- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- Equity and Liability Accounts

Equity and Liability Accounts

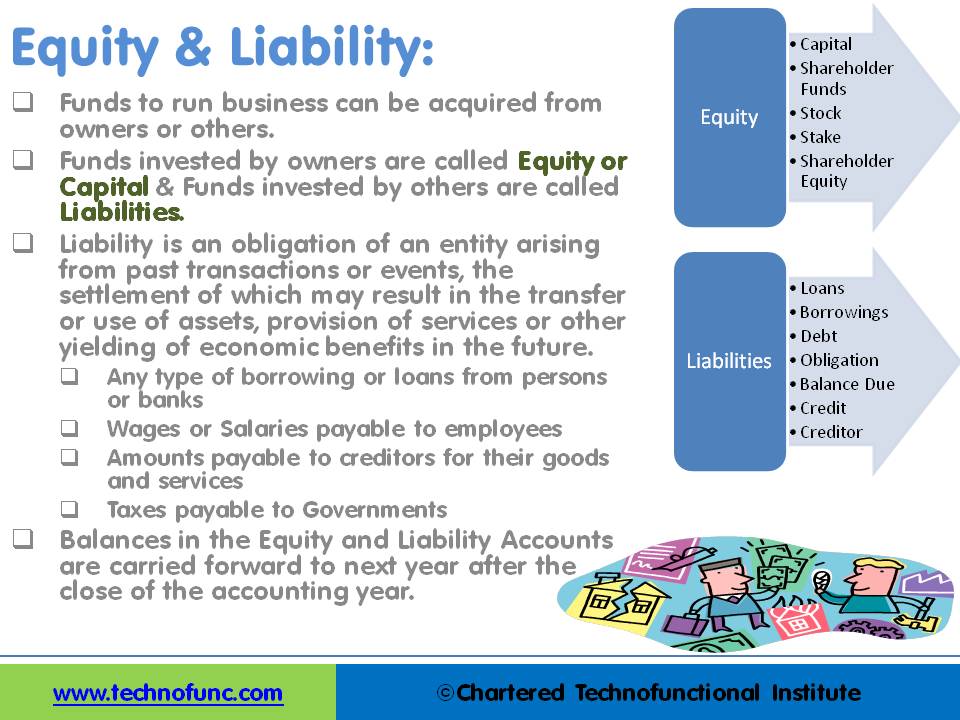

Funds contributed by owners in any business are different from all other types of funds. Equity is the residual value of the business enterprise that belongs to the owners or shareholders. The funds contributed by outsiders other than owners that are payable to them in the future. Liabilities are generally classified as Short Term (Current) and Long Term Liabilities. Current liabilities are debts payable within one year.

Equity Accounts:

The amount of the funds contributed by the owners (the stockholders) added or subtracted by accumulated gains and losses. Equity is the residual value of the business enterprise that belongs to the owners or shareholders.

Funds contributed by owners in any business are different from all other types of funds. Generally, they don’t have any cost of carrying for the business and in the event of winding up of the business, shareholders are entitled to the residual value of the business after discharging all other liabilities. They are expected to remain invested in the business for a long period of time and no immediate payback is anticipated in case of a going concern.

Equity accounts are also referred to as “Capital Account”, “Shareholder’s Funds” or “Accounts”, “Stock, Stake” and “Shareholder Equity”. Normally they have a credit balance and are reflected on the left side of the balance sheet. Profits and losses from each accounting year are added to Equity at the end of each year.

Balances in the Retained Earnings Account are transferred to “Equity” at the end of each accounting year. While running a revaluation of balances, equity is revalued using the historical rates in accordance with the accounting standards. Equity is a separate account type in ERP’s to segregate funds from owners and others.

Liability Accounts:

The number of funds contributed by outsiders other than owners that are payable to them in the future. Liability is an obligation of an entity arising from past transactions or events, the settlement of which may result in the transfer or use of assets, provision of services, or another yielding of economic benefits in the future.

Liabilities are generally classified as Short Term (Current) and Long Term Liabilities. Current liabilities are debts payable within one year, while long-term liabilities are debts payable over a longer period.

Liabilities can be from a lot of sources like Loans, External Borrowings, Debt – Secured and Unsecured, Obligation for services received Balance Due or Credit due to Creditors. Some generally known examples of liabilities are any type of borrowing or loans from persons or banks or wages or salaries paid to employees or amounts payable to creditors for their goods and services and taxes payable to Governments.

Balances in the Equity and Liability Accounts are carried forward to next year after the close of the accounting year. While running a revaluation of balances, liability is revalued using the period end rates in accordance with the accounting standards. Liability is a separate account type in ERP’s to segregate funds from owners and others.

Intercompany transactions also result in receivables and liabilities (payables) between different units of the same entity. Such transactions are settled in cash if they are in the normal course of business. At the time of the final consolidation of accounts, these intercompany liabilities and assets need to be eliminated from the books of the parent entity. We will discuss this concept in detail in the Intercompany chapter.

Related Links

You May Also Like

-

There are two commonly used methods of accounting - Cash Basis and the Accruals Basis. Understand the difference between accruals and reversals. Recap the earlier discussion we had on accruals and reversals and see the comparison between these two different but related accounting concepts. Understand how the action of accruing results in reversals subsequently in the accounting cycle.

-

Explore the concept of journal reversals and understand the business scenarios in which users may need to reverse the accounting entries that have been already entered into the system. Understand the common sources of errors resulting in the reversal of entries and learn how to correct them. Discuss the reversal of adjustment entries and the reversal functionalities in ERPs.

-

GL - Journal Posting and Balances

In this tutorial, we will explain what we mean by the posting process and what are the major differences between the posting process in the manual accounting system compared to the automated accounting systems and ERPs. This article also explains how posting also happens in subsidiary ledgers and subsequently that information is again posted to the general ledger.

-

Trial Balance in General Ledger

One of the greatest benefits of using a double-entry accounting system is the capability to generate a trial balance. What do we mean by trial balance? As the name suggests a trial balance is a report that must have its debits equals to credits. Understand the importance of trial balance and why it is balanced. Learn how it is prepared and in which format.

-

In every journal entry that is recorded, the debits and credits must be equal to ensure that the accounting equation is matched. In this article, we will focus on how to analyze and recorded transactional accounting information by applying the rule of credit and debit. We will also focus on some efficient methods of recording and analyzing transactions.

-

An account inquiry is a review of any type of financial account, whether it be a depository account or a credit account. In this tutorial, you learn what we mean by drill through functionality in the context of the general ledger system. We will explain the concept of drill-down and how it enables users to perform account and transaction inquiry at a granular level and the benefits of using this functionality.

-

The sole trader organization (also called proprietorship) is the oldest form of organization and the most common form of organization for small businesses even today. In a proprietorship the enterprise is owned and controlled only by one person. This form is one of the most popular forms because of the advantages it offers. It is the simplest and easiest to form.

-

Legal Structures for Multinational Companies

A multinational company generally has offices and/or factories in different countries and a centralized head office where they coordinate global management. A multinational company (MNC)is a corporate organization that owns or controls the production of goods or services in at least one country other than its home country.

-

In this article, we will explain the general Ledger journal processing flow from entering journals to running the final financial reports. Understand the generic general ledger process flow as it happens in automated ERP systems. The accounting cycle explains the flow of converting raw accounting data to financial information whereas general ledger process flow explains how journals flow in the system.

-

Learn the typical accounting cycle that takes place in an automated accounting system. We will understand the perquisites for commencing the accounting cycle and the series of steps required to record transactions and convert them into financial reports. This accounting cycle is the standard repetitive process that is undertaken to record and report accounting.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved