- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger

- GL - Understanding Chart of Accounts

GL - Understanding Chart of Accounts

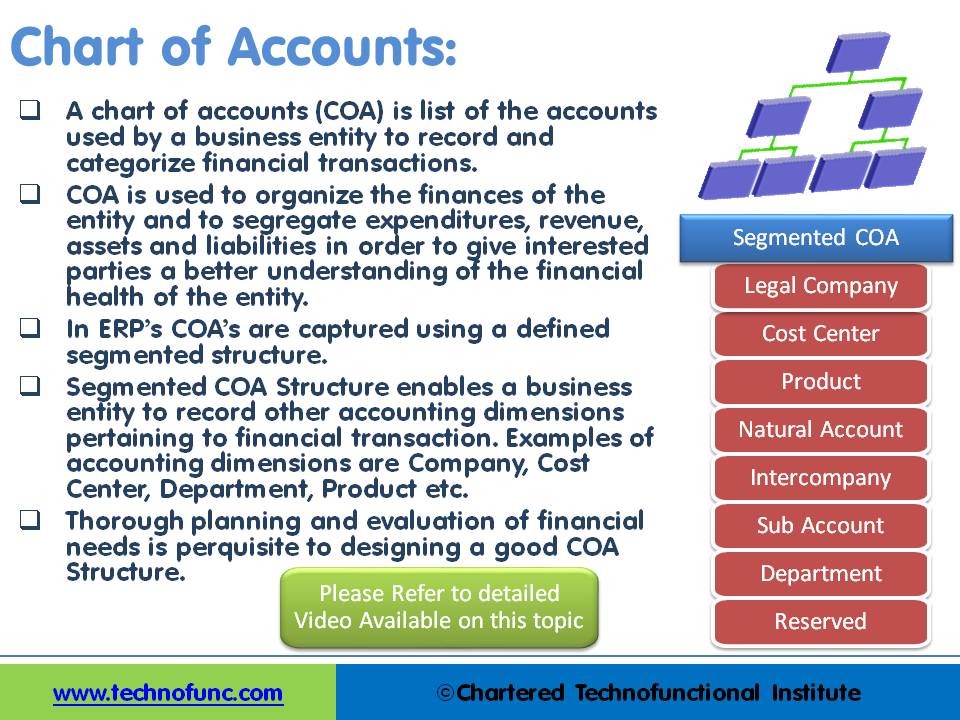

A chart of accounts (COA) is a list of the accounts used by a business entity to record and categorize financial transactions. COA has transitioned from the legacy accounts, capturing just the natural account, to modern-day multidimensional COA structures capturing all accounting dimensions pertaining to underlying data enabling a granular level of reporting. Learn more about the role of COA in modern accounting systems.

What is a Chart of Accounts?

A chart of accounts (COA) is a list of the accounts used by a business entity to record and categorize financial transactions. COA is used to organize the finances of the entity and to segregate expenditures, revenue, assets, and liabilities in order to give interested parties a better understanding of the financial health of the entity.

The chart of accounts is a list of all the accounts and their numbers contained in the general ledger. The accounts are listed in the order of assets, liabilities, owner's equity, revenue, and expenses. Transactions can be posted to each defined account in COA and it can capture balances in the general ledger chart of accounts is a way to outline the accounting system of a business, the chart of accounts establishes how the business will operate, what information will be captured, and what information will subsequently be readily retrievable by the system for reporting and other needs.

Is Chart of Accounts worth discussing? Does it really matter?

Have you ever wondered after hearing such phrases from accountants like "It's not in the chart of accounts. We don't know how to enter your transaction" or "We can't process your invoice without an account number." In the case of new general ledger implementations, nothing moves forward unless the chart of account has been finalized.

While to many non-financial managers and also to new IT implementers increased focus on the chart of accounts seems unwarranted and it appears that the client is unnecessarily slowing down the project by discussing chart of accounts too much. That's not really their purpose—and everyone who has worked in an IT project involving general ledger knows that this structure needs to be finalized first before other discussions can start and that too because it has a serious impact on the entire general ledger design.

Why we need a Chart of Accounts?

The entire recording process of any accounting system requires a basic organization of data so that the accounting data can be clubbed into meaningful accounts and represented in a way useful for the users and stakeholders. For example – purchases on credit from vendors through invoices can be later summarized and reported with some clarity as to what was purchased, why it was purchased, what organization(s) benefited from those expenditures, and what is the unpaid liability on account of all those purchases. That basic organization is called a chart of accounts.

You might think of the organizing system for your company's accounting data as a collection of buckets, or accounts, each with a particular kind of data inside. There might be a bucket for each ledger account names and associated numbers used by a company, arranged in the order in which they normally appear in financial statements—Assets, Liabilities, Owners' Equity or Stockholders' Equity, Revenue, and Expenses.

For management analysis, there will also be a bucket for each product or service the company sells and one for each type of department or cost center where those expenses might incur as it sells its products or services. The chart of accounts is an organized, comprehensive list of all those buckets. The buckets, in turn, are labeled with their appropriate account number and arranged by the kind of data they hold, so that accountants can quickly find the right bucket in which to store the latest piece of data about a particular accounting transaction. These buckets are then arranged and rearranged during the accounting process and their contents are counted and checked to produce reports that summarize the data they contain.

Purpose of Chart of Accounts:

General Ledger is used to recording and store each individual account and their transactions. The Chart of Accounts is the basis of any accounting system. The purpose of the Chart of Accounts is to classify each financial transaction and record it with reference to appropriate business dimensions enabling the users to select or extract the financial data through account inquiry screens or reports. Finally enabling reporting on (or enquire about) the sum total of financial transactions at various levels on the chart.

Adding more dimensions to the Chart of Accounts:

In ERP’s COA’s are captured using a defined segmented structure. Segmented COA Structure enables a business entity to record other accounting dimensions pertaining to financial transactions.

Modern organizations are complex generally consisting of many different lines of business; operating in different geographies, dealing in multiple products and services, running different projects, and moving resources and employees across these functions. The "chart of accounts” must reflect these complexities to enable effective management and external reporting. An effective chart of accounts structure can track revenue and expenses appropriately for different business dimensions like departments, geographies, product lines, etc. and can provide accurate analysis for decision making, and for reporting to government agencies, sponsors, and stakeholders.

What is Chart of Accounts Segment?

In automated accounting systems and ERPs, the chart of accounts is made up of and represented as a string of numeric and alphanumeric fields that act as identifiers. The companies define different segments to capture relevant business dimensions along with the natural account associated with the transaction. Companies may define anywhere from one to dozen segments to make up their Chart of Accounts and capture granular level business information associated with the transaction.

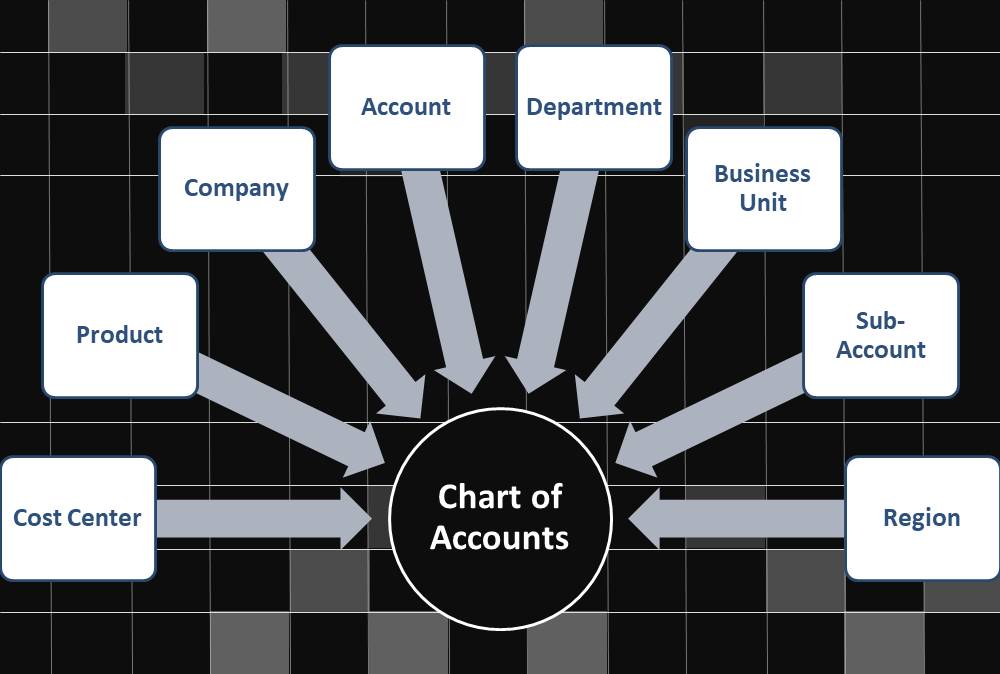

Examples of accounting dimensions are Company, Cost Center, Department, Product, etc. The figure below shows an example of the Segmented Chart of Accounts Structure using some of the commonly used business dimensions.

Thorough planning and evaluation of financial needs is a prerequisite to designing a good COA Structure. We have created a separate tutorial on GL Accounts that helps you understand the concept of Natural Accounts and some key GL Accounts. There is a full tutorial on the understanding of COA in detail and best practices to define an effective COA Structure.

Related Links

You May Also Like

-

A subsidiary is a company that is completely or partly owned by another corporation that owns more than half of the subsidiary's stock, and which normally acts as a holding corporation which at least partly or wholly controls the activities and policies of the daughter corporation.

-

Concept of Representative Office

A representative office is the easiest option for a company planning to start its operations in a foreign country. The company need not incorporate a separate legal entity nor trigger corporate income tax, as long as the activities are limited in nature.

-

An organizational design is the process by which a company defines and manages elements of structure so that an organization can control the activities necessary to achieve its goals. Good organizational structure and design helps improve communication, increase productivity, and inspire innovation. Organizational structure is the formal system of task and activity relationships to clearly define how people coordinate their actions and use resources to achieve organizational goals.

-

Prepayments and Prepaid Expenses

Prepayments are the payment of a bill, operating expense, or non-operating expense that settle an account before it becomes due. Learn the concept of prepaid expenses. Understand the accounting treatment for prepaid expenses. Understand the concept by looking at some practical examples and finally learn the adjusting entry for these expenses.

-

Global Business Services (GBS) Model

Global business services (GBS) is an integrated, scalable, and mature version of the shared services model. Global Business Services Model is a result of shared services maturing and evolving on a global scale. It is represented by the growth and maturity of the Shared services to better service the global corporations they support.

-

Explore the concept of journal reversals and understand the business scenarios in which users may need to reverse the accounting entries that have been already entered into the system. Understand the common sources of errors resulting in the reversal of entries and learn how to correct them. Discuss the reversal of adjustment entries and the reversal functionalities in ERPs.

-

Matrix Organizational Structures

In recent times the two types of organization structures which have evolved are the matrix organization and the network organization. Rigid departmentalization is being complemented by the use of teams that cross over traditional departmental lines.

-

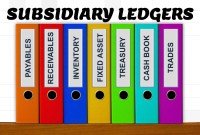

For any company that has a large number of transactions, putting all the details in the general ledger is not feasible. Hence it needs to be supported by one or more subsidiary ledgers that provide details for accounts in the general ledger. Understand the concept of the subsidiary ledgers and control accounts.

-

Legal Structures in Businesses

Businesses not only vary in size and industry but also in their ownership. Most businesses evolve from being owned by just one person to a small group of people and eventually being managed by a large numbers of shareholders. Different ownership structures overlap with different legal forms that a business can take. A business’s legal and ownership structure determines many of its legal responsibilities.

-

GL - Review & Approve Journals

Review and Approval mechanisms ensure that the accounting transaction is reasonable, necessary, and comply with applicable policies. Understand why we need review and approval processes, what are they, and how they are performed in automated general ledger systems. Learn the benefits of having journal approval mechanisms in place.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved