- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

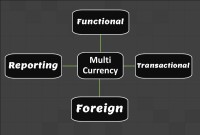

- Functional

- General Ledger (Record to Report)

- GL - Review & Approve Journals

GL - Review & Approve Journals

Review and Approval mechanisms ensure that the accounting transaction is reasonable, necessary, and comply with applicable policies. Understand why we need review and approval processes, what are they, and how they are performed in automated general ledger systems. Learn the benefits of having journal approval mechanisms in place.

What is Internal Control?

Internal control plays an important role in the prevention and detection of fraud and errors to ensure the accuracy of financial results. Internal control is the process designed to ensure reliable financial reporting, effective and efficient operations, and compliance with applicable laws and regulations. This needs to be supplemented by an effective control environment that ensures that established policies and procedures are followed.

What are the principles of Internal Control?

Management defines specific policies and procedures to achieve its objectives and run the day to day operations in the organization. The most important control activities involve segregation of duties, proper authorization of transactions and activities, adequate documents and records, physical control over assets and records, and independent checks on performance. These controls and checks ensure that financial statements are complete and accurate.

Principle 1: Segregation of Duties:

The internal control principle of segregation of duties requires that different individuals be assigned responsibility for different elements of related activities, particularly those involving authorization, custody, or recordkeeping. Some examples in the context of general ledger transactions are; the same person who is responsible for recording a transaction should not be responsible for posting the same in the general ledger. The recorded transaction should be checked and reviewed by someone else as having different individuals perform these functions creates a system of checks and balances.

Principle 2: Authorization of Transactions:

Proper authorization of transactions and activities helps ensure that all company activities adhere to established guidelines unless responsible managers authorize exceptions granting another course of action. In the context of the general ledger for example, Journals with different levels of amounts should go to various officers in the company for official authorization before they can be posted in General Ledger. Another example could be that any journal necessitating a debit to Revenue Account must be approved by the accounts manager before it can be posted, to allow the accounts manager to authorize and verify the reversal of revenue.

Principle 3: Adequate Documentation & Physical Control:

Adequate documents and records provide evidence that financial statements are accurate and based on genuine business transactions pertaining to the entity. Controls designed to ensure adequate recordkeeping include the creation of journals and other supporting documents that are easy to use and sufficiently informative. Document sequencing is another functionality that is used to pre-number consecutive journals. It is also very important to document the review and approval process to make it available for audit staff subsequently. The simplest way to do this is to print out the journal entries and have the reviewer initial them. This should then be saved as support. In the automated general ledgers, each user is associated with a user id and transactions can flow to the reviewer and approver before posting and a system audit trail is sufficient audit evidence if such a process has been established.

Physical control over assets and records helps protect the company's assets. These control activities may include electronic or mechanical controls. Journals should be physically safeguarded in case they are on paper and guarded with access privileges & established backup and recovery procedures in case of automated systems.

What is the need for Journal Review and Approval?

Under the Sarbanes-Oxley Act, companies are required to perform a fraud risk assessment and assess related controls. This typically involves identifying scenarios in which theft or loss could occur and determining if existing control procedures effectively manage the risk to an acceptable level. The risk that senior management might override important financial controls to manipulate financial reporting is also a key area of focus in fraud risk assessment. Top managers of publicly held companies must sign a statement of responsibility for internal controls and include this statement in their annual report to stockholders. Review and approval in the accounting process are independent checks on performance, which are carried out by employees who did not do the work being checked. These processes help ensure the reliability of accounting information and the efficiency of operations. Internal auditors and external auditors rely on established processes to gaze at the extent of their audit procedures.

Having the journal review and approval process in place ensures that all general journal entries get reviewed. This review is done to help prevent errors such as adjusting the wrong accounts and transposing numbers. It also helps protect against fraud by making sure there is a valid reason for the journal entry and someone is not manipulating the accounts for vested interests.

1. Review Transactions/Edit Transactions:

The transactions can be reviewed for accuracy and completeness once they have been entered into the automated accounting system. If a review is done by another person who is not responsible or involved in recording the transaction it can help to ensure that financial information in the journals accurately reflects actual activity.

A review of transactions is done to ensure that the transaction is within the guidelines of the purpose of the accounts used and is appropriately charged to the account following the concepts defined in the accounting equation. In the case of manual journals, one must ensure that the transaction is consistent with available supporting documents. If any errors are found in the transaction, they can be edited and corrected at this stage.

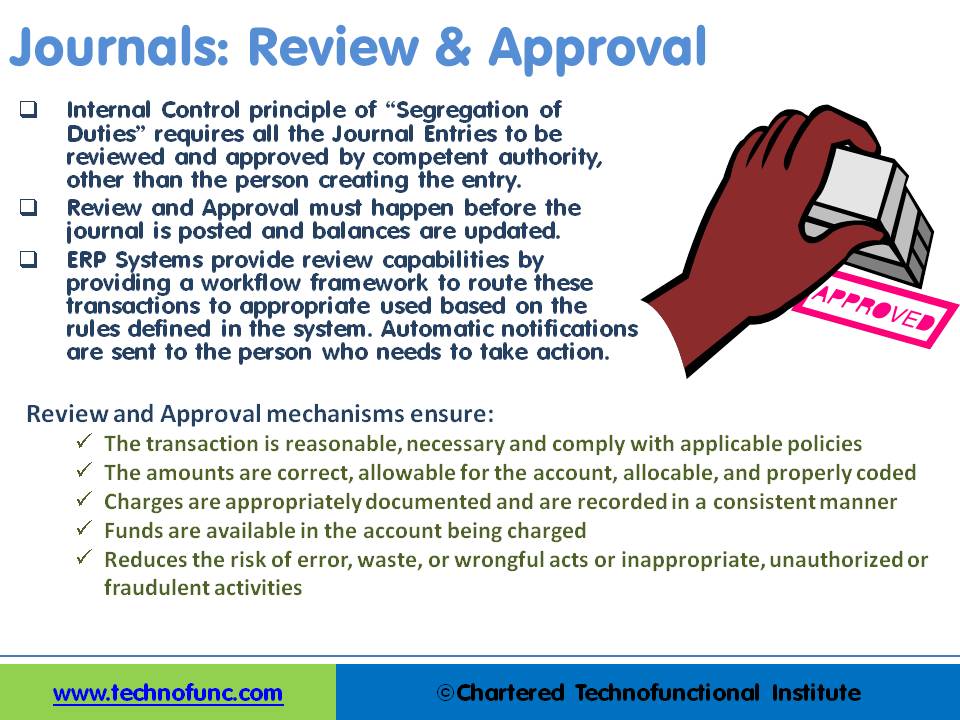

2. Journal Approval:

In the case of journal recording the journal entered by one person needs to be approved by another person in this step. This ensures having more than one person to complete the “Journal Creation Task”. In GL the separation by getting the financial transaction approved by more than one individual prevents fraud and error.

3. Journal Approval Workflow:

Automated accounting systems provide you with the functionality of sending the journals for approval to the designated person. The system will validate the journal batch, determine if approval is required, and submit the batch to approvers (if required), then notifies appropriate individuals of the approval results. Review and Approval must happen before the journal is posted and balances are updated.

ERP Systems provide review capabilities by providing a workflow framework to route these transactions to appropriate users based on the rules defined in the system. Automatic notifications are sent to the person who needs to take action.

Benefits of Journal Review and Approve:

Review and Approval mechanisms ensure:

- The transaction is reasonable, necessary, and complies with applicable policies

- The amounts are correct, allowable for the account, allocable, and properly coded

- Charges are appropriately documented and are recorded in a consistent manner

- Funds are available in the account being charged

- Reduces the risk of error, waste, or wrongful acts or inappropriate, unauthorized, or fraudulent activities

Related Links

You May Also Like

-

Team-Based Organizational Structure

Team-based structure is a relatively new structure that opposes the traditional hierarchical structure and it slowly gaining acceptance in the corporate world. In such a structure, employees come together as team in order to fulfill their tasks that serve a common goal.

-

What is Accounting & Book Keeping

Accounting is a process designed to capture the economic impact of everyday transactions. Each day, many events and activities occur in an entity, these events and activities are in the normal course of business; however, each of these events may or may not have an economic impact. Events or activities that have an effect on the accounting equation are accounting events.

-

As the business grows, the company may want to transition to a branch structure as branches are allowed to conduct a much broader range of activity than representative offices. Branches can buy and sell goods, sign contracts, build things, render services, and generally everything that a regular business can do. A company expands its business by opening up its branch offices in various parts of the country as well as in other countries.

-

GL - Different Accounting Methods

The accounting method refers to the rules a company follows in reporting revenues and expenses. Understand the two common systems of bookkeeping, single, and double-entry accounting systems. Learners will also understand the two most common accounting methods; cash and accrual methods of accounting and the advantages and disadvantages of using them.

-

Period End Accruals, Receipt Accruals, Paid Time-Off Accruals, AP Accruals, Revenue Based Cost Accruals, Perpetual Accruals, Inventory Accruals, Accruals Write Off, PO Receipt Accrual, Cost Accrual, etc. are some of the most complex and generally misconstrued terms in the context of general ledger accounting. In this article, we will explore what is the concept of accrual and how it impacts general ledger accounting.

-

In this article we will discuss various types of "Management Entities". Various types of operational units, are created by management, to effectively run, manage and control their business. Different types of functional units, and divisional units, are widely used across industry.

-

Concept of Representative Office

A representative office is the easiest option for a company planning to start its operations in a foreign country. The company need not incorporate a separate legal entity nor trigger corporate income tax, as long as the activities are limited in nature.

-

A subsidiary is a company that is completely or partly owned by another corporation that owns more than half of the subsidiary's stock, and which normally acts as a holding corporation which at least partly or wholly controls the activities and policies of the daughter corporation.

-

An account inquiry is a review of any type of financial account, whether it be a depository account or a credit account. In this tutorial, you learn what we mean by drill through functionality in the context of the general ledger system. We will explain the concept of drill-down and how it enables users to perform account and transaction inquiry at a granular level and the benefits of using this functionality.

-

Horizontal or Flat Organizational Structures

Flat organizational structure is an organizational model with relatively few or no levels of middle management between the executives and the frontline employees. Its goal is to have as little hierarchy as possible between management and staff level employees. In a flat organizational structure, employees have increased involvement in the decision-making process.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved