in the entire financial system by mobilizing deposits from households spread across the nation and making these funds available for investment, either by lending or buying securities. Today the banking industry has become an integral part of any nation’s economic progress and is critical for the financial wellbeing of individuals, businesses, nations, and the entire globe. In this article, we will provide an overview of key industry concepts, main sectors, and key aspects of the banking industry’s business model and trends.

-

Banking Sector, Segments & It's Classifications

The banking industry players deal in a variety of products from savings accounts to loans and mortgages, offer various services from check cashing to underwriting, caters to different types of customers from individuals to large corporates, serve diverse geographies from rural villages to cross-border operations. Thus the banking industry is made up of several types of banks, with their own objectives, roles, and functions. In this article, we will explore the various sectors, segments, and classifications of banking based on parameters like products, customers, types, etc.

-

Type of Banks: Different Types of Banks in India & their Functions

This article explains the banking structure in India and how different banks are classified as per RBI Norms. The Indian banking industry has been divided into two parts, organized and unorganized sectors. The organized sector consists of Reserve Bank of India, Commercial Banks and Co-operative Banks, and Specialized Financial Institutions (IDBI, ICICI, IFC, etc.). The unorganized sector, which is not homogeneous, is largely made up of money lenders and indigenous bankers. Learn what we mean by nationalized banks, scheduled banks, public sector banks, private banks, and foreign banks.

-

Types of Banks: Different Banks & their Classifications (Global)

The banking industry caters to various sections of society thus the focus of banking becomes varied, catering to the diverse needs of clients through different products, services, and methods. To meet this, we need distinctive kinds of banks addressing complex business & social needs. In this article, we will explain various types of banking institutions ranging from retail banks, commercial banks, co-operative banks, investment banks, central banks to various other types of specialized banks.

-

Banking Operations: Understanding Various Transactions & Activities

Banks perform a variety of operations ranging from basic or primary functions like day to day transactions at a branch to others that maybe the agency or general utility services in nature. The transactions that are incidental to revenue/sales or sustaining the business are an important element of the banking industry value chain. In this article, we will look at the key operations performed in the course of banking.

-

Banking Industry Business Model - Understanding How the Banking System Works

Banks are commercial profitable institutions and need to increase their business, grow their revenue, and provide returns to their owners. Unlike other stores and shops, banks are providing services rather than selling their products. Learn how banks get their funds and how they make money on services. Read more to learn how the banks earn their profit!

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved