- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

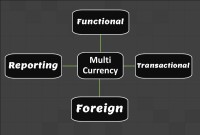

- Functional

- General Ledger (Record to Report)

- Concept of Subsidiaries

Concept of Subsidiaries

A subsidiary is a company that is completely or partly owned by another corporation that owns more than half of the subsidiary's stock, and which normally acts as a holding corporation which at least partly or wholly controls the activities and policies of the daughter corporation.

A subsidiary is a company that is completely or partly owned by another corporation that owns more than half of the subsidiary's stock, and which normally acts as a holding corporation which at least partly or wholly controls the activities and policies of the daughter corporation. The controlling entity is called its parent company, parent, or holding company. Subsidiaries are a common feature of business life, and all multinational corporations organize their operations in this way.

A subsidiary may itself have subsidiaries, and these, in turn, may have subsidiaries of their own. A parent and all its subsidiaries together are called a "group", although this term can also apply to cooperating companies and their subsidiaries with varying degrees of shared ownership. Examples include holding companies such as Berkshire Hathaway, Time Warner, or Citigroup; as well as more focused companies such as IBM or Xerox. These, and other MNCs, organize their businesses into national and functional subsidiaries, often with multiple levels of subsidiaries.

Subsidiaries are separate, distinct legal entities for the purposes of taxation, regulation, and liability. For this reason, they differ from divisions, which are businesses fully integrated within the main company, and not legally or otherwise distinct from it. A parent company may own one or more subsidiaries, in which case each of its subsidiaries are known as ‘sister’ companies to one another.

For the purposes of liability, taxation and regulation, subsidiaries are distinct legal entities. A subsidiary can sue and be sued separately from its parent and its obligations will not normally be the obligations of its parent. If a parent company owns a foreign subsidiary, the company under which the subsidiary is incorporated must follow the laws of the country where the subsidiary operates, and the parent company still carries the foreign subsidiary's financials on its books (consolidated financial statements).

Foreign Subsidiary:

In subsidiary structure the inbound company incorporates a wholly owned subsidiary in the foreign country, making it a distinct legal entity separate from the parent company. Subsidiary incorporated by a foreign company generally is not subject to specific restrictions/limitations with respect to its activities other than the general limitations applicable to domestic entities as well. The profits earned by a foreign subsidiary are liable to tax as per the local laws and regulations of the country of operation.

The Walt Disney Company has more than 50 Subsidiaries (https://www.sec.gov/Archives/edgar/data/1001039/000100103917000198/fy2017_q4x10kxex21.htm).

Given below are some of its foreign subsidiaries:

- Disney FTC Services (Singapore) Pte. Ltd, Singapore

- Euro Disney Associes S.C.A. France

- Hong Kong Disneyland Management Limited, Hong Kong

- Shanghai International Theme Park Company Limited, China

- UTV Software Communications Limited, India

Related Links

You May Also Like

-

What is a Business Eco System?

The goal of a business is to generate capital appreciation and profits for its owners or stakeholders by engaging in provision of goods and services to customers within the eco system/framework governed by respective laws(local/international). The eco system involves various entities that the business works with for delivery of a product or service.

-

A subsidiary is a company that is completely or partly owned by another corporation that owns more than half of the subsidiary's stock, and which normally acts as a holding corporation which at least partly or wholly controls the activities and policies of the daughter corporation.

-

As the business grows, the company may want to transition to a branch structure as branches are allowed to conduct a much broader range of activity than representative offices. Branches can buy and sell goods, sign contracts, build things, render services, and generally everything that a regular business can do. A company expands its business by opening up its branch offices in various parts of the country as well as in other countries.

-

Introduction to Organizational Structures

Organizations are systems of some interacting components. Levitt (1965) sets out a basic framework for understanding organizations. This framework emphasizes four major internal components such as: task, people, technology, and structure. The task of the organization is its mission, purpose or goal for existence. The people are the human resources of the organization.

-

A joint venture (JV) is a business agreement in which the parties agree to develop, for a finite time, a new entity and new assets by contributing equity. They exercise control over the enterprise and consequently share revenues, expenses and assets. A joint venture takes place when two or more parties come together to take on one project.

-

An allocation is a process of shifting overhead costs to cost objects, using a rational basis of allotment. Understand what is the meaning of allocation in the accounting context and how defining mass allocations simplifies the process of allocating overheads to various accounting segments. Explore types of allocations and see some practical examples of mass allocations in real business situations.

-

Generally Accepted Accounting Principles define the accounting procedures, and understanding them is essential to producing accurate and meaningful records. In this article we emphasize on accounting principles and concepts so that the learner can understand the “why” of accounting which will help you gain an understanding of the full significance of accounting.

-

Funds contributed by owners in any business are different from all other types of funds. Equity is the residual value of the business enterprise that belongs to the owners or shareholders. The funds contributed by outsiders other than owners that are payable to them in the future. Liabilities are generally classified as Short Term (Current) and Long Term Liabilities. Current liabilities are debts payable within one year.

-

GL - Accrued / Unbilled Revenue

Accrued revenues (also called accrued assets) are revenues already earned but not yet paid by the customer or posted to the general ledger. Understand what we mean by the terms accrued revenue, accrued assets, and unbilled revenue. Explore the business conditions that require recognition of accrued revenue in the books of accounts and some industries where this practice is prevalent.

-

A legal entity is an artificial person having separate legal standing in the eyes of law. A Legal entity represents a legal company for which you prepare fiscal or tax reports. A legal entity is any company or organization that has legal rights and responsibilities, including tax filings.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved