- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- Example of Subsidiary Ledgers

Example of Subsidiary Ledgers

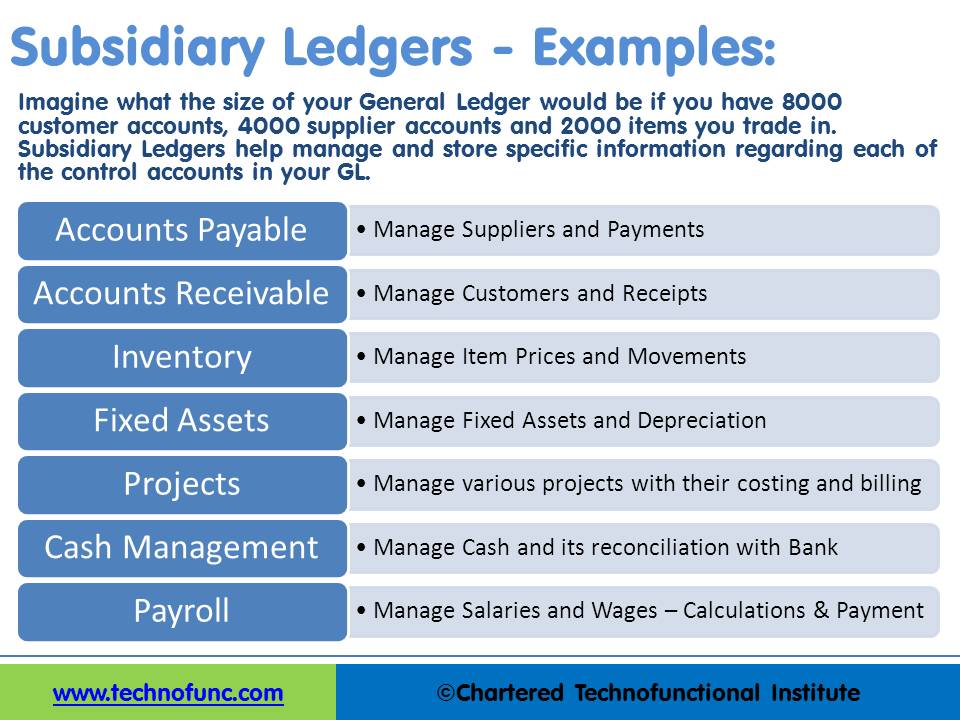

In this article, we explain some commonly used subsidiary ledgers like accounts receivable subsidiary ledger, accounts payable subsidiary ledger or creditors' subsidiary ledger, inventory subsidiary ledger, fixed assets subsidiary ledger, projects subsidiary ledger, work in progress subsidiary ledger, and cash receipts or payments subsidiary ledger.

Subsidiary Ledgers help manage and store specific information regarding each of the control accounts in your GL. Companies create subsidiary ledgers whenever they need to monitor the individual components of a controlling general ledger account. You can keep all the details in your sub-ledgers and post the summation for each account in the control account maintained at General Ledger.

Commonly Used Subsidiary Ledgers:

Some commonly used subsidiary ledgers are accounts receivable subsidiary ledger, accounts payable subsidiary ledger or creditors' subsidiary ledger, inventory subsidiary ledger, fixed assets or property or plant & equipment subsidiary ledger, projects subsidiary ledger, work in progress subsidiary ledger, and cash receipts or payments subsidiary ledger.

1. Accounts Receivable Subsidiary Ledger:

The accounts receivable subsidiary ledger is essential to most businesses and is used to manage sales of goods and services to customers and entering receipts for the sales made. Main transactions are recording of sales invoices and managing the receipts from the customers. It is also known as Customers Sub-Ledger or just AR Sub-Ledger. Companies may have hundreds or even thousands of customers who purchase items on credit, who make one or more payments for those items, and who sometimes return items or purchase additional items before they finish paying for prior purchases. Different customers may be subject to different credit terms and an organization might need to track these terms to raise reminders or due date invoices.

Recording all credit sales, sales returns, and part or subsequent payments in a single account would make it virtually impossible to calculate an individual customer's balance because the customer's transactions would be interspersed among thousands of other transactions belonging to different customers. Accounts receivable subsidiary ledger provides quick access to each customer's balance and account activity.

Companies maintain a list of invoices due from their customers, normally in the form of an accounts receivable aging register. This provides them with a listing of all the outstanding and unpaid invoices due to their customers. It also lets them know how old the invoices are, so they are aware of any past due items.

2. Accounts Payable Subsidiary Ledger:

Accounts Payable Subsidiary Ledger is used to manage invoices from suppliers and payments to them against the purchases made. Main transactions are recording of invoices for purchases & managing the payments for these invoices. It is also known as Suppliers Subsidiary Ledger or Creditors Subsidiary Ledger.

Once the PO has been raised and against that material has been received, suppliers will raise invoices on the company for the payment due to them. Accountants enter individual invoices due to suppliers in the accounting system for later payment. Suppliers usually offer the company payment terms, along with discounts for early payments. The company needs to track these payment terms for making effective use of its cash resources. All these invoices entered into the accounting system that has not yet been paid off make up the subsidiary ledger for accounts payable.

3. Inventory Subsidiary Ledger:

Inventory Sub-Ledger is used to manage the inventory/stock or items that a company buys, sell,s, or manufacture. Inventory Ledger is also used to manage and track item cost and issue prices and movements of stock items due to trading transactions. It is also known as “Stock Sub-Ledger” and sometimes referred to as “Material Ledger”.

From the Inventory sub-ledger, one can get details of the quantity and cost price of any inventory item at any point in time. Manufactures, Retailers, and Wholesalers keep a record of in-stock inventory items so that they know what is available for sale or as a raw material for the subsequent manufacturing process. This record normally contains a description of each item, quantity on-hand, the normal selling/issue price, and the cost of the item. The quantitative record is used periodically to conduct physical verification of the stock and account for any variances both positive and negative. Sales Returns and Purchase Returns are also recorded in the inventory sub-ledger.

4. Fixed Assets Subsidiary Ledger:

Fixed Assets Subsidiary Ledger is used to manage purchase, sale, allocation, and retirement of fixed assets. This is also known as “Equipment Subsidiary Ledger” or just the “Asset Register”. It is a very important to record for the companies that carry a large number of depreciable assets, each of which must be depreciated over a number of years.

The depreciation is recorded for each item in the Fixed Assets Subsidiary Ledger. This sub-ledger can include information about the acquisition, original cost and disposal of the item, residual value, the accumulated depreciation, and current book value. Fixed assets include items like equipment, plant, and machinery, office furniture, computer equipment, machinery, buildings, or land. Using Fixed Assets Sub-Ledger organization can get details of any fixed asset including original cost, current depreciated value, and location, etc. at any point in time.

5. Projects Subsidiary Ledger:

Certain companies like Real Estate Builders and Construction Companies undertake various independent projects. Many businesses of the same nature sometimes need to isolate and track financial activity associated with a particular project or event. They need projects sub-ledger for storing, tracking, and reporting financial activity like capital budgeting, capital expenditure tracking, monitoring costs, isolating and reporting the labor and overhead costs, etc. that helps them understand their operational costs and profitability. In that case, a sub-ledger is required for each project.

Projects Sub-Ledger is used to track project milestones, costs, and resources and to make billing to the customers. From projects sub-ledger, you can get details of any project like percentage complete, current cost, etc. at any point in time.

This approach necessitates reconciliation of the project ledger with the general ledger because certain project-related costs might need to be posted to both the project ledger as well as general ledger and hence this can be a reconciliation of the project ledger's balances against the main financial ledger, or a reconciliation of the journals extracted from the financial ledger to those journals posted to the project ledger.

6. Work in Progress Subsidiary Ledger:

Companies using a job costing system use their job cost sheets as a subsidiary ledger for the Work-in-Process Inventory account. Construction contractors might also track the costs associated with each unit under construction separately in a subsidiary ledger. Similarly, manufacturers make use of the Work-in-Progress sub-ledger to keep track of the costs associated with work-in-process inventory for several different products being produced.

7. Cash Management Subsidiary Ledger

Cash Management subsidiary ledger is used to manage cash and its reconciliation with the bank. This ledger contains all cash receipts and payments, including bank deposits and withdrawals. This sub-ledger is periodically reconciled with the bank statements to ensure balances match and account for the missing transactions.

Maintaining a cash subsidiary ledger helps to reconcile and void payments generated in the accounts payable sub-ledger, reconcile accounts receivable and other bank transactions, record funds transfers between bank accounts, and enter cash receipt deposits.

8. Payroll Subsidiary Ledger:

In a company, payroll is the sum of all financial records of salaries for an employee, wages, bonuses, and deductions. In accounting, payroll refers to the amount paid to employees for services they provided during a certain period of time. The Payroll subsidiary ledger is used to process all types of payroll transactions for the purpose of computing and paying your salaried employees or time and labor-based contractors. Payroll subsidiary ledger is used to manage both salaries and wages. You can record calculations & payments made to each of the employees in this sub-ledger. The Payroll Sub-ledger captures the salary cost under different account heads as prescribed by the law based on the timecards submitted by the employees.

Maintaining payroll subsidiary ledger also facilitates capturing other employees related information like earnings detail, contribution detail, deduction detail, payments and check detail, and timecard detail.

Related Links

You May Also Like

-

A legal entity is an artificial person having separate legal standing in the eyes of law. A Legal entity represents a legal company for which you prepare fiscal or tax reports. A legal entity is any company or organization that has legal rights and responsibilities, including tax filings.

-

GL - Review & Approve Journals

Review and Approval mechanisms ensure that the accounting transaction is reasonable, necessary, and comply with applicable policies. Understand why we need review and approval processes, what are they, and how they are performed in automated general ledger systems. Learn the benefits of having journal approval mechanisms in place.

-

In this article we will discuss various types of "Management Entities". Various types of operational units, are created by management, to effectively run, manage and control their business. Different types of functional units, and divisional units, are widely used across industry.

-

Divisional Organizational Structures

The divisional structure or product structure consists of self-contained divisions. A division is a collection of functions which produce a product. It also utilizes a plan to compete and operate as a separate business or profit center. Divisional structure is based on external or internal parameters like product /customer segment/ geographical location etc.

-

GL - Accrued / Unbilled Revenue

Accrued revenues (also called accrued assets) are revenues already earned but not yet paid by the customer or posted to the general ledger. Understand what we mean by the terms accrued revenue, accrued assets, and unbilled revenue. Explore the business conditions that require recognition of accrued revenue in the books of accounts and some industries where this practice is prevalent.

-

Five Core General Ledger Accounts

Typically, the accounts of the general ledger are sorted into five categories within a chart of accounts. Double-entry accounting uses five and only five account types to record all the transactions that can possibly be recorded in any accounting system. These five accounts are the basis for any accounting system, whether it is a manual or an automated accounting system. These five categories are assets, liabilities, owner's equity, revenue, and expenses.

-

Functional Organizational Structures

A functional organizational structure is a structure that consists of activities such as coordination, supervision and task allocation. The organizational structure determines how the organization performs or operates. The term organizational structure refers to how the people in an organization are grouped and to whom they report.

-

GL - Recurring Journal Entries

A “Recurring Journal” is a journal that needs to be repeated and processed periodically. Recurring Entries are business transactions that are repeated regularly, such as fixed rent or insurance to be paid every month. Learn the various methods that can be used to generate recurring journals. See some examples and explore the generic process to create recurring journals in any automated system.

-

Hierarchical Organization Structures

Hierarchical structure is typical for larger businesses and organizations. It relies on having different levels of authority with a chain of command connecting multiple management levels within the organization. The decision-making process is typically formal and flows from the top down.

-

Matrix Organizational Structures

In recent times the two types of organization structures which have evolved are the matrix organization and the network organization. Rigid departmentalization is being complemented by the use of teams that cross over traditional departmental lines.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved