- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Industry Knowledge

- Banking Domain

- Introduction to Banking: What is a Bank?

Introduction to Banking: What is a Bank?

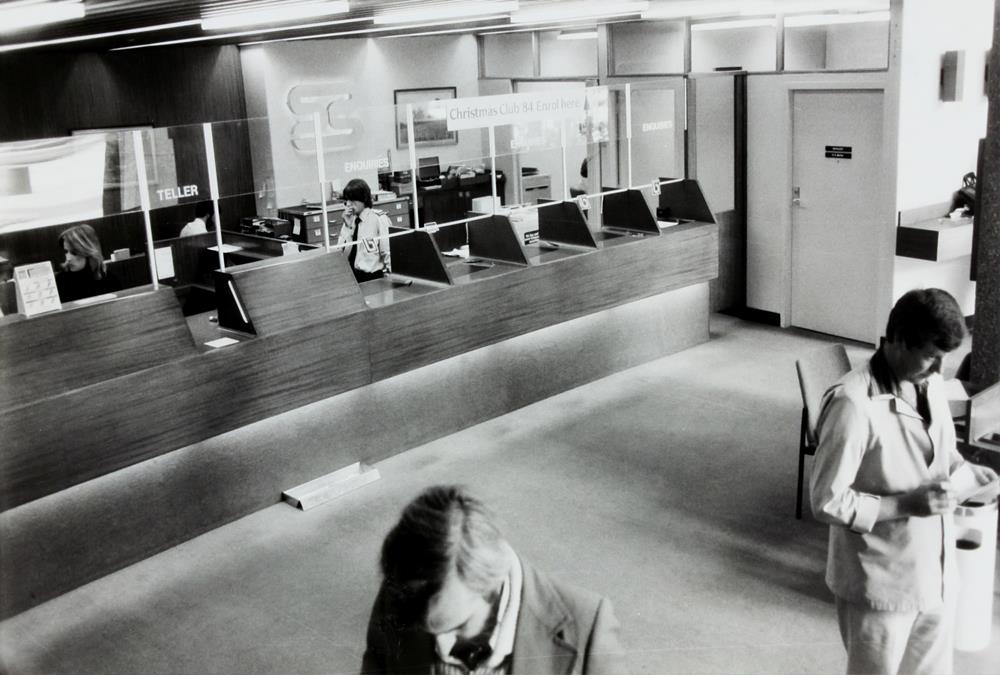

When you think of a bank, what image comes to mind? A bank is a financial intermediary for the safeguarding, transferring, exchanging, or lending of money. Banks distribute “money” - the medium of exchange. A bank is a business and banks sell their services to earn money, and they need to market and manage those services in a competitive field. Learn more about the fundamentals of banking.

What is a Bank?

A bank is a financial institution and a financial intermediary that accepts deposits and channels those deposits into lending activities, either directly by loaning or indirectly through capital markets.

A bank is a financial institution and a financial intermediary that accepts deposits and channels those deposits into lending activities, either directly by loaning or indirectly through capital markets.

A bank may be defined as an institution that accepts deposits, makes loans, pays checks and provides financial services. A bank is a financial intermediary for the safeguarding, transferring, exchanging, or lending of money. A primary role of banks is connecting those with funds, such as investors and depositors, to those seeking funds, such as individuals or businesses needing loans. A bank is a connection between customers that have capital deficits and customers with capital surpluses.

Banks distribute the medium of exchange. Banking is a business. Banks sell their services to earn money, and they must market and manage those services in a competitive field. Banks are financial intermediaries that safeguard, transfer, exchange, and lend money and like other businesses that must earn a profit to survive. Understanding this fundamental idea helps you to understand how banking systems work and helps you understand many modern trends in banking and finance.

Banking is a Unique Business

The services banks offer to customers have to do almost entirely with handling money or finances for other people. Banks are critical to our economy. The primary function of banks is to put their account holders' money to use by lending it out to others who are in need of the same.

The services banks offer to customers have to do almost entirely with handling money or finances for other people. Banks are critical to our economy. The primary function of banks is to put their account holders' money to use by lending it out to others who are in need of the same.

Money is a medium of exchange, an agreed-upon system for measuring the value of goods and services. Once, and still in some places today, precious stones, animal products, or other goods of value might be used as a medium of exchange. This system was used for centuries, before the invention of money. People used to exchange goods or services for other goods or services in return. This system is also known as “Barter System” and an age-old method that was adopted by people to exchange their services and goods. Roman soldiers were sometimes paid in salt because it was critical to life and was a scarce commodity at those times.

Anything with an agreed-upon value might be a medium of exchange. Today, many forms of money are used. Money is any object or record that is generally accepted as payment for goods and services and repayment of debts in a given socio-economic context or country. The main functions of money are distinguished as a medium of exchange; a unit of account; a store of value; and, occasionally in the past, a standard of deferred payment. Any kind of object or secure verifiable record that fulfills these functions can be considered money. Money simply shows how much something is worth, whether it is a new gadget that you can purchase or two hours of your labor. When you have money, a bank can act as your agent for using or protecting that money.

How Banks are created?

Banks and money are essential to maintaining economies and they impact the entire societies and nations. Hence they are closely regulated and strict procedures and principles are advised to be followed by the banks by various authorities and governments. In the United States, banks may be chartered by federal or state governments and in India government decides the rules for opening any banks or its branches.

Banks and money are essential to maintaining economies and they impact the entire societies and nations. Hence they are closely regulated and strict procedures and principles are advised to be followed by the banks by various authorities and governments. In the United States, banks may be chartered by federal or state governments and in India government decides the rules for opening any banks or its branches.

From a business structure perspective, most of the Banks are corporations or cooperative societies and may be owned by groups of individuals, corporations, or some combination of the two. Around the world, banks are supervised by governments to guarantee the safety and stability of the money supply and of the country.

Types of Banks:

Banks provide a multitude of financial services beyond the traditional practices of holding deposits and lending money. Commercial, retail, and central banks are three main types.

Banks provide a multitude of financial services beyond the traditional practices of holding deposits and lending money. Commercial, retail, and central banks are three main types.

Understand the difference between the three:

Commercial Banks: Provide familiar services such as checking and savings accounts, credit cards, investment services, and others. Historically, offered their services only to businesses, including credit and debit cards, bank accounts, deposits and loans, and secured and unsecured loans. Due to deregulation, commercial banks are also competing more with investment banks in money market operations, bond underwriting, and financial advisory work.

Retail Banks: Developed to help individuals not served by commercial banks. Provide basic banking services to individual consumers. These institutions help customers save money, acquire loans, and invest. They also offer a wide range of financial services to a broad customer base. Examples include savings banks, savings and loan associations, and credit unions and examples of products and services include safe deposit boxes, checking and savings accounting, certificates of deposit (CDs), mortgages, and car loans.

Central Banks: Banks formed, owned, and regulated by the government to manage, regulate, and protect both the money supply and the other banking institutions. Guarantee stable monetary and financial policy from country to country. Typical functions include implementing monetary policy, managing foreign exchange and gold reserves, making decisions regarding official interest rates, acting as banker to the government and other banks, and regulating and supervising the banking industry. Central banks serve as the government's banker. Central banks issue currency and conduct monetary policy.

Benefits of Banking:

Safety: It’s risky to keep your money in cash as it could be lost, stolen, or destroyed. Financial institutions keep your funds safe.

Safety: It’s risky to keep your money in cash as it could be lost, stolen, or destroyed. Financial institutions keep your funds safe.

Convenience: With banks, there's no need to carry cash. If you need cash, you can easily access your funds virtually anywhere.

Security: Banks follow stringent laws and regulations and at most banks, funds are insured.

Financial Future: As an individual, you'll have access to financial professionals to help you. Knowledgeable advice of bankers is a valuable resource to help you build a better financial future.

Banking Domain Knowledge - Resources

Related Links

You May Also Like

-

Definition of Bank: Meaning of the term Bank and the Business of Banking

What do we mean by the word bank? How did the word bank originate? What is the most simple and concise definition of a bank that explains the fundamentals of the banking process? Does the definition of banking vary from country to country? What are the key differentiators between any other business and a Bank? Get answers to all these questions and explore the basics of bank and banking as an industry.

-

History of Banking: Evolution of Banking as an Industry

Banking is one of the oldest industries and banking in the form that we know of began at about 2000BC of the ancient world. It started with merchants making grain loans to farmers and traders while carrying goods between cities. Since then, the banking industry has evolved from a simplistic barter system and gift economies of earlier times to modern complex, globalized, technology-driven, and internet-based e-banking model. In this article, we will take you through the major events and developments in the history of the banking industry.

-

History of Banking: Famous Banks from the Past

Seven hundred years ago a bank was established in Venice, which made transactions resembling modern banking. In 1407, another bank was founded in Italy under the name of Banco di San Giorgio which was one of the oldest chartered banks in Europe. Sveriges Riksbank (Riksbanken), is the central bank of Sweden and the world's oldest central bank. The Bank of England is the second oldest central bank in the world, and most modern central banks have been based on that model. Let us explore some interesting events as we learn more about these early banking institutions.

-

History of Banking: The Gold Standard & Fractional Reserve Banking

Gold has always been considered as a safe economic investment and treated like a currency. All of the economically advanced countries of the world were on the gold standard for a relatively brief time. Under a gold standard, the value of a unit of currency, such as a dollar, is defined in terms of a fixed weight of gold and banknotes or other paper money are convertible into gold accordingly. Explore the fascinating history of the gold standard through the lens of history and also learn why banks hold back a certain fraction of deposits as reserves.

-

Overview of Banking Industry: The Industry Basics

Banks play a key role in the entire financial system by mobilizing deposits from households spread across the nation and making these funds available for investment, either by lending or buying securities. Today the banking industry has become an integral part of any nation’s economic progress and is critical for the financial wellbeing of individuals, businesses, nations, and the entire globe. In this article, we will provide an overview of key industry concepts, main sectors, and key aspects of the banking industry’s business model and trends.

-

Banking Sector, Segments & It's Classifications

The banking industry players deal in a variety of products from savings accounts to loans and mortgages, offer various services from check cashing to underwriting, caters to different types of customers from individuals to large corporates, serve diverse geographies from rural villages to cross-border operations. Thus the banking industry is made up of several types of banks, with their own objectives, roles, and functions. In this article, we will explore the various sectors, segments, and classifications of banking based on parameters like products, customers, types, etc.

-

Type of Banks: Different Types of Banks in India & their Functions

This article explains the banking structure in India and how different banks are classified as per RBI Norms. The Indian banking industry has been divided into two parts, organized and unorganized sectors. The organized sector consists of Reserve Bank of India, Commercial Banks and Co-operative Banks, and Specialized Financial Institutions (IDBI, ICICI, IFC, etc.). The unorganized sector, which is not homogeneous, is largely made up of money lenders and indigenous bankers. Learn what we mean by nationalized banks, scheduled banks, public sector banks, private banks, and foreign banks.

-

Types of Banks: Different Banks & their Classifications (Global)

The banking industry caters to various sections of society thus the focus of banking becomes varied, catering to the diverse needs of clients through different products, services, and methods. To meet this, we need distinctive kinds of banks addressing complex business & social needs. In this article, we will explain various types of banking institutions ranging from retail banks, commercial banks, co-operative banks, investment banks, central banks to various other types of specialized banks.

-

Banking Operations: Understanding Various Transactions & Activities

Banks perform a variety of operations ranging from basic or primary functions like day to day transactions at a branch to others that maybe the agency or general utility services in nature. The transactions that are incidental to revenue/sales or sustaining the business are an important element of the banking industry value chain. In this article, we will look at the key operations performed in the course of banking.

-

Banking Industry Business Model - Understanding How the Banking System Works

Banks are commercial profitable institutions and need to increase their business, grow their revenue, and provide returns to their owners. Unlike other stores and shops, banks are providing services rather than selling their products. Learn how banks get their funds and how they make money on services. Read more to learn how the banks earn their profit!

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved