- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

- GL - Enter & Analyze Journals

GL - Enter & Analyze Journals

In every journal entry that is recorded, the debits and credits must be equal to ensure that the accounting equation is matched. In this article, we will focus on how to analyze and recorded transactional accounting information by applying the rule of credit and debit. We will also focus on some efficient methods of recording and analyzing transactions.

The accounting equation serves as the basic foundation for the accounting systems of all companies. From the smallest business, such as the local convenience store, to the largest business, such as large companies accounting equation remains valid. In the previous article, we gained an understanding of the concept of the accounting equation. In this article, we will focus on how to analyze and recorded transactional accounting information by applying the rule of credit and debit.

If you're not a bookkeeper or an accountant and have not received the formal education in accounting or finance, the whole system of debiting certain accounts and crediting others can seem overwhelming, however, don't be discouraged. If you can focus on understanding the fundamentals of double-entry accounting; the logic for debiting and crediting to various accounts will be clear for you. One of the optimum uses of ERP and Automated Accounting packages is that the users only enter real business transactions and ERPs will trace the accounts, calculate and enter the debits and credits.

Understanding “T” Account

Companies have to record and summarize thousands or millions of transactions daily that result as a result of their business operations. To cater to this, accounting systems are designed to show the increases and decreases in each financial statement item as a separate record. This record is called an account. An account, in its simplest form, has three parts. First, each account has a title, which is the name of the item recorded in the account. Second, each account has a space for recording increases in the amount of the item. Third, each account has a space for recording decreases in the amount of the item. The account form is called a T account because it resembles the letter, T. The left side of the account is called the debit side, and the right side is called the credit side. Amounts entered on the left side of an account are debits, and amounts entered on the right side of an account credit.

Asset Account

---------------------------------|-------------------------------------------

Debit | Credit

---------------------------------|---------------------------------------------

Accountants make use of “T” Accounts to analyze complex transactions, as it helps to simplify the thought process. Many ERP’s also represent accounts in the “T” format for an easier understanding of the accounting impacts.

Understand Your Transactions:

The rule of debit and credit is a fundamental theory behind accounting procedures. This rule is derived from the concept of double-entry accounting, which states that transactions are recorded in two or more accounts, where an amount is entered on the debit side and an equal amount is entered on the credit side. The practice of recording amounts on two sides is intended to minimize errors.

Recording transactions in accounts must follow certain rules. For example, increases in assets are recorded on the debit (left side) of an account. Likewise, decreases in assets are recorded on the credit (right side) of an account. The excess of the debits of an asset account over its credits is the balance of the account. To apply the rule of debit and credit, and properly record amounts, every transaction is first analyzed to determine the following:

What is being exchanged?

To begin analyzing the transaction, first determine what items are exchanged. Remember that a transaction is defined as the sale or exchange of goods or services.

What accounts are affected?

The next step in analyzing the transaction is to identify the affected accounts. The three categories of accounts in which a business records its transactions are assets, liabilities, and owner's equity.

Which of the accounts is increasing or decreasing?

Most transactions benefit—or increase—the business's resources in one area, and creates a corresponding decrease in another. But a transaction does not always cause this effect. A transaction can result in just an increase or just a decrease.

Are the amounts debits or credits?

The final step in the analysis is to determine whether to record the amounts on the debit side or the credit side of the affected accounts.

Rule of Debit & Credit:

The rule of debit and credit states that for whatever amount is entered in the debit side, an equal amount must be recorded on the credit side. To determine whether accounts are debited or credited, an analysis of the effect of the transaction must occur first as detailed above. An understanding of the rule of debit and credit is fundamental to performing accurate accounting procedures and the double-entry accounting system has specific rules of debit and credit for recording transactions in the accounts. Given below is a brief discussion on how to use various rules to determine the last two steps of analyzing transactions, whether the accounts in increasing or decreasing, and amounts should be debits or credits.

Balance Sheet Accounts:

The double-entry accounting system is based on the accounting equation and specific rules for recording debits and credits. The debit and credit rules for balance sheet accounts are as follows:

1. ASSETS:

The debit for increases and credit for decreases

2. LIABILITIES:

The debit for decreases and credit for increases

3. OWNER'S EQUITY:

The debit for decreases and credit for increases

Income Statement Accounts:

The debit and credit rules for income statement accounts are based on their relationship with the owner’s equity. As shown above, the owner’s equity accounts are increased by credits. Since revenues increase owner’s equity, revenue accounts are increased by credits and decreased by debits. Since the owner’s equity accounts are decreased by debits, expense accounts are increased by debits and decreased by credits. Thus, the rules of debit and credit for revenue and expense accounts are as follows:

4. REVENUE ACCOUNTS:

The debit for decreases and Credit for increases

5. EXPENSE ACCOUNTS:

The debit for increases and Credit for decreases

Owner Withdrawals:

Common types of owner's equity accounts include Capital, Withdrawals, Revenue, and Expenses. The debit and credit rules for recording owner withdrawals are based on the effect of owner withdrawals on owner’s equity. Since the owner’s withdrawals decrease the owner’s equity, the owner’s drawing account is increased by debits. Likewise, the owner’s drawing account is decreased by credits.

Normal Balances:

The sum of the increases in an account is usually equal to or greater than the sum of the decreases in the account. Thus, the normal balance of an account is either a debit or credit depending on whether increases in the account are recorded as debits or credits. For example, since asset accounts are increased with debits, asset accounts normally have debit balances. Common types of asset accounts include Cash, Accounts Receivable, Equipment, Office Supplies, and Prepaid Expenses. Likewise, liability accounts normally have credit balances. Common types of liability accounts include Accounts Payable, Unearned Fees (money received in advance), and Notes Payable (money a business promises to pay at a future date).

Related Links

You May Also Like

-

Explore the concept of journal reversals and understand the business scenarios in which users may need to reverse the accounting entries that have been already entered into the system. Understand the common sources of errors resulting in the reversal of entries and learn how to correct them. Discuss the reversal of adjustment entries and the reversal functionalities in ERPs.

-

Funds contributed by owners in any business are different from all other types of funds. Equity is the residual value of the business enterprise that belongs to the owners or shareholders. The funds contributed by outsiders other than owners that are payable to them in the future. Liabilities are generally classified as Short Term (Current) and Long Term Liabilities. Current liabilities are debts payable within one year.

-

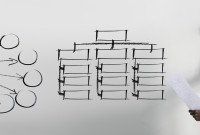

Divisional Organizational Structures

The divisional structure or product structure consists of self-contained divisions. A division is a collection of functions which produce a product. It also utilizes a plan to compete and operate as a separate business or profit center. Divisional structure is based on external or internal parameters like product /customer segment/ geographical location etc.

-

In this article we will discuss various types of "Management Entities". Various types of operational units, are created by management, to effectively run, manage and control their business. Different types of functional units, and divisional units, are widely used across industry.

-

Global Business Services (GBS) Model

Global business services (GBS) is an integrated, scalable, and mature version of the shared services model. Global Business Services Model is a result of shared services maturing and evolving on a global scale. It is represented by the growth and maturity of the Shared services to better service the global corporations they support.

-

The purpose of the general ledger is to sort transaction information into meaningful categories and charts of accounts. The general ledger sorts information from the general journal and converts them into account balances and this process converts data into information, necessary to prepare financial statements. This article explains what a general ledger is and some of its major functionalities.

-

Accrued expenses, sometimes referred to as accrued liabilities, are expenses that have been incurred but have not been recorded in the accounts. Discuss the need to record accrued liabilities and why they require an adjustment entry. Understand the treatment for these entries once the accounting period is closed and learn to differentiate when the commitments become liabilities.

-

Concept of Representative Office

A representative office is the easiest option for a company planning to start its operations in a foreign country. The company need not incorporate a separate legal entity nor trigger corporate income tax, as long as the activities are limited in nature.

-

In most of the automated financial systems, you can define more than 12 accounting periods in a financial year. This article will explain the concept of the adjustment period and the benefits of having adjustment periods. Adjustment periods have their inherent challenges for the users of financial statements and there is a workaround for those who don’t want to use adjustment periods.

-

GL - Journal Posting and Balances

In this tutorial, we will explain what we mean by the posting process and what are the major differences between the posting process in the manual accounting system compared to the automated accounting systems and ERPs. This article also explains how posting also happens in subsidiary ledgers and subsequently that information is again posted to the general ledger.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved