- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- GL - Intercompany Accounting

GL - Intercompany Accounting

After reading this article the learner should be able to understand the meaning of intercompany and different types of intercompany transactions that can occur. Understand why intercompany transactions are addressed when preparing consolidated financial statements, differentiate between upstream and downstream intercompany transactions, and understand the concept of intercompany reconciliations.

What are intercompany transactions?

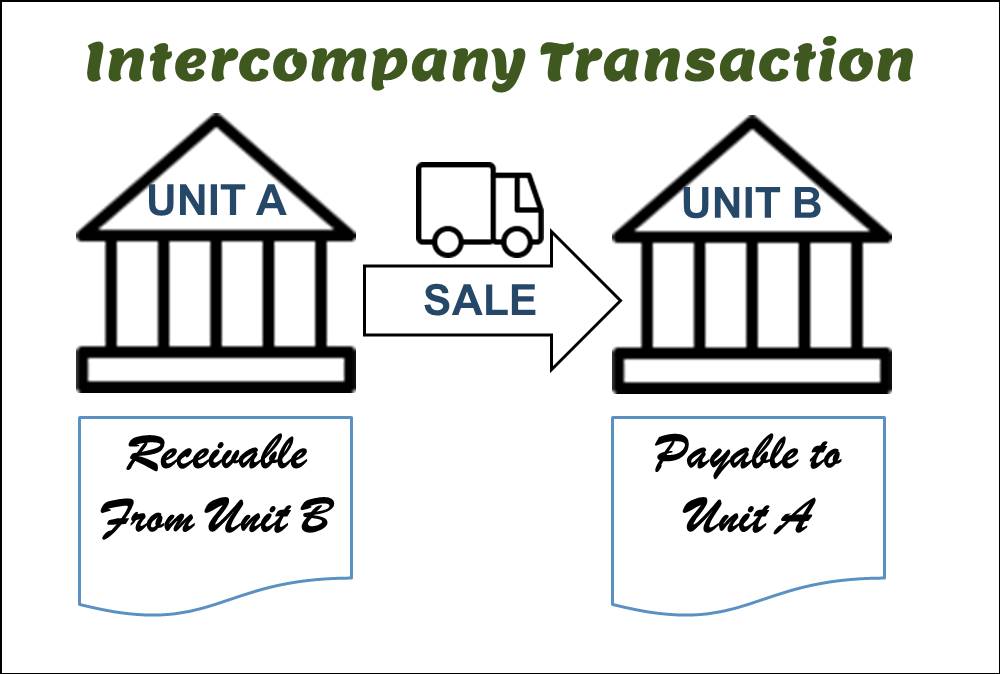

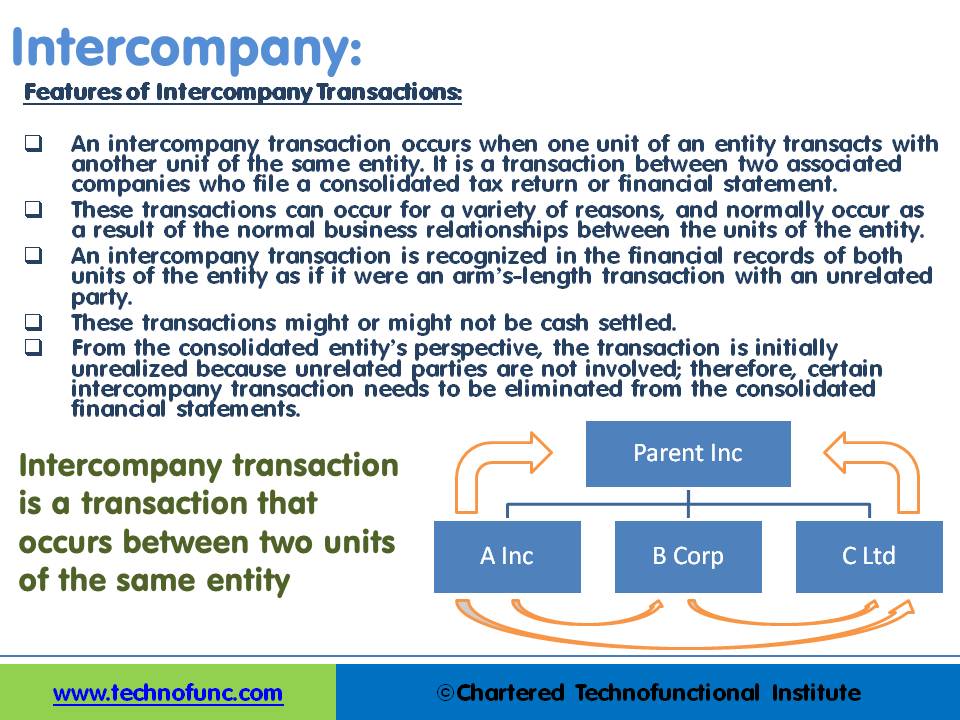

An intercompany transaction occurs when one unit of an entity is involved in a transaction with another unit of the same entity. Most economic transactions involve two unrelated entities, although transactions may occur between units of one entity (intercompany transactions). An intercompany transaction is a transaction that occurs between two units of the same entity. An intercompany transaction occurs when one unit of an entity transacts with another unit of the same entity. It is a transaction between two associated companies that file a consolidated tax return or financial statement.

Why intercompany transactions occur?

While these transactions can occur for a variety of reasons, they often occur as a result of the normal business relationships that exist between the units of the entity. These units may be the parent and a subsidiary, two subsidiaries, two divisions, or two departments of one entity.

It is common for vertically integrated organizations to transfer inventory among the units of the consolidated entity. On the other hand, a plant asset may be transferred between organizational units to take advantage of changes in demand across product lines. Intercompany transactions may involve such items as the declaration and payment of dividends, the purchase and sale of assets such as inventory or plant assets, and borrowing and lending.

Accounting Treatment for Intercompany Transactions:

An intercompany transaction is recognized in the financial records of both units of the entity as if it were an arms-length transaction with an unrelated party. From the consolidated entity’s perspective, the transaction is initially unrealized because unrelated parties are not involved; therefore, the intercompany transaction needs to be interpreted differently than it was by either of the participating units. The difference in interpretation generally results in the elimination of certain account balances from the consolidated financial statements.

The purpose of consolidated statements is to present, primarily for the benefit of the shareholders and creditors of the parent company, the results of operations and the financial position of a parent company and its subsidiaries essentially as if the group were a single company with one or more branches or divisions. Regardless of the type of transaction, the occurrence of an intercompany transaction, if not removed (eliminated) from the consolidated financial statements, will often result in a misrepresentation of the consolidated entity’s financial position.

- These transactions can occur for a variety of reasons and normally occur as a result of the normal business relationships between the units of the entity.

- An intercompany transaction is recognized in the financial records of both units of the entity as if it were an arms-length transaction with an unrelated party.

- These transactions might or might not be cash-settled.

- From the consolidated entity’s perspective, the transaction is initially unrealized because unrelated parties are not involved; therefore, the intercompany transaction needs to be eliminated from the consolidated financial statements.

Types of Intercompany Transactions:

Transactions between units of an entity can take several forms and can occur between any units of the entity. Transactions flowing from the parent to the subsidiary are commonly called downstream transactions, transactions from the subsidiary to the parent are commonly called upstream transactions, and transactions between subsidiaries are commonly called lateral transactions. Hence intercompany transactions can be classified as:

- Downstream Intercompany Transactions

- Upstream Intercompany Transactions

- Lateral Intercompany Transactions

Impact of Intercompany Transactions:

Interpreting the impact of intercompany transactions on the financial records of the units involved begins with understanding how the transactions are initially recognized on each unit’s financial records. Intercompany transactions need an effective system to manage them appropriately as it could be a complex affair for globalized companies. Some complexities are streamlining intercompany trading with unlimited trading partners, local statutory compliance with intercompany invoices for each of the trading partners, intercompany reconciliation, and transaction-level balancing for sub-ledger applications and intercompany eliminations at period close.

It is also important to understand how each intercompany transaction impacts the income statement and balance sheet of the units involved in the period of the intercompany transaction as well as in subsequent periods.

Intercompany V/s Intracompany Transactions:

Intercompany Transactions are between two or more related internal legal entities with common control, i.e. in the same enterprise. Intracompany transactions are between two or more entities within the same legal entity. Hence intercompany is cross legal entities and intracompany is across various units belonging to the same legal entity. Rules for intracompany processing can be determined by the organization based on internal procedures and guidelines, however, for intercompany transactions, companies need to follow the GAAP and the law.

Intercompany Reconciliations:

Intercompany reconciliations are required to ensure that balances owed to and from companies (legal entities) in the same group are in agreement so that when group accounts are prepared the intercompany balances all cancel out on consolidation. As organizations use multi-currency and different accounting systems, balances at business units or subsidiary companies may not match with each other and the yearend process can be delayed. Too many reconciling differences may require investigation or resolution before the balances are acceptable to management and/or auditors.

Some of the factors that give rise to intercompany differences are:

- Individual companies may book items to intercompany balances and not confirm with the other group company if they have recorded the other leg of the transaction.

- Wrong posting to/from intercompany accounts, may post balances due from other members of the group to sundry debtors or creditors

- Currency rate differences due to recording transactions on different dates may translate at different values when accounts are consolidated

- Summarization by aggregating amounts and posting them as a single journal when the counterparty posts amount individually

- Counterparties may be incorrectly identified by each other so that although the net positions are correctly stated overall the actual balance details do not eliminate

Related Links

You May Also Like

-

GL - Recurring Journal Entries

A “Recurring Journal” is a journal that needs to be repeated and processed periodically. Recurring Entries are business transactions that are repeated regularly, such as fixed rent or insurance to be paid every month. Learn the various methods that can be used to generate recurring journals. See some examples and explore the generic process to create recurring journals in any automated system.

-

Funds contributed by owners in any business are different from all other types of funds. Equity is the residual value of the business enterprise that belongs to the owners or shareholders. The funds contributed by outsiders other than owners that are payable to them in the future. Liabilities are generally classified as Short Term (Current) and Long Term Liabilities. Current liabilities are debts payable within one year.

-

Generally Accepted Accounting Principles define the accounting procedures, and understanding them is essential to producing accurate and meaningful records. In this article we emphasize on accounting principles and concepts so that the learner can understand the “why” of accounting which will help you gain an understanding of the full significance of accounting.

-

In every journal entry that is recorded, the debits and credits must be equal to ensure that the accounting equation is matched. In this article, we will focus on how to analyze and recorded transactional accounting information by applying the rule of credit and debit. We will also focus on some efficient methods of recording and analyzing transactions.

-

What Is a General Ledger? General Ledger (also known in accounting as the GL or the Nominal Ledger) is at the heart of any accounting system. A general ledger is the master set of accounts that summarize all transactions occurring within an entity. Ledger is the skillful grouping and presentation of the Journal entries. Learn the accounting fundamentals, general ledger process, and general ledger flow.

-

What is a Business Eco System?

The goal of a business is to generate capital appreciation and profits for its owners or stakeholders by engaging in provision of goods and services to customers within the eco system/framework governed by respective laws(local/international). The eco system involves various entities that the business works with for delivery of a product or service.

-

Although technically a general ledger appears to be fairly simple compared to other processes, in large organizations, the general ledger has to provide many functionalities and it becomes considerably large and complex. Modern business organizations are complex, run multiple products and service lines, leveraging a large number of registered legal entities, and have varied reporting needs.

-

GL - Journal Posting and Balances

In this tutorial, we will explain what we mean by the posting process and what are the major differences between the posting process in the manual accounting system compared to the automated accounting systems and ERPs. This article also explains how posting also happens in subsidiary ledgers and subsequently that information is again posted to the general ledger.

-

Prepayments and Prepaid Expenses

Prepayments are the payment of a bill, operating expense, or non-operating expense that settle an account before it becomes due. Learn the concept of prepaid expenses. Understand the accounting treatment for prepaid expenses. Understand the concept by looking at some practical examples and finally learn the adjusting entry for these expenses.

-

Horizontal or Flat Organizational Structures

Flat organizational structure is an organizational model with relatively few or no levels of middle management between the executives and the frontline employees. Its goal is to have as little hierarchy as possible between management and staff level employees. In a flat organizational structure, employees have increased involvement in the decision-making process.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved