- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Domain Knowledge

- BFSI Domain

- Definition of Bank: Meaning of the term Bank and the Business of Banking

Definition of Bank: Meaning of the term Bank and the Business of Banking

What do we mean by the word bank? How did the word bank originate? What is the most simple and concise definition of a bank that explains the fundamentals of the banking process? Does the definition of banking vary from country to country? What are the key differentiators between any other business and a Bank? Get answers to all these questions and explore the basics of bank and banking as an industry.

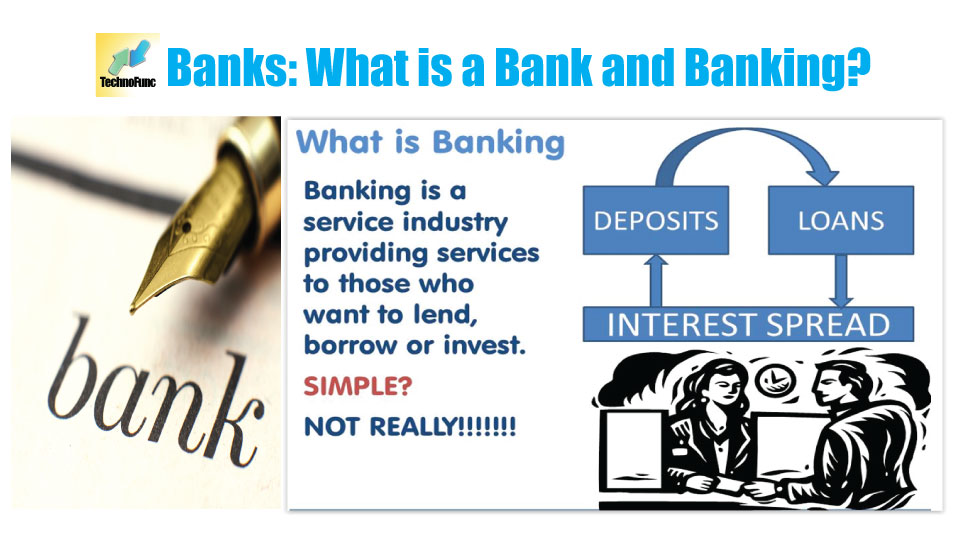

Banking Industry is a service industry. It provides various services to its customers. Traditionally the services were restricted to deposits and loans. Banks started by taking deposits from people who had a surplus of money and lending this money to others who wanted money for different reasons. Banks charged interest from those who borrowed and gave back a portion of the interest earned to those who deposited. The difference in the rate of interest between deposits and lending constituted the major source of revenue for banks. Hence, banking is a service industry, which provides services to those who want to lend, borrow, or invest.

Origin of the term “Bank”

The term bank apparently owes its origin to the “bank” or bench used by the moneychangers during the middle ages. Historically, some banks were called banks of deposit, and mainly held -deposits of foreign and domestic currencies and arranged payment in foreign trade transactions. Other banks created deposits that acted as a circulating medium of money in a society. One of the earliest banks in this category, the Bank of Venice, was formed when a group of the government’s creditors combined and began using government debt as a means of payment in trade.

The term bank apparently owes its origin to the “bank” or bench used by the moneychangers during the middle ages. Historically, some banks were called banks of deposit, and mainly held -deposits of foreign and domestic currencies and arranged payment in foreign trade transactions. Other banks created deposits that acted as a circulating medium of money in a society. One of the earliest banks in this category, the Bank of Venice, was formed when a group of the government’s creditors combined and began using government debt as a means of payment in trade.

Origin of the “Banking”

Banking in the modern sense of the word can be traced to medieval and early Renaissance Italy, to the rich cities in the north like Florence, Venice and Genoa. The word bank was borrowed in Middle English from Middle French “Banque”, from Old Italian Banca, from Old High German banc, meaning "bench/counter". Benches were used as desks or exchange counters during the Renaissance by Florentine bankers, who used to make their transactions atop desks covered by green tablecloths.

Banking in the modern sense of the word can be traced to medieval and early Renaissance Italy, to the rich cities in the north like Florence, Venice and Genoa. The word bank was borrowed in Middle English from Middle French “Banque”, from Old Italian Banca, from Old High German banc, meaning "bench/counter". Benches were used as desks or exchange counters during the Renaissance by Florentine bankers, who used to make their transactions atop desks covered by green tablecloths.

Evolution of Banking

Banking might have started like this, but today the banking industry is one of the most complex and hugely diverse commercial enterprises offering a portfolio of a large number of services. Commercial banks are an important stimulant of the economy by managing institutional credit to their customers. Today, banks are large and complex organizations. Their clients range from individuals and corporate institutions, other banks, and governments of entire nations. Banking is a service industry, which means that they don't produce physical products but provide services to their clients. They deal with all types of money transactions, borrowing it, lending it, and many other related activities that will be explained in this series.

The Definition

The definition of a bank varies from country to country. Under English common law, a banker is defined as a person who carries on the business of banking, which is specified as conducting current accounts for his customers, paying cheques drawn on him, and collecting cheques for his customers. Whereas in some legal texts in India, the banking company is defined as the one which transacts the business of banking which means accepting, for the purpose of lending and investment of deposits of money from the public, repayable on demand or otherwise and withdrawals by cheques, draft, order or otherwise. Let us now delve into some known definitions of the bank given by established authors & various statues and try to examine the essentials of ‘bank’ inferred in these definitions.

The definition of a bank varies from country to country. Under English common law, a banker is defined as a person who carries on the business of banking, which is specified as conducting current accounts for his customers, paying cheques drawn on him, and collecting cheques for his customers. Whereas in some legal texts in India, the banking company is defined as the one which transacts the business of banking which means accepting, for the purpose of lending and investment of deposits of money from the public, repayable on demand or otherwise and withdrawals by cheques, draft, order or otherwise. Let us now delve into some known definitions of the bank given by established authors & various statues and try to examine the essentials of ‘bank’ inferred in these definitions.

Famous Definitions of Bank

1. “A banker is defined as a person who carries on the business of banking, which is specified as: conducting current accounts for his customers, paying cheques drawn on him, and collecting cheques for his customers”.

English Common Law2. “A banking company is the one which transacts the business of banking which means accepting, for the purpose of lending and investment of deposits of money from the public, repayable on demand or otherwise and withdrawals by cheques, draft, order or otherwise.“

"Banking means the accepting, for the purpose of lending or investment of deposits of money from the public, repayable on demand or otherwise and withdraw-able by cheque, draft, order or otherwise."

Banking Regulation Act; India3. "A banker is one who in the ordinary course of his business honors cheques drawn upon him by persons from and for whom he receives money on current accounts."

Herbert L. Hart4. "The function of receiving money from his customers and repaying it by honoring their cheques as and when required is the function above all other functions which distinguishes a banking business from any other kind of business."

H. P. Seldon5. “A bank is a financial institution and a financial intermediary that accepts deposits and channels those deposits into lending activities, either directly by loaning or indirectly through capital markets. A bank is the connection between customers that have capital deficits and customers with capital surpluses”.

Definition by Wikipedia6. "No person or body corporate or otherwise, can be a banker who does not take deposit accounts, take current accounts, issue and pay cheques and collect cheques, crossed and uncrossed, for his customers."

Sir John Paget7. "banking business" means the business of receiving money on current or deposit account, paying and collecting cheques drawn by or paid in by customers, the making of advances to customers, and includes such other business as the Authority may prescribe for the purposes of this Act;”

Banking Act Singapore8. "An establishment for custody of money, which it pays out on customer's order."

Bank Definition as per Oxford Dictionary

Distinguishing Features of a Bank

From the above discussion, you can identify some of the distinguishing features of a bank, which we have highlighted below:

The bank is an institution, which deals in money

Acceptance of deposits of money from the public

It mobilizes the savings of people

Lending or investing money

Profitable employment of such funds

Makes funds available to businesses, financing their capital and revenue expenditure

Provides financial services for a price i.e., interest, discount, commission, etc.

Not supposed to refund the money on his own accord

For refunds, the depositor must make a proper demand for a refund of money

Obligation to refund deposits on demand

Deals in financial instruments

Banking as the main business

A bank stimulates economic activity in the market by dealing in money

Key Takeaways

Some other key points that emerge from the above discussion are:

Some other key points that emerge from the above discussion are:

The banks mobilize the resources by accepting deposits and utilize such funds by employing them profitably. The banker is, thus, an intermediary and deals with the money belonging to the public.

Acceptance of deposits, of money, is an essential function, however, because a company is accepting deposits of money from the public, it does not make it a banker. It is necessary that the deposits accepted should also be used for lending or investment. Currently, industrial units, large business houses, and other commercial undertakings also accept deposits from the public with the facility to withdraw them when required or after the expiry of a certain lock-in period. Nevertheless, such institutions cannot be termed as bankers because acceptance of deposits is their subsidiary business, while the main function is manufacturing or trading.

Also, similarly, if a business concern carries on banking business only as an ancillary to the same other primary business, it cannot be considered as a bank.

Besides receiving deposits and lending or investing funds, the banks also perform various incidental services such as a collection of cheques, drafts, bills of exchange, interests, and dividends on securities, making payment on behalf of his customers, remittance of funds, discounting the bills of exchange, acceptance of valuables for safe custody, etc.

Finally, we can summarize that ‘Bank’ is an institution that accepts deposits, makes loans, pays checks, and provides financial services. A primary role of banks is connecting those with funds, such as investors and depositors, to those seeking funds, such as individuals or businesses needing loans. In the entire process, it earns revenue and stimulates the economy.

Banking Domain Knowledge - Resources

Related Links

You May Also Like

-

Definition of Bank: Meaning of the term Bank and the Business of Banking

What do we mean by the word bank? How did the word bank originate? What is the most simple and concise definition of a bank that explains the fundamentals of the banking process? Does the definition of banking vary from country to country? What are the key differentiators between any other business and a Bank? Get answers to all these questions and explore the basics of bank and banking as an industry.

-

History of Banking: Evolution of Banking as an Industry

Banking is one of the oldest industries and banking in the form that we know of began at about 2000BC of the ancient world. It started with merchants making grain loans to farmers and traders while carrying goods between cities. Since then, the banking industry has evolved from a simplistic barter system and gift economies of earlier times to modern complex, globalized, technology-driven, and internet-based e-banking model. In this article, we will take you through the major events and developments in the history of the banking industry.

-

History of Banking: Famous Banks from the Past

Seven hundred years ago a bank was established in Venice, which made transactions resembling modern banking. In 1407, another bank was founded in Italy under the name of Banco di San Giorgio which was one of the oldest chartered banks in Europe. Sveriges Riksbank (Riksbanken), is the central bank of Sweden and the world's oldest central bank. The Bank of England is the second oldest central bank in the world, and most modern central banks have been based on that model. Let us explore some interesting events as we learn more about these early banking institutions.

-

History of Banking: The Gold Standard & Fractional Reserve Banking

Gold has always been considered as a safe economic investment and treated like a currency. All of the economically advanced countries of the world were on the gold standard for a relatively brief time. Under a gold standard, the value of a unit of currency, such as a dollar, is defined in terms of a fixed weight of gold and banknotes or other paper money are convertible into gold accordingly. Explore the fascinating history of the gold standard through the lens of history and also learn why banks hold back a certain fraction of deposits as reserves.

-

Overview of Banking Industry: The Industry Basics

Banks play a key role in the entire financial system by mobilizing deposits from households spread across the nation and making these funds available for investment, either by lending or buying securities. Today the banking industry has become an integral part of any nation’s economic progress and is critical for the financial wellbeing of individuals, businesses, nations, and the entire globe. In this article, we will provide an overview of key industry concepts, main sectors, and key aspects of the banking industry’s business model and trends.

-

Banking Sector, Segments & It's Classifications

The banking industry players deal in a variety of products from savings accounts to loans and mortgages, offer various services from check cashing to underwriting, caters to different types of customers from individuals to large corporates, serve diverse geographies from rural villages to cross-border operations. Thus the banking industry is made up of several types of banks, with their own objectives, roles, and functions. In this article, we will explore the various sectors, segments, and classifications of banking based on parameters like products, customers, types, etc.

-

Type of Banks: Different Types of Banks in India & their Functions

This article explains the banking structure in India and how different banks are classified as per RBI Norms. The Indian banking industry has been divided into two parts, organized and unorganized sectors. The organized sector consists of Reserve Bank of India, Commercial Banks and Co-operative Banks, and Specialized Financial Institutions (IDBI, ICICI, IFC, etc.). The unorganized sector, which is not homogeneous, is largely made up of money lenders and indigenous bankers. Learn what we mean by nationalized banks, scheduled banks, public sector banks, private banks, and foreign banks.

-

Types of Banks: Different Banks & their Classifications (Global)

The banking industry caters to various sections of society thus the focus of banking becomes varied, catering to the diverse needs of clients through different products, services, and methods. To meet this, we need distinctive kinds of banks addressing complex business & social needs. In this article, we will explain various types of banking institutions ranging from retail banks, commercial banks, co-operative banks, investment banks, central banks to various other types of specialized banks.

-

Banking Operations: Understanding Various Transactions & Activities

Banks perform a variety of operations ranging from basic or primary functions like day to day transactions at a branch to others that maybe the agency or general utility services in nature. The transactions that are incidental to revenue/sales or sustaining the business are an important element of the banking industry value chain. In this article, we will look at the key operations performed in the course of banking.

-

Banking Industry Business Model - Understanding How the Banking System Works

Banks are commercial profitable institutions and need to increase their business, grow their revenue, and provide returns to their owners. Unlike other stores and shops, banks are providing services rather than selling their products. Learn how banks get their funds and how they make money on services. Read more to learn how the banks earn their profit!

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved