- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- GL - Enter & Analyze Journals

GL - Enter & Analyze Journals

In every journal entry that is recorded, the debits and credits must be equal to ensure that the accounting equation is matched. In this article, we will focus on how to analyze and recorded transactional accounting information by applying the rule of credit and debit. We will also focus on some efficient methods of recording and analyzing transactions.

The accounting equation serves as the basic foundation for the accounting systems of all companies. From the smallest business, such as the local convenience store, to the largest business, such as large companies accounting equation remains valid. In the previous article, we gained an understanding of the concept of the accounting equation. In this article, we will focus on how to analyze and recorded transactional accounting information by applying the rule of credit and debit.

If you're not a bookkeeper or an accountant and have not received the formal education in accounting or finance, the whole system of debiting certain accounts and crediting others can seem overwhelming, however, don't be discouraged. If you can focus on understanding the fundamentals of double-entry accounting; the logic for debiting and crediting to various accounts will be clear for you. One of the optimum uses of ERP and Automated Accounting packages is that the users only enter real business transactions and ERPs will trace the accounts, calculate and enter the debits and credits.

Understanding “T” Account

Companies have to record and summarize thousands or millions of transactions daily that result as a result of their business operations. To cater to this, accounting systems are designed to show the increases and decreases in each financial statement item as a separate record. This record is called an account. An account, in its simplest form, has three parts. First, each account has a title, which is the name of the item recorded in the account. Second, each account has a space for recording increases in the amount of the item. Third, each account has a space for recording decreases in the amount of the item. The account form is called a T account because it resembles the letter, T. The left side of the account is called the debit side, and the right side is called the credit side. Amounts entered on the left side of an account are debits, and amounts entered on the right side of an account credit.

Asset Account

---------------------------------|-------------------------------------------

Debit | Credit

---------------------------------|---------------------------------------------

Accountants make use of “T” Accounts to analyze complex transactions, as it helps to simplify the thought process. Many ERP’s also represent accounts in the “T” format for an easier understanding of the accounting impacts.

Understand Your Transactions:

The rule of debit and credit is a fundamental theory behind accounting procedures. This rule is derived from the concept of double-entry accounting, which states that transactions are recorded in two or more accounts, where an amount is entered on the debit side and an equal amount is entered on the credit side. The practice of recording amounts on two sides is intended to minimize errors.

Recording transactions in accounts must follow certain rules. For example, increases in assets are recorded on the debit (left side) of an account. Likewise, decreases in assets are recorded on the credit (right side) of an account. The excess of the debits of an asset account over its credits is the balance of the account. To apply the rule of debit and credit, and properly record amounts, every transaction is first analyzed to determine the following:

What is being exchanged?

To begin analyzing the transaction, first determine what items are exchanged. Remember that a transaction is defined as the sale or exchange of goods or services.

What accounts are affected?

The next step in analyzing the transaction is to identify the affected accounts. The three categories of accounts in which a business records its transactions are assets, liabilities, and owner's equity.

Which of the accounts is increasing or decreasing?

Most transactions benefit—or increase—the business's resources in one area, and creates a corresponding decrease in another. But a transaction does not always cause this effect. A transaction can result in just an increase or just a decrease.

Are the amounts debits or credits?

The final step in the analysis is to determine whether to record the amounts on the debit side or the credit side of the affected accounts.

Rule of Debit & Credit:

The rule of debit and credit states that for whatever amount is entered in the debit side, an equal amount must be recorded on the credit side. To determine whether accounts are debited or credited, an analysis of the effect of the transaction must occur first as detailed above. An understanding of the rule of debit and credit is fundamental to performing accurate accounting procedures and the double-entry accounting system has specific rules of debit and credit for recording transactions in the accounts. Given below is a brief discussion on how to use various rules to determine the last two steps of analyzing transactions, whether the accounts in increasing or decreasing, and amounts should be debits or credits.

Balance Sheet Accounts:

The double-entry accounting system is based on the accounting equation and specific rules for recording debits and credits. The debit and credit rules for balance sheet accounts are as follows:

1. ASSETS:

The debit for increases and credit for decreases

2. LIABILITIES:

The debit for decreases and credit for increases

3. OWNER'S EQUITY:

The debit for decreases and credit for increases

Income Statement Accounts:

The debit and credit rules for income statement accounts are based on their relationship with the owner’s equity. As shown above, the owner’s equity accounts are increased by credits. Since revenues increase owner’s equity, revenue accounts are increased by credits and decreased by debits. Since the owner’s equity accounts are decreased by debits, expense accounts are increased by debits and decreased by credits. Thus, the rules of debit and credit for revenue and expense accounts are as follows:

4. REVENUE ACCOUNTS:

The debit for decreases and Credit for increases

5. EXPENSE ACCOUNTS:

The debit for increases and Credit for decreases

Owner Withdrawals:

Common types of owner's equity accounts include Capital, Withdrawals, Revenue, and Expenses. The debit and credit rules for recording owner withdrawals are based on the effect of owner withdrawals on owner’s equity. Since the owner’s withdrawals decrease the owner’s equity, the owner’s drawing account is increased by debits. Likewise, the owner’s drawing account is decreased by credits.

Normal Balances:

The sum of the increases in an account is usually equal to or greater than the sum of the decreases in the account. Thus, the normal balance of an account is either a debit or credit depending on whether increases in the account are recorded as debits or credits. For example, since asset accounts are increased with debits, asset accounts normally have debit balances. Common types of asset accounts include Cash, Accounts Receivable, Equipment, Office Supplies, and Prepaid Expenses. Likewise, liability accounts normally have credit balances. Common types of liability accounts include Accounts Payable, Unearned Fees (money received in advance), and Notes Payable (money a business promises to pay at a future date).

Related Links

You May Also Like

-

Understand what we mean by GAAP to STAT adjustments. This article discusses the different standards that are used for multiple representations of the financial results for global organizations. Understand the meaning of US GAAP, Local GAAP, STAT, IFRS, and STAT. Finally, understand why accounting differences arise and how they are adjusted for different financial representations.

-

Period End Accruals, Receipt Accruals, Paid Time-Off Accruals, AP Accruals, Revenue Based Cost Accruals, Perpetual Accruals, Inventory Accruals, Accruals Write Off, PO Receipt Accrual, Cost Accrual, etc. are some of the most complex and generally misconstrued terms in the context of general ledger accounting. In this article, we will explore what is the concept of accrual and how it impacts general ledger accounting.

-

Defining Organizational Hierarchies

A hierarchy is an ordered series of related objects. You can relate hierarchy with “pyramid” - where each step of the pyramid is subordinate to the one above it. One can use drill up or down to perform multi-dimensional analysis with a hierarchy. Multi-dimensional analysis uses dimension objects organized in a meaningful order and allows users to observe data from various viewpoints.

-

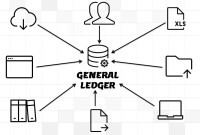

This article explains the process of entering and importing general ledger journals in automated accounting systems. Learn about the basic validations that must happen before the accounting data can be imported from any internal or external sub-system to the general ledger. Finally, understand what we mean by importing in detail or in summary.

-

McKinsey 7S Framework is most often used as an organizational analysis tool to assess and monitor changes in the internal situation of an organization. The model is based on the theory that, for an organization to perform well, seven elements need to be aligned and mutually reinforcing.

-

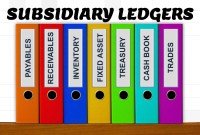

For any company that has a large number of transactions, putting all the details in the general ledger is not feasible. Hence it needs to be supported by one or more subsidiary ledgers that provide details for accounts in the general ledger. Understand the concept of the subsidiary ledgers and control accounts.

-

General Ledger - Advanced Features

Modern automated general ledger systems provide detailed and powerful support for financial reporting and budgeting and can report against multiple legal entities from the single system. These systems offer many advanced functionalities right from journal capture to advanced reporting. This article will provide an overview of some advanced features available in today's General Ledgers.

-

In this article, we will describe how to determine if an account needs adjustment entries due to the application of the matching concept. Learners will get a thorough understanding of the adjustment process and the nature of the adjustment entries. We will discuss the four types of adjustments resulting from unearned revenue, prepaid expenses, accrued expenses, and accrued revenue.

-

Accrued expenses, sometimes referred to as accrued liabilities, are expenses that have been incurred but have not been recorded in the accounts. Discuss the need to record accrued liabilities and why they require an adjustment entry. Understand the treatment for these entries once the accounting period is closed and learn to differentiate when the commitments become liabilities.

-

A Company (also called corporation) may be understood as an association of persons in which money is contributed by them, to carry on some business or undertaking. Persons who contribute the money are called the shareholders or the members of the company. A corporation is an artificial being, invisible, intangible and existing only in contemplation of law. Being the mere creature of law, it possesses only those properties which the charter of its creation confers upon it.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved